Volatile markets are just beginning

19 October 2021

Here we go again

2 November 2021INSIGHT • 26 October 2021

Is inflation out of control?

Phillip Pearce, Global Capital Markets Associate

Inflation, inflation, inflation – it’s the economic indicator on every corner of the market’s mind. Is it transitory? If so, for how long? Will it be permanent? Are we on the brink of hyperinflation? Central banks were at odds as to why inflation was muted in the 2010s despite the vast amounts of central bank liquidity since the GFC. Oh, how times have changed.

The fact of the matter is inflation is here and it’s causing central banks all over the world great concern as the factors driving the rapid surge in prices are largely outside of their control. However, there are 2 elements central banks can influence in the current cycle: Demand and inflation expectations.

Elevated levels of consumption of goods have contributed in part to supply chain disruptions as consumers are demanding more than they did before the pandemic and during 2020. At first, the demand helped spur on the global recovery in growth, but it is now creating a bottleneck in supply chains as once globally connected manufacturers and suppliers asynchronously open up, navigate new structural hurdles and fight for raw materials.

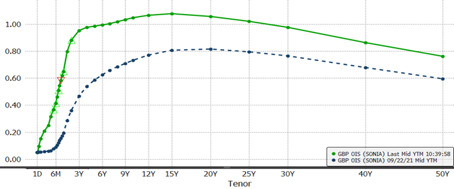

The larger cause of concern for central banks like the BoE is that inflation expectations become embedded. The theory goes that if consumers and businesses become more accustomed to expecting prices to increase rapidly, it makes it easier for businesses to pass costs on to the consumers and for consumers to demand wage increases. Essentially, it’s a self-fulfilling prophecy as expectations become reality and the cycle perpetuates. The hawks on the Bank of England’s MPC have been talking up the prospects of a rate hike before the end of the year to combat this idea and the market has reacted aggressively. The chart below shows how the Sterling Overnight Interest Swap (OIS) curve has become considerably steeper from before the BoE meeting on the 23rd September to now.

Chart 1: Sterling Overnight Interest Swap (OIS) Curve (22-Sept vs 23-Sept)

Source: Bloomberg

A month ago, the market wasn’t expecting a rate hike of 15bps until late in Q1 in 2023 but is now aggressively pricing in at least three rate hikes over the same period. By convincing the market to frontload expectations of interest rate hikes, the BoE hawks have successfully reined in inflation expectations as compared to the US and EU over the last month, as shown below.

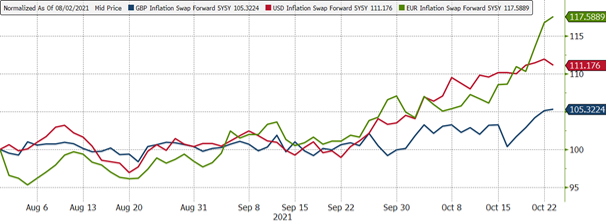

Chart 2: UK, US & EU Inflation Expectations

Source: Bloomberg

Before the BoE meeting on the 23rd September, UK inflation expectations for 2026 to 2030 were broadly tracking US expectations but since the meeting and subsequent hawkish comments from BoE members, UK expectations have disconnected from the US and EU (as the market views the ECB and Fed comparatively dovish). The BoE hawks have succeeded in moderating inflation expectations for now but for the trick to stick they need to follow through with the final act of hiking rates this year.

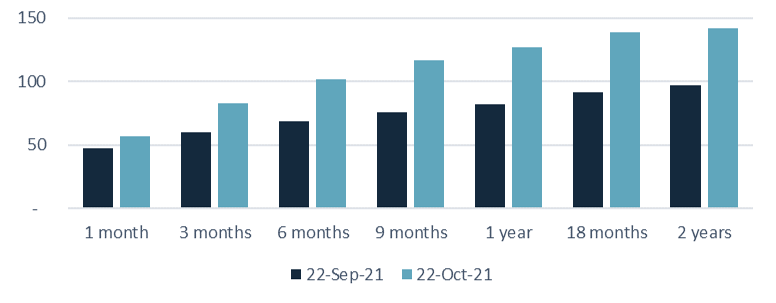

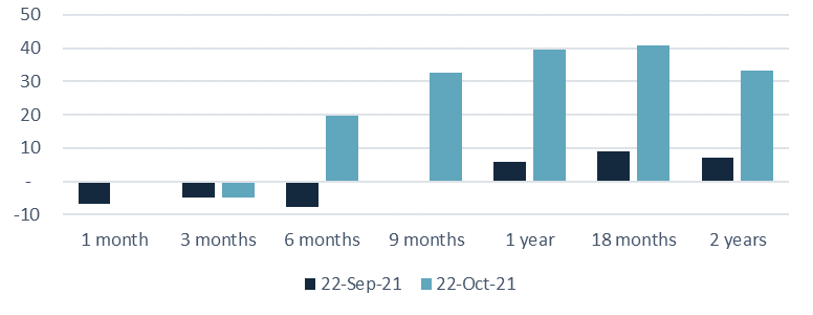

Hedging costs for sterling assets rise considerably

A knock-on effect from the aggressive moves in the GBP OIS market over the past month is that the annualised costs of hedging sterling assets for dollar and euro dominated funds have increased considerably across the board, as illustrated below. The bars above zero indicate a cost to hedging sterling assets and below zero represent a benefit to hedging sterling assets.

Chart 3: GBPEUR Cost of Hedging (abps)

Source: Validus Risk Management

Chart 4: GBPUSD Cost of Hedging (abps)

Source: Validus Risk Management

The BoE has a plan

It is debatable whether the BoE should hike rates or not with potential risks on the horizon such as the effect of the furlough scheme coming to an end, the possibility of a winter lockdown, and the risk that hiking rates into a wider growth decline may exacerbate it and lead to stagflation. However, what the BoE has done is prudently identify the factors in the current inflation cycle that it can affect and deems to be a risk and, importantly, has instituted a plan to tackle those risks. On the other hand, it has identified risks like the supply-side disruptions that monetary policy cannot affect but continues to monitor these to make informed decisions at a later point. It shows the value for risk managers in having an established risk management framework and how access to data and experts help to identify the risks we can affect and those we cannot, but still need to pay heed to. ,/p>

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.