Trump’s Potential Economic Impact: A Look Back at 2016 and the Current Risks

3 July 2024

Is this the Rachel Reeves Rally?

17 July 2024RISK INSIGHT • 22 MAY 2024

A Nation at the Crossroads: France’s Election Results and The Impact on Europe

Shane O'Neill, Head of Interest Rate Trading

Last weekend marked the final round of voting in the French parliamentary elections, a significant event with the potential to send shockwaves across the macro landscape (as previously discussed here). Today we’ll review the outcomes and how it may affect Europe moving forward.

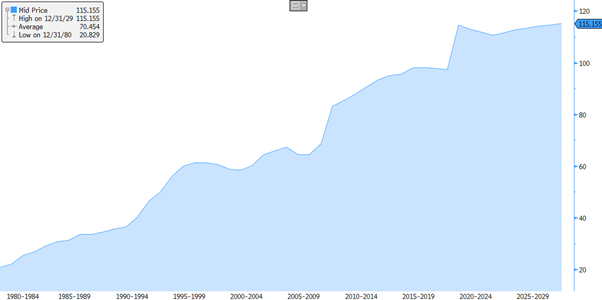

The backdrop to these elections includes the June European Parliamentary election, the first domino to fall – where President Macron’s coalition party performed woefully, and Marine Le Pen’s far-right National Rally party gained substantial support. Macron, interpreting this as a sign of widespread dissatisfaction amongst the populus, called a snap parliamentary election to clarify political mandates. The markets were spooked – the prospect of the National Rally winning a majority seemed increasingly likely. The National Rally’s economic policies made people nervous – though its president talked down the risk of “Frexit” and some of the more extreme tax policies, the thought of a large majority meant markets couldn’t discount these risks. A brief look at France’s finances makes it clear why aggressive spending may cause concern – France’s public debt, at 115% of GDP post-COVID, remains a significant issue. France remains the fourth most levered country in the EU on this measure.

Chart 1: French Debt as % GDP, including IMF predictions for the number to continue to grow in the coming years

Source: Bloomberg, IMF

Unexpected outcomes

The first round of election exceeded market expectations. While the National Rally won 33.4% of the vote, the margin of victory was less than expected. The left coalition New Popular Front (NPF) secured 27.9%, and Macron’s centrists got 20.7%. This eased market fears, lowering the French/German 10y bond spread (the premium investors require to hold French debt over German debt) from over 80bps to around 70bps. Macron then formed an electoral agreement with the NPF to pull certain candidates to avoid vote splitting against the National Rally, which proved highly effective.

The final round of voting garnered the largest turn out in France since the election in 1997, highlighting the national significance of the event. The outcome was a shock – not only did the National Rally fail to win a majority, but it also ended up coming third in the voting, after NPF (first) and Macron’s Renaissance (second). No party secured a majority, but the largest party in France was now a left leaning one – quite the reversal from expectations a month earlier. Initially, markets reacted positively, with the German/French spread decreasing and the French equity index CAC40 rising, but this optimism was short lived.

The NPF is now France’s largest party, combining left parties with ideologies ranging from the far-left France Unbowed to the more moderate Socialists, the party of former President Francois Hollande. Markets are particularly concerned about the vocal far-left faction led by Jean-Luc Mélenchon, which proposes significant tax hikes on the rich and corporations, and EUR150 billion in spending increases – which critics estimate would be closer to EUR300 billion. These policies could exacerbate the debt burden, cause potentially irrevocable ruptures with the EU, and deter foreign investment. Consequently, the CAC40 has fallen, bond spreads have widened back toward 70bps, and the Euro has lost any gains seen post-result. But need we really worry?

Future governance: coalition challenges

Though the prospect of a Mélenchon-led parliament is unnerving, it is very unlikely – his party, within the wider NPF, won 74 seats, while the more moderate Socialists, also within NPF, won 59. Macron’s party secured 168 seats, all short of the 289 needed for majority. Though left leaning parties have banded together to form NPF, the alliance was really an attempt to stop the far-right and it succeeded – governing is a different question. Mélenchon’s more radical ideas are unlikely to ever gain majority backing, and the harder he pushes, the more likely it is that a centrist coalition with moderate right and left parties will run the country.

From a macro perspective, the French elections appear to fall somewhere between an outright win for markets and a draw. The political extremes, both right and left, failed to take control of the country, and the moderates are actually the most numerous. While significant change will be challenging, and we may even end up with a technocrat, the outcome is preferable to the worst-case scenarios hypothesized less than a month ago. This considered, we would expect the France risk premium to gradually normalize, and markets to refocus elsewhere. For EURUSD, we anticipate a weaker dollar in the medium-to-long. As France’s political risk diminishes, attention will turn to the upcoming US elections in November, making France’s political situation seem more stable by comparison.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.