Private Credit and Higher Rates: Opportunities and Costs

12 April 2022

ECB’s Pivot in Stance and What it Could mean for the EUR

26 April 2022INSIGHT • 19 APR 2022

The Tale of the Yen

Kambiz Kazemi, Partner & Chief Investment Officer

Inflation continues to be the talk of the town and latest CPI measures for major developed economies are all above 6%. But Japan remains a distinct outlier in the developed world. Japan’s latest year-over-year measure CPI was only 0.6% in February and at -1.0% (yes negative) excluding food and energy. And these are inflation numbers for a country that imports 94% of its energy needs.

The “why?” can be the subject of a lengthy note – not this one – which would end up highlighting that no one has a clear answer. But the differential in actual inflation, inflation expectations, which are only at 0.8% for a 10-year horizon in Japan, as well long-term nominal rates are part of that explanation. In this note we will have a look at the Japanese currency and how it has been faring of late, and share some thoughts on potential paths and risks ahead.

Since the start of war in Ukraine (end of February) the Yen has depreciated nearly 10% versus the USD while the US Dollar index is up 4%, making it the worst performing G10 currency by far.

Let us remember that over the last few decades the Yen was often described as a flight to quality currency which appreciated (vs. others) when there was talk of crisis of any kind. Yet, this time around its value is falling.

As Chart 1 shows we are at a multi-decade high for the USDJPY. One might be tempted to “sell the high” on this multi-decade top.

Chart 1 – Spot Japanese Yen vs. USD (USDJPY) 2003-2022

Source: Bloomberg

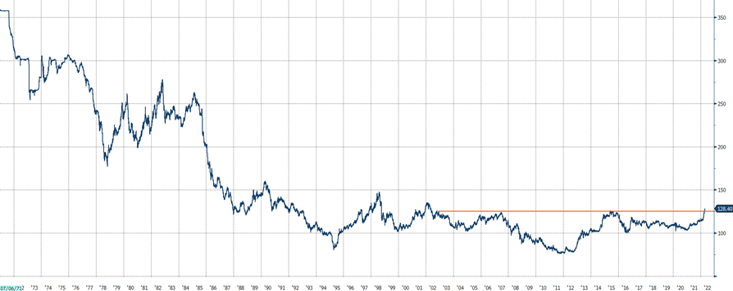

But in life, time is perspective. The same goes for the financial markets. The biggest trap for investors and risk managers alike is over relying on the recent past, and recent past can in some cases be decades long. Here is a look at the price of USDJPY since the breakdown of Bretton Woods in 1970.

Chart 2: Spot Japanese Yen vs. USD (USDJPY) 1971-2022

Source: Bloomberg

What a difference three additional decades make! So, should one actually “buy this breakout” rather than sell the high?

To answer that question, let’s remember how we got here:

- The Yen was allowed to freely float against the US only after 1973 (from 300), at which point it started strengthening continuously for several years with 1977 marking a (free float) low of 177 for USDJPY.

- In early 1980s – still free float – and despite a massive Japanese trade surplus, given higher interest rates in the US, investors preferred the US Dollar and then Yen depreciated to around 250.

- Then in 1985 came the Plaza Accord where the Group of Five Industrialized Nations (predecessor to G7) decided that the US dollar was overvalued and then acted to weaken it. The US currency dropped and by end of 1987 the exchange rate of USDJPY was 120, close to its current level.

(Note: those who have traded and invested in FX markets over the last decade and a half have been told/thought that systematic and widespread sovereign currency intervention/manipulation in developed markets is taboo and unlikely to happen, a closer study of 1985 and 1987 might be very timely!)

- The bursting of the asset bubble followed, and Japan progressively adopted a zero-interest rate policy (1995-2000) and the carry trade (where investor borrow yen at near zero interest to buy higher yielding currencies) gained in popularity driving the Yen to lows, nearing the 150 level against the US dollar.

- The Global Financial Crisis of 2008 caused the unwind of carry trades and the appreciation of the Yen with USDJPY printing an all time low of 76 in 2011.

- Since 2013, as US rates rose, it seems that the return of carry trade – at least in part – drove the Yen lower only to have it generally trade in a 100 to 120 range until recently.

What’s next?

Some takeaways and additional observations from this lookback are that:

- Widening of US minus Japan interest rate differentials were traditionally accompanied/followed by the weakening of the Yen.

- In the 1980s, and on a free-float basis, despite massive Japanese trade account surplus the Yen was weaker and traded in a 250-150 range.

- We have not observed or lived through a sustained period of trade deficit accompanied simultaneously by a wide US – Japan rate differential since 1973.

Today, Japan has a trade deficit and the rise in commodity and raw material prices for an energy intensive and production-based economy are, at the very least, not constructive for the local currency.

If US – Japan rate differentials continues to widen (a very likely scenario in our view) coupled with persistent divergence in inflation expectations (which continues to be true so far), there is a non-negligeable probability that the Yen could further weaken to levels not seen since the 1980s, namely 150 or even higher.

At the time of writing; option markets price the probability of the USDJPY ending above 150 in 6 months and 1 year at 1% and 4% respectively.

In our view a realistic probability (barring Central Bank intervention in currency markets) is rather in the 10-15% range. Such divergence allows investors and hedgers to implement attractive strategies with limited risk via option structures.

More generally, those with exposure to the Yen should not dismiss the scenario of a noticeably weaker Yen.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.