ECB on a Tightrope: Will It Cut Rates?

22 May 2024

Hitting the lower bound (of inflation)

29 May 2024INSIGHT • 28 MAY 2024

The 2024 US Economic Rollercoaster: Inflation, Rates, and Geopolitical Tensions Take Hold

Pierre Roke, Senior Advisor

This year, the US economy has developed in a way few expected. The market was expecting a series of rate cuts, some as early as March. But fast forward to today, and it is plausible we will see not cuts at all. What caused this sudden shift, and what can we expect next?

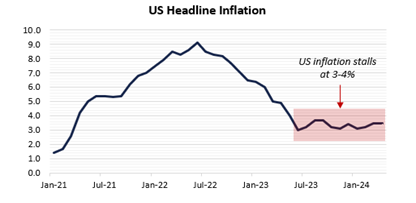

We believe the main reason for shift is straightforward and has been the dominant theme of this cycle: inflation. Inflation has not come down as quickly as the market anticipated. Headline CPI stood at 3.4% in January, climbed to 3.5% in April, and has since reverted to its January level – hardly the non-stop progress expected. While numerous variables influence this, the market has focused on two main factors:

Chart 1: US Headline Inflation

- Lags in the economy: it takes time for interest rates changes to affect the market. Although the timing and severity can be challenging to measure, economists generally believe that in the US, this process can take up to 18 months. 18 months before January 2024 there had been 150bps of hikes, and 18 months from today there were an additional 225bps. Meaning at the start of this year only 28% of the rate hikes had taken effect and fed through to the economy at large. Even now, the full hiking cycle of 525bps has yet to be felt, if we accept the 18month lag hypothesis.

- Strong labour market: despite some recent slowdowns, the labour market has been running hot in the US. This gives the Fed more leeway to postpone these rate cuts.

As we approach the mid-way point of 2024, several economic themes deserve attention for their potential impacts. The first noteworthy theme is ongoing tension between the US and China. Although headlines about the US-China trade war subsided after Trump left office in 2021, President Biden maintained the Trump-era tariffs. Then, last week, the Biden administration imposed fresh tariffs on China and reintroduced this theme to the front page. These new tariffs, amounting to an estimated $18 billion across various imports - primarily target semiconductors, lithium-ion batteries, and electric vehicles. While considerably less than Trump's 80-billion-dollar trade war across 2018/2019, it does highlight a couple of key things:

- It serves as a reminder of the economic impact a trade war can have. Trump's played a role in the dollar running ~4% from trough to peak, the S&P 500 dropping ~20% and 10yr ~70bps.

- It marks a significant change in Biden’s stance on tariffs. Historically Biden has publicly opposed Trump's use of tariffs, citing their contradictive economic drawbacks. However, as the US election race intensifies, Biden’s decision to implement his tariffs indicates a strategic shift.

The voter base has had to endure a high-interest rate environment, high inflation, and the inevitable squeeze on their incomes - resulting in falling saving rates and higher credit card delinquencies. These economic pressures have contributed to Trump's favourable lead in the polls. Nevertheless, the election in the end comes down to a few key swing states, including Arizona, Georgia, Michigan, Nevada, Pennsylvania, and Wisconsin.

Should recent polls be accurate, and we see a Trump victory, this could easily result in aggressive foreign policy through executive orders introducing new tariffs. Recently, he has indicated 10% tariffs on imports across the board and 60% tariffs on China. He would also likely scale back environmental policies and increase oil exports, potentially lowering energy costs. Then, much like when he was last in office, he’d introduce stricter immigration policies, which could exert upward pressure on wages. All policies indicate a much more volatile market than Biden would impose. Whether a Trump or Biden win, it is likely both will keep the fiscal tap on, which would again increase price pressures, likely leading to higher rates for longer and raising the risk of higher corporate bankruptcy.

Rising rates squeeze businesses and banks

Corporate bankruptcies in the US spiked in April, reaching a year-high according to S&P Global. This surge was partly fuelled by dashed hopes for interest rate cuts. Instead, yields have continued to rise throughout 2024, resulting in larger refinancing burdens and subsequent failures. Wobbles in the banking sector are also reemerging. April saw the first FDIC-insured bank failure of 2024 with the collapse of Republic First Bank. Though less impactful than the 2023 SVB collapse, similar factors led to its failure. Burdened by $650 billion in unrealized losses on its balance sheet, the bank was further aggravated by the absence of anticipated rate cuts, rising 10-year yields, and a high concentration of uninsured deposits that quickly withdrew.

In summary, sticker-than-expected inflation and a strong labour market are key reasons the Fed is maintaining interest rates. With that said, the Fed still believes that the current 5.25% level is in restrictive territory and there is little risk of the target rate going higher. However, a strong economy and labour market make the Fed reluctant to cut rates without solid evidence of inflation retreating towards the 2% target. Fed Governor Waller echoed this view, stating that "in the absence of a significant weakening in the labour market, I need to see several more months of good inflation data before I would be comfortable supporting an easing in the stance of monetary policy."

In the short term, these factors are likely to keep upward pressure on the dollar – as seen throughout 2024. But beyond this – with China/US tensions, corporate delinquencies and fiscally (and potentially politically) volatile presidential candidates – the medium to long term looks a lot shakier for the greenback.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.