Commodity-based Currencies in Top 5 as Global Prices Surge

25 May 2021

Validus appoints Goldman Sachs Executive Director to head new US office in New York

1 June 2021INSIGHTS • 1 June 2021

Beware of Calm (FX) Waters

Kambiz Kazemi, Chief Investment Officer

So far, 2021 has been marked by a number of historic events across financial markets. Commodities continued their seminal rally, which started in the fall of 2020, with the CBR index up over 22% so far year-to-date 2021. Major equity indices reached new all-time highs earlier in May, despite some jitters and weakness early in the year, as markets focus on the potential reduction of the Fed’s accommodative policy.

Interest rates had a staggering rise early in the year, particularly in February, with the US 10-year yield up to ~1.60%, up 70bps from its start of the year level of 0.90% (an 80% increase!). Meanwhile, inflation expectations have been rising steadily with US 10-year break-even rates reaching decade long highs.

Yet conspicuously absent from headlines and investor’s daily concerns seems to be the asset class that is the foundation of international flow of capital and goods, the ultimate outlet for the equilibrium between economies in a global context: foreign exchange

Calm despite so many changing fundamentals

A closer look at major currencies (in USD terms) points to an astonishing trend: the trading range of these currencies so far this year has been the “tightest” in (at least) two decades.

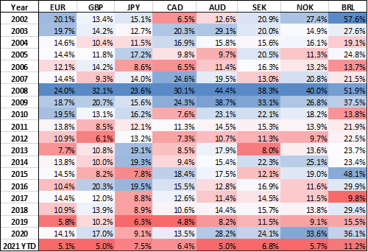

Table 1: Trading range of major currencies ((high– low of year) / average price of that year)

Source: Bloomberg

Unsurprisingly, the Great Financial Crisis (2008 and 2009) had the widest trading range (shown in blue), a result of the massive volatility at that time.

But what is really surprising is that, so far in 2021, major currencies have had the lowest trading range in over two decades (row in red). The Canadian dollar and the Yen, which had a slightly smaller trading range in 2019 and the Brazilian Real in 2017.

The fact that we are observing this “calm” tight price range with low volatility, while there have been notable changes in long-term rates, inflation expectations and commodities, should raise our vigilance.

Risk measures: projecting more of the same ahead?

Until now, we only looked at the past. The fact that price ranges have been so subdued this year does not necessarily mean that investors expect the same going forward.

Risk specialists monitor option prices as they contain valuable information about expected future range of outcomes for prices. In particular, the higher options prices for a given horizon (i.e. the higher the “implied volatility”), the riskier the road ahead is perceived to be by the market, in aggregate and vice versa. To look at what market participants’ future expectation of risk is in FX land, we take a closer look at implied volatilities in a historical context.

Table 2: 1-year implied volatility of select major crosses since 2001

Source: Bloomberg

As we can see, like all other crises, after the Coronavirus pandemic of 2020 expectations of future volatility (implied volatility) has generally fallen from March and April 2020 highs. Yet, a closer look highlights a more subtle and mixed picture. We have compared today’s 1-year implied volatility (the measure of perceived risk over a 1-year time horizon) to its range over the last 20 years (as a percentile), to have a relative understanding of whether risk is perceived to be low or high.

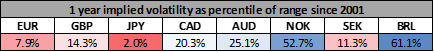

Table 3: Today’s risk perception (over 1 year) in percentile of last 20 years range

Source: Bloomberg VRM calculation (for BRL since 2003)

Market expectation of risks are noticeably higher for commodity driven currencies such CAD, AUD, NOK, and BRL (which is both EM and commodity driven) rather than for developed markets, with the Yen standing out as being near all-time lows in the 1-year risk measure.

What does this mean?

Our analysis of the state of the FX market highlights two important observations: Despite tectonic shifts in inflation expectations and long-term interest rates in major economies, market participants generally price low levels of risk and price volatility for major developed market currencies (except for NOK in our selected list).However, market participants perceive the potential for future turmoil and volatility (vs. USD) to be higher for commodity driven currencies.

The history of financial markets and our past experience points definitively to the fact that periods of excessive “calm” – as we observe presently in FX markets - are bound to end at some point. They do not necessarily lead to crisis, but they will usually be followed by periods of price adjustment and volatility levels that reflect the fundamental factors driving market equilibrium.

In our view, the dichotomy between this multi-decade “calm” currency price action and the fundamentals (rates, inflation expectations, commodity, and equity price action) is likely to result in more volatility and changing prices across the medium to long-term. The market’s increasing focus on the economic recovery, incoming inflation data and the effects of government spending, will flow into and be reflected by FX pricing. Should we see some surprises in the evolution of interest rates, these are likely to also affect exchange rates, especially if the rate movements are asynchronous between jurisdictions.

This means one can expect more volatility and shifting prices, and it would be wise for investors to prepare for this likely new regime. Given the low historical prices in some option markets, hedges and trading structures with attractive risk rewards can be put in place, with the potential to massively benefit the holder in case such a scenario unravels. As this is an area of expertise here at Validus, we will expand on this theme in the coming weeks/months to help you navigate such changes.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.