Validus Risk Management appoints former NatWest Markets director to lead client engagement in the UK

4 October 2022

GBP: the Great British Problem?

17 October 2022RISK INSIGHT • 4 SEPTEMBER 2022

How much longer for the US Dollar bull run?

Ali Jaffari, Head of North American Capital Markets

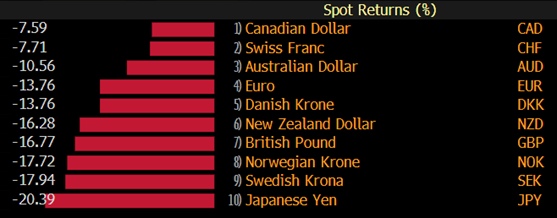

The US dollar has been a rising tide across all G10 currency pairs amidst continued risk-off sentiment and a renewed spike in market volatility. Year-to-date, G10 pairs have come off 8% – 20% vs USD (see chart 1) and the uncertain climate shows little reprieve in the near-term. Hence, the question remains, when is it time for a reversal? With ample headline risk (i.e. fiscal / monetary activity, central bank intervention, data releases on inflation/unemployment, economic performance etc.) that could further fuel dollar strength, a stark reversal is questionable. However, let’s explore scenarios that lead us in that direction.

Chart 1: YTD Spot Returns vs USD

Source: Bloomberg

The Fed’s path to tightening is currently priced in. A series of weaker data prints could disrupt current market expectations.

Following the Fed’s removal of forward guidance at its FOMC meetings (in an effort to remain data dependent and flexible on policy), market volatility remains high as participants are free to interpret and predict rate paths. Recent USD strength hinges on consistent messaging from the Fed, on hiking rates to bring down inflation, while being accepting of recessionary risks.

With the Fed’s dual mandate of employment and price stability, the Fed is able to carry on with its tightening measures as labor market data remains strong. Signs of weakness loom, as the labor mismatch continues and more Americans are re-entering workforce, and if manifested in weaker labor prints, there could be a pause or slowdown in hiking activity followed by dollar weakness.

US implied inflation expectations are softening for now. A continued trend would ease upward pressure on USD.

The Fed’s credibility has fallen into question time and time again, however more recently the markets perception on the Fed’s ability to tackle inflation has been positive. We see the market implied inflation rate, as measured by breakeven inflation rates, significantly lower in recent months (see Chart 2), which supports monetary policy actions. This could ease some pressures off the Fed and USD accordingly, however ultimately inflation data prints do need to come in lower to warrant a meaningful reaction.

Chart 2: US implied 10Y inflation rates

Source: Bloomberg

A strong USD continues to impact capital flows and net trade terms across several nations, and there has been a greater impetus for central banks to intervene.

With USD strength in recent weeks, economies continue to struggle with imported inflation, where a weak domestic currency weighs on the cost of imported goods and adds to inflation prints. As a result, central bank intervention is now in focus.

The Bank of Japan, in a move not seen since 1998, spent close to USD $20B as it intervened in the markets to slow the Yen’s slide. Similarly, the Peoples Bank of China imposed a risk reserve requirement of 20% on banks’ FX forward sales to clients. Recently, the Bank of England’s move to step in and purchase long-term UK bonds on a temporary basis, when the initial plan was to trim the balance sheet, is another intervention that supported the GBP.

A continued rise in the dollar could bring intervention into focus for other central banks across the developed and emerging markets world. This leads us into a new era of central bank involvement, which could create further instability and volatility in FX markets.

Geopolitical tensions fuel demand for safe haven USD flows, until further resolve on conflict.

Rising tensions in the Ukraine war along with the ongoing European energy crisis add to USD strength, as we continue to see more flows out of Europe and into dollar denominated assets. Barring a resolution in the near term, the conflict will keep on driving USD flows and markets will react to headline risk.

With lots of event risk in the near-term, market volatility is expected to remain elevated. Keep an eye out for the aforementioned risks that could impact the current USD trend. As always, having a sound approach to risk management is critical to navigate the current environment and ensure protection of capital.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.