Why Currency Risk Matters (to everyone)

9 August 2021

Fed Tapering: Uncertainty and Unforeseen Consequences

24 August 2021INSIGHTS • 17 August 2021

Stimulus on stimulus: how will the US infrastructure bill impact markets?

Ali Jaffari, Head of North American Capital Markets

After much anticipation, the US senate voted to pass a $1 trillion infrastructure bill, adding to the already immense ~$6 trillion of fiscal support since the onset of the pandemic. With the US economy still running hot, following the recent $1.9 trillion America Rescue Plan (signed into law by President Biden on March 11, 2021) it begs the question of what the marginal impact this large infrastructure package could have on the current economic environment. The longer-term benefits of the bill and the creation of jobs are prevalent, however shorter-term impacts, in an already aggressively stimulated economy, could bear unanticipated effects.

Stimulus measures over the past 18-months have been deployed to no ends, with the objective to revive and restore the economy to its pre pandemic levels. From a macro perspective, the Fed remains focused on labor market recovery and is sidelined on inflation, despite rising cost pressures and inflation prints at multi-decade highs.

With a largely uneven recovery, divergence across economic sectors, regions and households continue to drift with part of the economy operating at high output levels while others severely lag. Labor market shortages continue to persist despite a record number of job openings, highlighting the mismatch in skills / wage expectations. Until substantial progress is made, the Fed is likely to kick the can on tapering discussions and carry on with its monthly $120 billion asset purchase program.

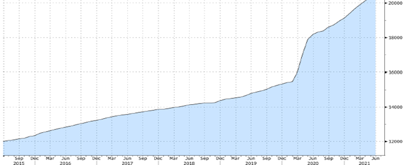

The combination of fiscal and monetary stimulus measures has galvanized the economy and led to a significant increase in money supply. M2, which is a measure of money supply comprising of cash, checking deposits and near money (savings deposits, mutual funds, etc.) has grown over $4 trillion (see Chart 1) since stimulus efforts initiated, a level of growth previously seen over the preceding 5-year period. As funds are put to use and household spending is gradually unleashed, inflationary pressures are ticking higher, with the latest infrastructure bill adding further to the pressure.

Chart 1: Federal Reserve US Money Supply (M2)

Source: Bloomberg

Although the infrastructure bill falls short of President Biden’s early ~$2+ trillion proposal, the $1 trillion bipartisan agreement was quite an accomplishment, well surpassing the magnitude of previous bills alike (compare this to the package passed during Obama’s term of $305B). Though the bill still needs to pass the house and be signed into law, the outlook on the labor market will no doubt improve given the millions of jobs which are expected to be created as part of it. The Fed, whose inaction is a function of the lag in labor market recovery, will certainly need to take this into consideration at the upcoming Fed meetings.

What also differentiates this bill is the timeframe related to the planned use of proceeds. Unlike earlier stimulus measures and COVID-19 related relief packages, which were aimed to provide more of an immediate boost, infrastructure spending is of course viewed over a longer horizon and designed to create lasting and sustained economic growth. The bulk of the funds here, however, will be put to use in relatively short order, to have more of a broader and speedy impact on the current economy. Could this potentially stimulate an already turbo charged economy?

With US stimulus spending far exceeding the rest of the world at ~30% of GDP since 2020, and the continued growth in money supply (see Chart 1), economists continue to ponder over the true inflationary effects. Looking back at history, there are periods of time when the correlation with money supply and inflation strongly held (e.g., 1950 – 1980 in the UK), and other times when the relationship derails. Whether this holds true for the US remains to be seen, however it is getting increasingly challenging to brush aside the consistent 5% handle CPI prints, a year-on-year growth rate higher than developed peer nations.

Inflation overshoots continue to pressure US real rates and we have seen a steady decline in recent weeks and months (see Chart 2). The USD is trading higher on a YTD basis, however a decline in real yields driven by unpredictable activity on the supply side (sporadic cost increases) will inevitably weigh on the USD.

Chart 2: Treasury Real Yield Curve Rates: 5-year (black, RHS) and 10-year (blue, LHS)

Source: Bloomberg

A bill of this size is likely to have a widespread effect on various sectors and its workers. As infrastructure projects commence and job openings arise, US States are likely to further pare back on unemployment benefits. With the infrastructure bill getting closer to being signed, be conscious of near-term inflationary pressures and the impact it can have on the economy and broader markets.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.