China’s road to recovery: how heavily will real estate weigh on growth?

16 April 2024

Geopolitical Heat Up – What’s the Impact on Rates?

24 April 2024INSIGHTS • 17 APRIL 2024

Iran-Israel tensions: are markets under-pricing escalation risk?

Marc Cogliatti, Head of Capital Markets EMEA

The events of the weekend were nothing short of historic, as Iran launched an unprecedented retaliation in response to the killing of two senior generals in Damascus. On Sunday night as the dust settled, many went to bed thinking about how markets would respond. How far would equities be down at the open? How much stronger would safe haven currencies like the USD and JPY be against their peers? What would be the impact on rates?

Despite the global shock, Saturday’s news was hardly a surprise. Markets had wind of a response on Friday and closed last week in the red (the S&P 500 was down 1.46% - its worst day since January), US President Joe Biden cut short his holiday to return to Washington in anticipation of an escalation and armed forces in the region were on high alert.

The scale of the attack was perhaps larger than many anticipated, but markets were surprisingly calm on Monday morning. Maybe it was the fact that most of the drones and missiles were intercepted or maybe investors took some comfort from Iran’s chief of general staff, General Mohammad Bagheri, when he said that the operation was considered a success and that further attacks on its part were not necessary. If anything, ‘risk’ assets were up, partially reversing Friday’s fall in classic ‘buy the rumour, sell the fact’ fashion. Even the Shekel was up!

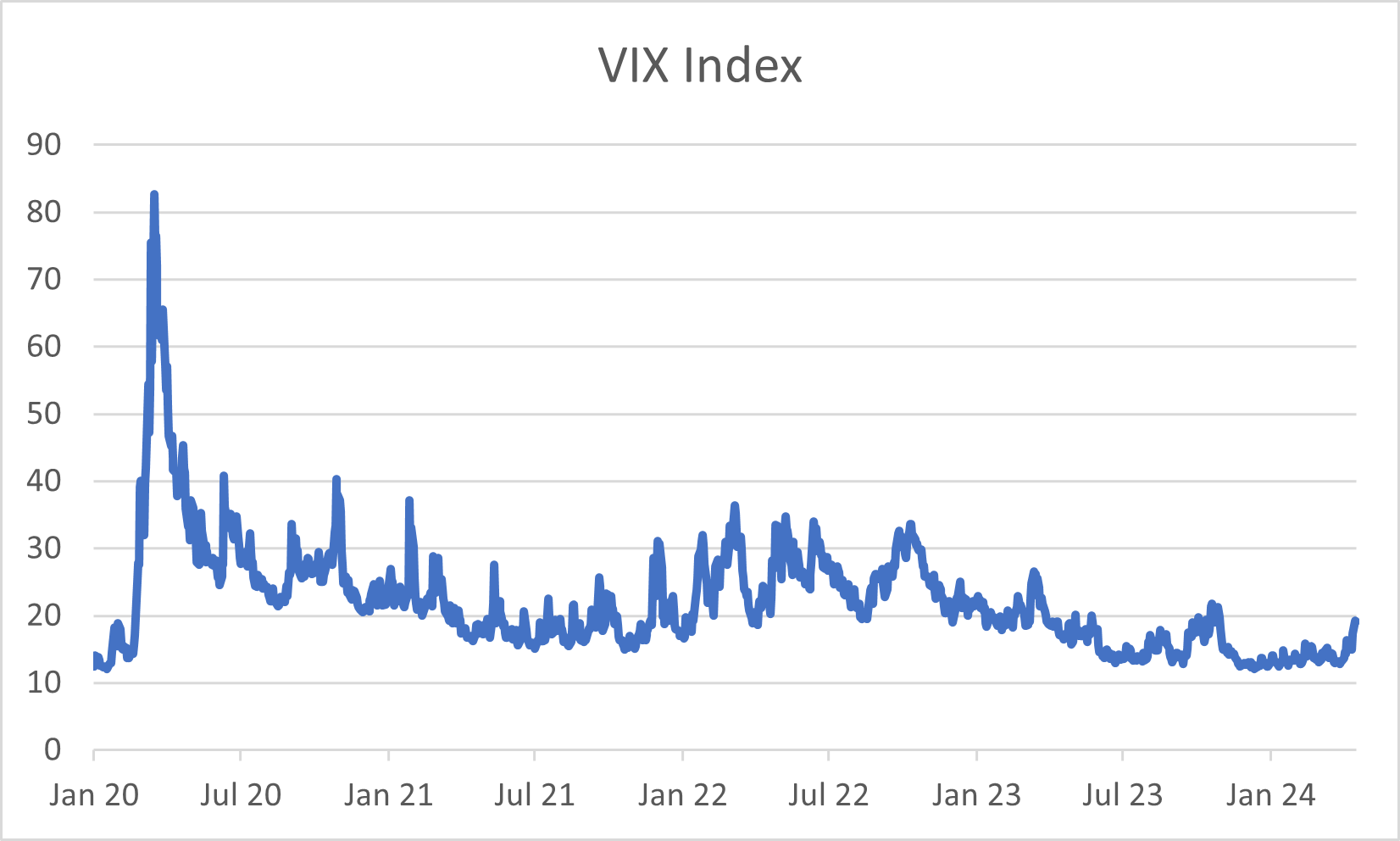

Looking at various market indicators, there are some early warning signs of concern, but generally speaking, these are no more than the relatively minor moves we’ve seen in spot markets. For example, the VIX index (widely dubbed the market’s ‘fear index’) has risen from ~15 to ~19 since Friday but its still relatively low vs where we’ve been in recent years. The move is insignificant compared to the moves we saw at the onset of the COVID related crisis (see chart below).

Chart 1: VIX Index

Source: Bloomberg

Meanwhile, in FX, GBP and EUR risk reversals have moved lower (meaning an increased cost to protect against the downside in these currencies vs the USD) but again both are relatively minor moves and fall within the ranges that we’ve seen of late. Even oil prices have been stable over the past couple of days (although I’m mindful that we’ve already seen a big move higher in the past six weeks).

Pricing elevated risk

The key point that concerns us at Validus, is that the markets seem to be under pricing the risk that tensions escalate further. We’re not taking a view on Geopolitics, but instead noting that markets remain surprisingly sedate given the apparent elevated levels of risk. This presents hedgers with an opportunity to add some protection at a cheaper cost compared to where we were at the start of 2024. For example, a 1 Year At The Money GBPUSD Put back in January cost ~3.55%. Today, the cost for the same protection costs ~2.92%. There same applies to EURUSD where vols are even lower (currently 1.32% for a 1yr ATM Put vs 1.91% back in January).

Most of our clients hedge using forwards, but the same principle applies. If volumes were to shoot up dramatically (as we saw back in 2020) Bid/Ask spreads in both spot and forward markets are likely to widen and banks will likely increase credit charges to compensate them for the higher level of risk. For now, everything remains very much ‘business as usual’ but experience tells us that when sentiment changes, it changes very quickly.

The impact on interest rates is an even more interesting one. Will central banks be forced to cut rates to support demand if sentiment plunges or will they be forced to raise rates to combat higher inflation if oil prices spike higher and supply chains suffer further disruption? That’s a debate for another week, but for now, rates markets appear unscathed and thus protection is worthy of further consideration.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.