Six things we learnt at the Private Capital Symposium 2022

14 July 2022

Hedging costs rise as central banks battle inflation

26 July 2022INSIGHT • 20 JULY 2020

Does the Fed’s battle against inflation risk collateral damage?

Caleb Thibodeau, Associate at Global Capital Markets

After belabouring the message again and again, there is little room for any more ambiguity on the Fed’s current focus: break CPI, full stop. A little late to the party at first, perhaps, but J. Powell and the FOMC have pushed aside their dual mandate amid an historically tight labour market and begun hiking rates at a serious clip in an effort to catch-up to inflation. So serious, in fact, that the most recent hike of 75bps was the largest increase going back to November of 1994, and a second consecutive hike of 75bps – currently priced in for later this month, would be unprecedented. A 100bps increase would in itself be unprecedented, although this seems very unlikely, especially with the Fed’s Waller vocally supportive of 75bps and WSJ Chief Economist (and de facto Fed media conduit) Nick Timiraos indicating the latter is ‘more likely’. While the Bank of Canada front-loaded its hiking action via a 100bps hike earlier this month, a of move of this type by the Fed would potentially induce an unwarranted panic across markets by signalling, “we have lost control”.

So, the question on everyone’s mind is, where will the Fed go after this hike?

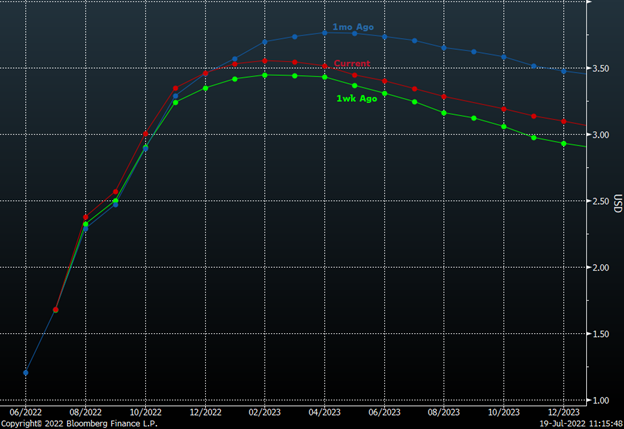

Chart 1: Fed Funds futures curve

Source: Bloomberg

Fed funds futures curve has moderated to price in a lower and faster peak in Fed hikes.

Consider the following: the June MoM CPI change was the largest print since 2005 at 1.37%, with gasoline in particular contributing a massive 2.24% or nearly a quarter of the overall 9.1% YoY figure. Though gasoline prices have moderated since mid-June, they are still up roughly 100% versus a year ago.

Without a material increase in prices, these types of YoY effects could persist into December (chart 2) – and that’s not even accounting for the lag between energy prices moderating and downstream costs following suit. Further still, a ‘no increase in prices’ assumption gives no consideration to the continued maximum refining capacity constraints experienced across the energy complex and the still-prevalent ‘Russia risk factor’. As things stand right now, physical traders in the crude oil futures market are showing that there is already not enough supply, evidenced by over-extended time spreads in the front end of the curve.

Chart 2: RBOB Gasoline Contract Price

Source: Bloomberg

Last time RBOB traded under $200 was Dec 2021, meaning base effects could persist.

On the energy front, this is not great news for CPI and therefore the Fed. But, of course, there are many other elements to CPI, a few of which have indeed started to show some reprieve. Goods have showed a decreasing contribution to CPI, as higher prices take effect and the stimulus consumption boom fades (chart 3). The Cleveland Fed’s Inflation Nowcasting projection for July CPI at the time of writing was only 0.33%. Though even if this were the final figure, it would still imply an 8.9% YoY CPI print for the month of July when released in mid-August. Due to base effects from the summer of 2021, keeping an 8.9% YoY print for both August and September would only require a MoM change of 0.2% and 0.3%, respectively. That’s right, inflation printing at roughly one sixth of the June MoM CPI rate in August and September (which are released in September and October, respectively) could keep YoY CPI at 8.9% until November! There are three more Fed meetings between now and early November.

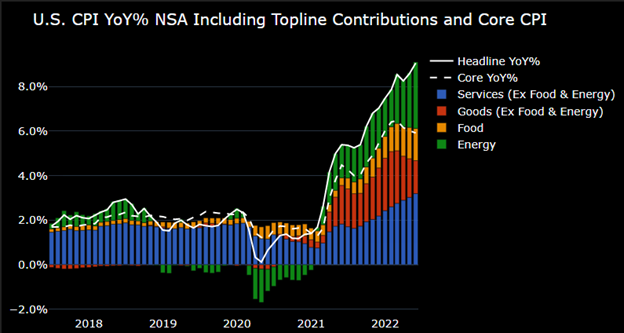

Chart 3: US CPI YoY contributions

Source: Bloomberg

Goods inflation has receded somewhat, though demand for services continues to grow.

Under a scenario where CPI remains close to 9% towards the end of 2022, the Fed is almost certain to require calling their own bluff. That is, regardless of negative growth, recessionary measures, a plunging equity market, or potentially a softening labour market, they will be forced to push ahead with restrictive monetary policy measures and continue trying to break CPI. This is also known as ‘the hard landing’ and entails volatility, despair, and for at least a little bit of time, stagflation. The Fed has been known to pivot in the past, and a weak resolve to raise rates in a deteriorating macro back drop is a potential outcome, but the probability of continued CPI upside surprises appears to be higher than most perceive it to be.

From a currency standpoint, this may ironically continue to feed the ‘dollar doom loop’. The broad dollar index is currently up around 16-18% from a year ago, and we’ve recently seen the euro below parity for the first time in two decades. With countries like Germany moving from a structural current account surplus to deficit, we are seeing the effects of a shifting trade balance. Higher input costs and demand for dollars, especially related to energy, are contrasted by lower overall manufacturing and production, hence lower exports and simultaneously lower demand for euros. Considering rising yields, potential for further risk-off moves, and structural trade changes, it is likely we are not yet in the ninth inning.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.