Does the Fed’s battle against inflation risk collateral damage?

20 July 2022

A technical recession – how bad will it be? It depends on the Fed.

2 August 2022INSIGHT • 26 July 2022

Hedging costs rise as central banks battle inflation

Phillip Pearce, Associate Global Capital Markets

Last week, we saw the ECB surprise markets and hike rates by 0.5% to bring rates out of negative territory for the first time since May 2014. This was the first rate hike by the ECB in almost 11 years. Rates volatility has seen an explosion in activity since central banks started to pivot from the erroneous “transitory” narrative at the end of 2021 to an aggressive attempt in 2022 to reign in broadening inflation. To put that into perspective, if you had hedged 5-year ESTR debt exposure with quarterly payments a year ago, you would have locked in a rate of -0.5% before charges, the same debt hedged today would be fixed at 1.26% before charges, that’s an increase of EUR880k over the life of the hedge for every EUR10m of exposure.

ESTR rate volatility has seen a significant jump since September 2021

Source: Bloomberg

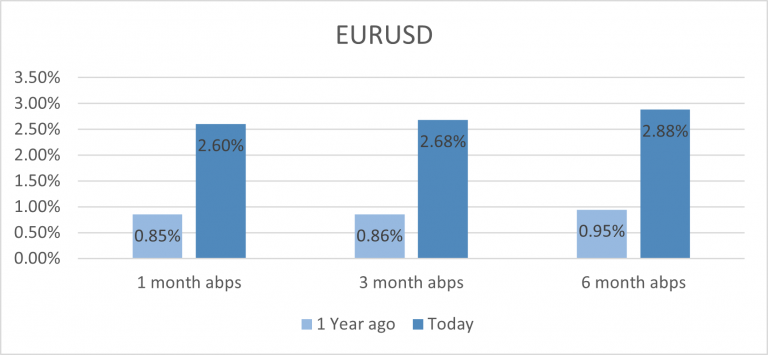

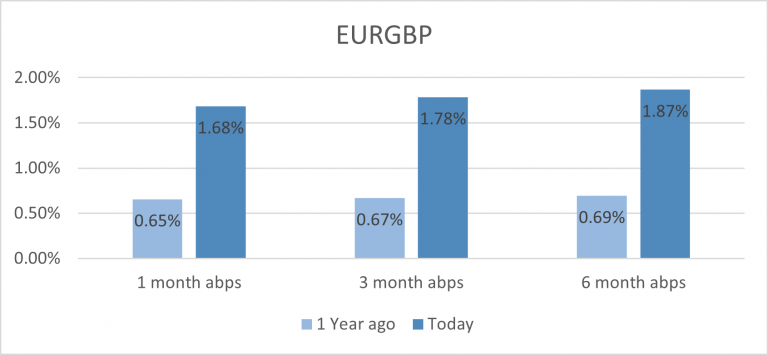

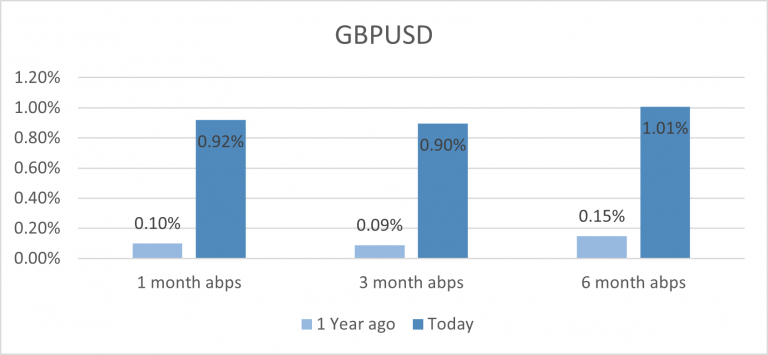

The FX market hasn’t escaped the volatility either, as euro-dollar reaches levels last seen when the pandemic hit in March 2020. Prior to that, euro-dollar was last this volatile when Trump was elected in 2016. Although the dollar has softened from its highs, it remains historically strong as compared to the last 20 years when the dollar index was last at these levels. All this volatility has resulted in increased hedging costs for euro and GBP funds as, for example, we’ve seen annualized 3-month hedging costs on EURUSD increase from 0.86% last year to 2.68% today. That’s roughly EUR175k more than a year ago for every USD10m hedged.

Hedging Costs: Today vs. a year ago

Source: Bloomberg

Amid an uncertain outlook, the ECB distanced itself from giving clear guidance on upcoming monetary policy decisions which will only add volatility to the system as, without any firm guidance, the market is free to price in whatever the data warrants. Political instability in Italy will be another source of volatility for the market and a source of pain for the ECB as they attempt to control the spreads between German Bunds and peripheral bonds like Italian BTPs. Although the ECB agreed to a new tool called the Transmission Protection Instrument (TPI), it will need another decision for it to be activated, adding further complexity to an environment that requires flexibility and action, not bureaucracy.

Add to this that the US Fed is meeting on the 27th July and the BoE the week after on the 4th August, and both central banks have been actively hiking this year, there is a clear widening between the Euro and the dollar and sterling which we’d expect would continue as the Fed is expected to hike rates by another 0.75% and the BOE by 0.5%. These hikes will lead to an increase in the cost to hedge for Euro funds. Furthermore, Germany’s trade surplus is teetering very close to a trade deficit, something that hasn’t been seen in over 30 years and a vital factor that has helped support the euro fundamentally and adds further pressure to EURUSD to sustainably break parity.

To add further stress, Germany, France, and Italy have probabilities of entering a recession within the next year of 45%, 52%, and 65% respectively which needs to be balanced with inflation levels that are expected to continue to rise and could reach double figures if the energy crisis gets worse. A clear signal that the ECB is seriously worried about the inflation outlook (having fallen behind the curve in tightening policy), is that it was willing to ditch its strong forward guidance and surprise the market on Thursday, but how they will manage to avoid a recession now is a conundrum. Ultimately, although the ECB has finally acted, it remains behind the curve and finds itself stuck between a rock and a hard place with a number of risks it needs to juggle.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.