Low FX vols – exploring the opportunities

31 July 2024

Carry Trade Crash: A Wake-Up Call

14 August 2024RISK INSIGHT • 7 AUGUST 2024

Bank of England’s Balancing Act: Rates, Growth and Inflation

Shane O'Neill, Head of Interest Rate Trading

Ahead of the Bank of England meeting last week markets were finely balanced – chances of a cut were approximately 60% and it felt like the first meeting in a long time where there was genuine indecision up until the last moment. The Monetary Policy Committee decided to cut rates by 25bps, taking the base rate to 5%. This marked the first easing in three years, and the first move of any sort over the last 12 months. Is this the long-awaited start of rate normalization or has the BoE false started?

The meeting was interpreted by some as a hawkish cut – though seemingly nonsensical, there may be some merit to this line of thinking. The decision to cut was very close, with the vote going 5-4 in favour of 25bps reduction versus a hold. Governor Bailey wouldn’t commit to any future cuts and insisted the bank would continue to “go from meeting to meeting, as we always do.” He also emphasized the ongoing battle against inflation, dismissing suggestions that the fight is over, claiming “we need to make sure inflation stays low, and be careful not to cut interest rates too quickly or too much.”

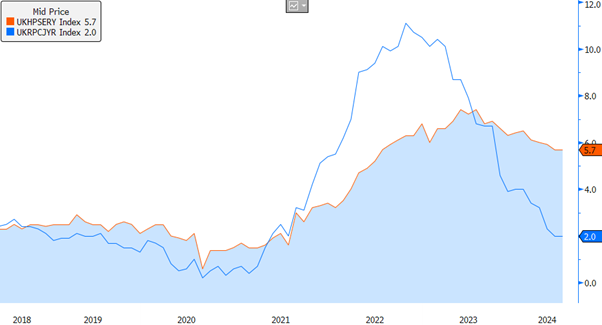

Inflationary pressures are indeed still present – June’s inflation report revealed services inflation at 5.7%, exceeding the BoE forecast of 5.1%, and though headline CPI has fallen to the 2% target, it is due to move higher again into year end. BoE chief economist Huw Pill was one of the dissenters in the vote and on Friday reiterated his reasoning – he noted the stickier services inflation and pointed out that he is seeing potential “second round” inflationary pressure in wage growth and corporate price setting.

Chart 1: Services inflation (orange) has struggled to make the same progress as headline figures (blue), causing concern for MPC members

Source: Bloomberg

Economic Resilience Strengthens Case to Hold Rates

The economy’s unexpected resilience has bolstered the argument for “holding rates” – growth has come back quicker than expected, with GDP growth outperforming analyst expectations, prompting the BoE to significantly upgrade its 2024 growth prediction from 0.5% to 1.25%. Meanwhile, the new government’s policies are adding to the economic mix. While much is yet to be unveiled, we have already seen public sector workers awarded a £10 billion pay rise. Although spending cuts and tax rises are anticipated in the budget, the initial policies – if not inflationary – are certainly not deflationary. Not until 30th October when the full budget is revealed will we be able to opine on the potential impacts of this new government’s policies.

Cut Early, Cut Often

While the current strength of the UK economy will be a source of comfort for the BoE, the recent shock to US labor markets serves as a stark reminder of economic volatility. The US economy added 114,000 jobs in July, versus 175,000 expected, accompanied by downward revisions to the previous two month’s numbers. Unemployment ticked up to 4.3%, above analyst expectations, and wage growth slumped more than expected.

These shocking figures have spooked markets, with many jumping to the conclusion that the Fed has waited too long to cut and will now need to cut soon and cut quickly. Markets quickly priced an additional 50bps of cuts into the US rates curve, with expectations for over 100bps of cuts in the next three meetings. The BoE will be watching these developments closely – it will be sensitive to avoid similar mistakes and if the Fed can miss the early signs of economic weakness, perhaps it can too.

Markets Pricing Further Cuts

Following the BoE meeting and worrying US data, the market, at time of writing, is pricing two further cuts from the MPC over the next three meetings due in 2024 – taking the base rate down to 4.5%. Following the US labor data, markets were trading very aggressively, and the size of the moves would not have incentivized traders to stand in the way, especially ahead of a weekend. The move in the US is perhaps explicable, but to drag UK expectations with them to the extent seen is, in our opinion, somewhat unwarranted.

As discussed, there are credible arguments for further cuts and for holding steady. Whilst we acknowledge that further normalization in interest rates is required, and that two further cuts this year is far from excessive – the factors of the stronger than expected growth, sticky inflation (particularly services inflation), and the unknown effects of the new government skew the risks in 2024 toward a BoE under delivering on cuts.

Chart 2: After a strong Q2 for GBP we have seen weakness in recent days - several factors point toward GBP strength making a comeback in the back end of 2024

Source: Bloomberg

A relatively stable political environment and an overachieving economy should continue to support sterling against its major peers in the US and Europe. A strong Q2 saw GBPUSD climb to 1.30 but has since given back much of the gains and now sits at 1.28. Fair value still sits some way higher and as we march toward political uncertainty across the pond, including explicit calls for a weaker dollar, the risk seems skewed toward a stronger pound. The BoE faces a complex task in the coming months. Two additional inflation reports before the September meeting will influence rate decisions, with markets currently pricing in 50/50 for a cut in this meeting. Following this, we will hear from Chancellor Reeves in October before the BoE meeting in November. With this busy calendar from now until year end, the BoE’s job continues to be fraught with difficulty and essential for risk managers to watch closely.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.