What can we learn from GameStop?

2 February 2021

Powell and the Fed: Reading Between the Lines

16 February 2021INSIGHT • 9 FEB 2021

Inflation: Gone but not forgotten

Kambiz Kazemi, Chief Investment Officer

Readers of this article born after December 1993 have seldom experienced periods of inflation (as measured by Personal Consumption Expenditures [PCE]) above 2.5%. For nearly three decades, technological advancements and the implementation of “new” monetary policy have driven deflationary forces, such as quantitative easing keeping a lid on the simmering pot of aggregate price increases.

Those who have witnessed first-hand periods of high(er) inflation in the 1980’s, have been talking about and looking out for signs of inflation ever since, especially following the Great Financial Crisis (GFC) of 2008. Common wisdom suggests that as economic activity accelerates, borrowing increases in unison with interest rates, as well as prices (and demand) for goods and services. At times of prosperity, the infamous Phillips Curve should also represent the inverse fall in unemployment.

However, during the global rebuild that followed the GFC, as the economy grew and unemployment fell, inflation failed to materialize. This lack of pickup puzzled central bankers greatly and has since been the focus of many studies and debates.

Inflation in the COVID-19 era

With the potential for a strong economic recovery driven by additional stimulus, questions about inflation are once again taking center stage as economies worldwide attempt to bring the COVID-19 pandemic under control through vaccination rollouts.

US 10-year breakeven inflation

Source: Bloomberg

Expectations that inflation will rise have increased over the last few months, are at multi-year highs, and are at levels above those witnessed prior to the start of the pandemic. Investors are faced with several key questions: 1) are we going to see these expectations rise further? And more importantly, 2) are these expectations going to be followed by actual inflation readings of the same order?

Relying on recent experience, the inverse relationship between economic growth, unemployment and inflation seems weak at best and fundamentally altered at worse. In our view, a massive economic recovery does not necessarily guarantee a pickup in inflation by itself.

Most importantly, inflation has a psychological component to it. If most investors do not expect it or factor it into their projections, potentially as they may never have witnessed it firsthand, it is unlikely to materialize. That is unless prices have a “real and palpable” and sustainable increase, which in turn will flow through the system to be felt by consumers and businesses alike.

In our view, there is a potential for noticeable price increases to manifest themselves due to the following three key drivers:

1. Supply disruption and destruction

The pandemic has had many unforeseen and unusual effects on the global supply chain. The oversupply of oil and the drop of Brent crude below $0 a barrel was certainly one of the most dramatic manifestations, as shut-ins could not be organized fast enough to counter the glut of available oil at the Cushing delivery point in Texas.

Similarly, many supply disruptions have appeared due to delay issues related to transport, production shutdowns, and geographical restrictions – factors that have combined to drive up the price of goods with low price elasticity. Some of these shifts have been temporary in nature and slowly subsiding, while others are more fundamental and potentially longer lasting.

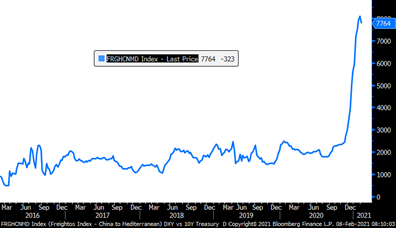

The latest example of pandemic related imbalances (with far reaching price impact) is the quadrupling of the price of sea freight from China to Europe. Due to a bottleneck of containers stuck in the US and Europe and the resulting cancellation of shipments earlier in 2020, the last two months have shown an incredibly steep price hike. (see Freightos Index chart)

Freightos Index – the price of shipping containers from China to the Mediterranean

Source: Bloomberg

In addition to these disruptions, we can also point to supply-induced price pressures which appear during a potential strong recovery, due to the mid and long-term grounding of the supply chain during 2020.

For instance, the high number of bankruptcies within the hospitality sector, including restaurants and bricks-and-mortar retail chains, has destroyed some important supply. If the economy sees a strong rebound in 2021 with a level of demand that normalizes relatively rapidly, it is still unlikely that the supply in these sectors will reappear overnight. The destruction inflicted in 2020 will take time to heal as new entrants or defunct incumbents enter progressively their respective markets or to set-up shop again.

The result could be an increase in prices of goods and services as many of these sectors will see the pace of demand outstrip the capacity to build supply. This should be considered a real outlet for inflationary forces, where the impact will be felt directly by consumers.

2. Deferred spending and “pent-up” demand

While the pandemic has had devastating effects for many, developed countries have acted to provide business-related emergency support programs, including direct payments to individuals or low interest, forgivable loans to small businesses.

This lower mobility, which is the result of cautious health measures and confinements, has resulted in lower consumer spending and higher personal savings. In the meantime, the US unemployment rate stands at 6.3% – currently above the 3.5% pre-pandemic level, but far from the highs experienced during the GFC of 2008.

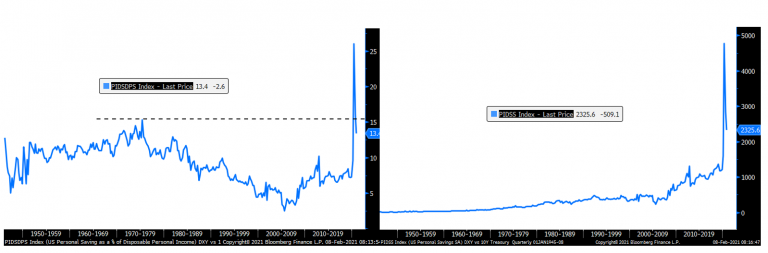

The balance sheets of US consumers are very healthy, with Personal Savings in both absolute $ and % terms reaching notable highs. Personal Savings, as a percentage of disposable income, is at its highest since 1975. It is increasingly becoming a consensus that these savings could help unleash a “pent-up” demand once consumers are confident about their health prospects and pandemic related concerns fade.

We would like to highlight that what lies ahead might not be just limited to this demand (increased consumption), but also the possibility of what can be called “deferred spending”: a consumption which is meant to make up (and exactly match) missed past expenditures. For example, some consumers might decide to take two full holidays instead of one, which would result in fully making up past missed consumption in many instances.

This combination of pent-up and deferred demand can in turn affect prices in two ways:

a) Even sharper price increases for those sectors that have seen supply destruction.

b) Providing some businesses with an opportunity to increase prices which they likely would have not had otherwise, in a “normal” economic cycle. Examples include hotel chains and airlines.

Consumer Savings are at record levels in both absolute and % terms

Source: Bloomberg

3. A globally synchronous recovery: imbalance of supply and demand flows

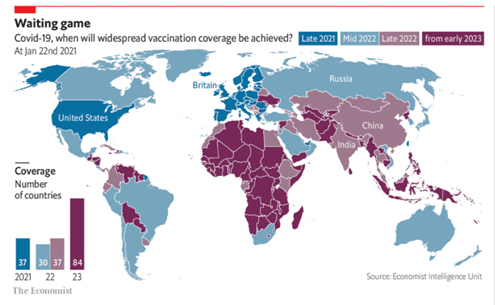

Over the last few months, it has become very clear that global vaccination campaigns will occur at differing speeds and at differing levels of effectiveness. Developed countries are ahead, both in the purchase of vaccines and their vaccination campaigns – many of them looking to complete full rollouts before the end of 2021. Meanwhile, most emerging and underdeveloped countries will, at best, be completing their campaign in the second half of 2022, in some instances as late as the end of 2023.

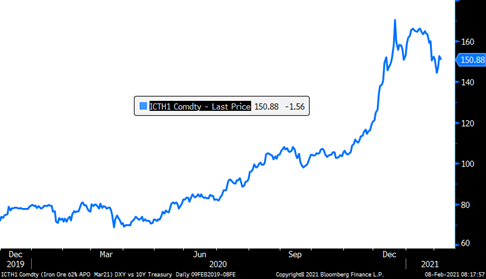

What will come from this asynchronous vaccination progress? It will likely result in an asynchronous recovery of economies. Many of the goods considered in demand by recovering, developed countries that are supplied by emerging and underdeveloped countries could see higher prices, as the latter still face supply disruptions due to the pandemic. So far, we have seen traces of this phenomenon since Autumn 2020, as China, in light of its economic recovery ahead of the Western world, seems to have ramped up the purchase of various commodities including grains and iron ore.

Iron ore China 62% prices

Source: Bloomberg

Similarly, we could also witness price adjustments and pressures by geography, as tourism will likely shift to countries which are considered “safe” (i.e., ahead in their vaccination campaigns), affecting prices in those jurisdictions due to the sheer size of travel flows.

It is wise to be ready

The case for inflation is a reasonable one and it would be wise for all those who have interest rate exposure to be cognizant of it, giving ample thought to its potential effect on their investments.

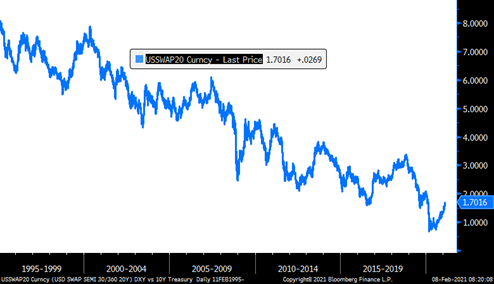

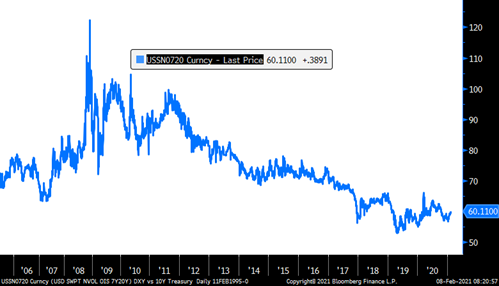

The good news is that controlling the risk of inflation across a portfolio has seldom been so inexpensive. In fact, the implied volatilities (i.e., a measure of options prices) on long-dated interest rates options are at extremely low levels and, in some cases, all-time lows.

This combination of low implied volatilities and low nominal rates allows investors attractive hedging opportunities for interest rates over a 5-to-7-year horizon.

If you have any questions on the above, or are simply interested in discussing interest rate hedging, please feel free to contact us on rates@validusrm.com

20-year US swap interest rate

Source: Bloomberg

Implied volatility of 7-year option on 20-year US swap interest rate (ATM)

Source: Bloomberg

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.