What are the economic implications of a Kamala Harris presidency?

4 September 2024

Japan’s Leadership Battle: Implications for the Global FX Markets and the Yen’s Future

18 September 2024RISK INSIGHT • 11 SEPTEMBER 2024

Fall of Uncertainty: Navigating Economic and Political Risks Ahead

Kambiz Kazemi, Chief Investment Officer

US equity markets stumbled after Labor Day, marking their worst performance of the year so far. It seems that the perspective of lower rates is not enough to cheer the markets, as talk of economic slowdown and growth has overtaken the initial excitement and rally in early summer, when the Fed indicated the potential arrival of rate cuts.

The upcoming fall season seems to be increasingly uncertain, with both positive and negative surprises possible. Regardless of where the markets stand by inauguration time next January, we expect increased uncertainty will likely lead to episodes of volatility – sometimes to the upside - and a higher floor for expected volatility as measured by the VIX and option prices.

Three sources of risk will contribute to the uncertain road ahead.

A Fed Caught in a Bind

After aggressive rate hikes, the Fed now appears willing to start an easing cycle while inflation remains somewhat above its sacrosanct 2% target. As we’ve previously noted, the “higher for longer” mantra carries significant risks. Recent signs of economic weakness, such as a stagnant housing market, softening employment, and declining commodity prices, seem to have prompted the Fed’s shift to adopt an easing tone at the end of the summer. This represents a significant change from the Fed’s hardline approach earlier this year.

In our view, the Fed has been overly communicative, with an unusually high number of Fed officials making public statements in a few weeks this year. The Fed’s overcommunication, coupled with the market’s already heightened sensitivity, has led to dramatic and rapid shifts in interest rate expectations. We anticipate that this pattern will continue throughout the Fed’s easing cycle.

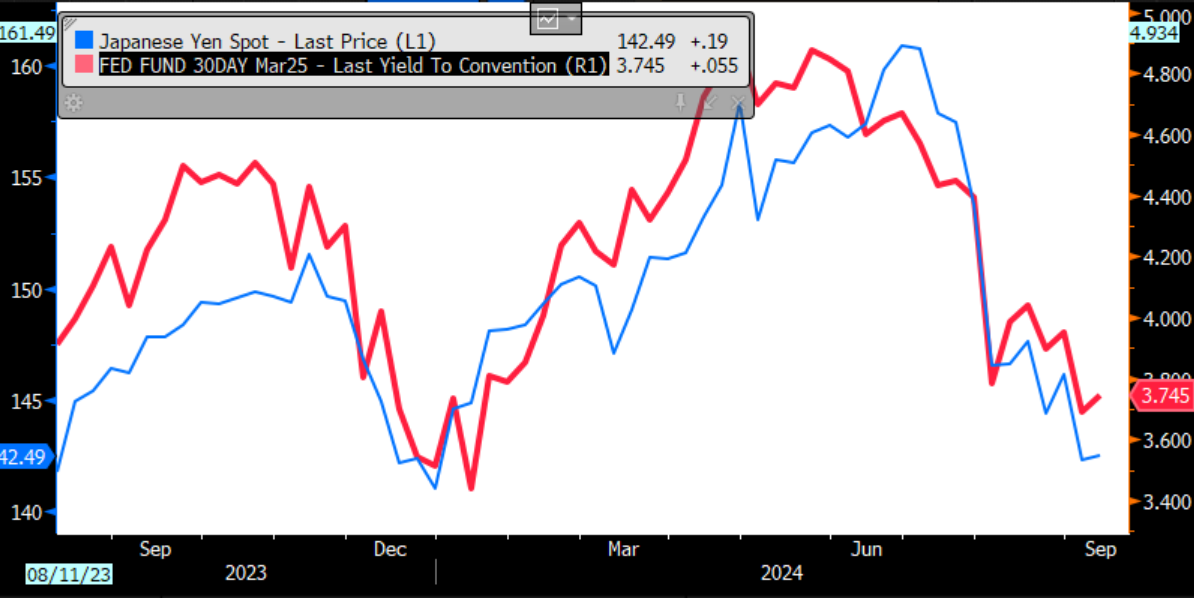

Chart 1: Expectation of interest Fed Fund rates for March 2025 versus the yen: sudden shifts in expectation can have domino effects: the brutal unwind of the yen carry trade

Source: Bloomberg

Presidential Risk

As the election date approaches, Donald Trump and Kamala Harris seem to be building on a slew of plans and policies that are very divergent. While one touts tax breaks across the board, the other talks of tax on unrealized capital gains. Trump continues to push for tariffs and immigration control, while both candidates address inflation – but their proposed solutions are starkly different.

As a result, we expect experts and markets to increasingly scrutinize the potential impact of a Trump-led economy versus a Harris-led one. The profound differences in their approaches could fuel volatility, especially if the polls remain tight, indicating a close electoral race.

Geopolitical Risk: A New Normal?

Humans, as adaptable creatures, have a remarkable capacity to endure hardship and overcome adversity. From harsh environments to economic challenges, we have consistently demonstrated our ability to innovate and find solutions. However, this adaptability can also lead to desensitization.

The ongoing conflicts in Ukraine and the Middle East provide stark examples of this. Initial coverage of these events was extensive, sparking debates, indignation, admiration, and testing the limits of pragmatism. Yet, as time has passed, coverage has waned, and it seems that what once seemed unimaginable has become a reality.

Yet, underlying tensions continue to simmer. Recent escalations, such as the delivery of airplanes to Ukraine or direct drone attacks on Moscow, could indicate a willingness from the West to push the boundaries. These seemingly incremental steps could inadvertently lead to a breaking point, catching the market off guard.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.