Hawkish Peak to Thread the Needle?

10 May 2022

Policy Mistakes, Sticky Inflation and Higher Rates

24 May 2022INSIGHT • 17 MAY 2022

Treading the inflation tight rope: can the BoE keep its balance?

Jesús Cabra Guisasola, Senior Associate, Global Capital Markets

“We are a very long way away from the 1970s”

Governor Andrew Bailey testifying to the UK Treasury committee in November 2021.

“I ‘m still very, very supportive of the forward guidance that there may well need to be further tightening in the coming months.”

Deputy Governor Dave Ramsden during an interview in Bloomberg on the 12th of May 2022.

“I have to say that this is the biggest test of the monetary policy framework that we’ve had in 25 years, no question about that.”

Governor Andrew Bailey testifying in the lower house of parliament on the 16th of May 2022.

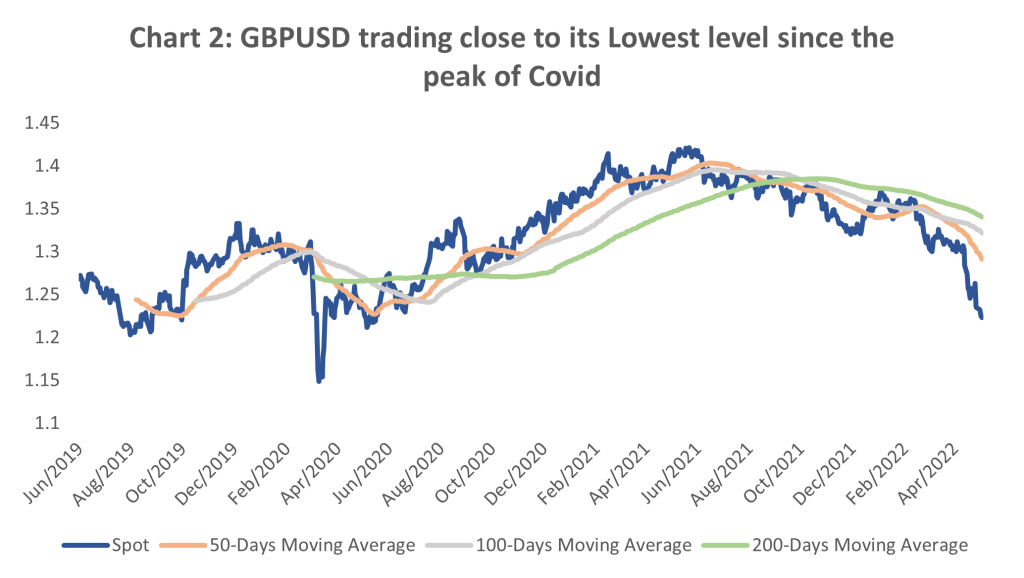

Sterling got off to a good start in 2022, the economy was recovering quickly from the outbreak of Omicron and with the first hike from the BoE in December 2021, the prospect of the British economy looked brighter which led to a rally of the pound against both the USD and EUR, towards the $1.38 and €1.20 levels.

However, back in February we warned that sterling was getting ahead of itself as the market was pricing aggressive hikes from the BoE that the central bank may not be able to deliver. Hence, we remained cautious around the prospect of the currency given the significant headwinds that the British economy faced.

A month later, the war between Ukraine and Russia started, which led to a spike in commodity prices. As a result, inflation became the biggest concern, squeezing household purchasing power and led to the British economy losing steam quicker than expected.

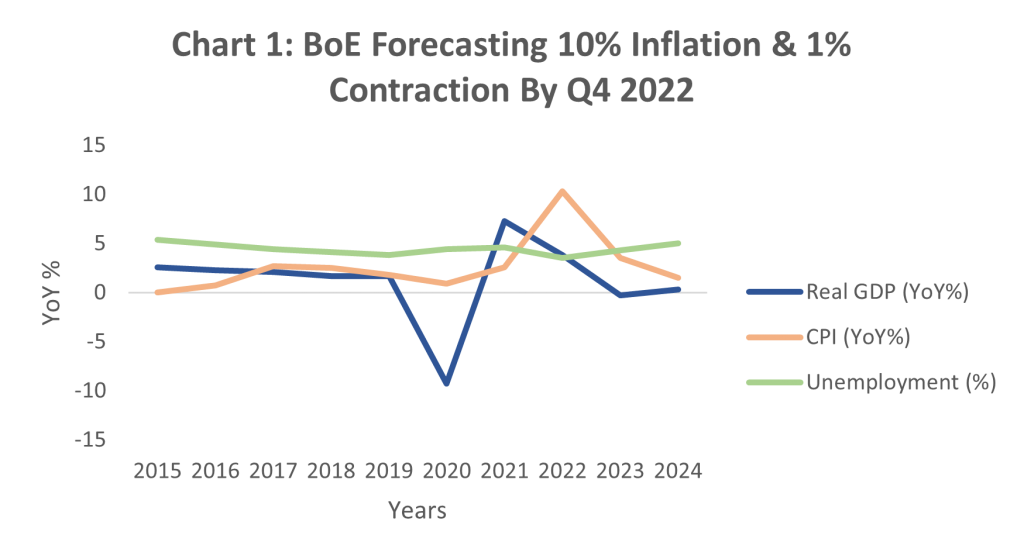

This was reflected in the gross domestic product figures released on the 12th of May, which showed that the UK economy unexpectedly fell 0.1% from February and only expanded 0.8% during Q1 2022 vs 1.0% forecasted by most economists. The BoE is now expecting inflation to reach double digits later this year, with a further 1.0% contraction in GDP by the end of Q4 2022.

Given the rapid recovery from the pandemic and with the economy re-opening, the unemployment rate is at historically low levels. Some argue that the departure of the UK from the EU has made filling vacancies more difficult, as the country is suffering of a significant reduction in labour supply – exacerbating inflation numbers via wage pressures.

Source: Bloomberg

Some would argue that the British economy is facing a similar situation to the one suffered back in the 70s. There are similarities between that crisis and today’s current economic situation, as a main driver of high inflation, then and now, is the shock in oil prices. However, the surge in oil prices in the 70s was larger with a rally of more than 70% and inflation reaching 25% by 1975. The political and social instability were also more adverse in the 70s, as the strength of the unions led to several strikes claiming higher wages for worker to combat the increase in utility bills.

It has become clear that the prospect of the British economy is more uncertain than ever. This has driven sterling to depreciate as the currency has usually underperformed during riskoff environments, with investors moving towards safe haven assets like USD. This has made the pound one the worst performing currencies in 2022, and with GBPUSD trading close to its lowest level since the peak of the pandemic.

Source: Bloomberg

Moreover, central banks’ actions have not helped boost confidence in the economy. Central banks were once considered saviours during the aftermath of the global financial crisis and during the pandemic, but they are now fast becoming villains as economists are criticizing them for being too complacent with high inflation during 2021 as well as too slow and late on trying to curb it. Also, recent comments from Governor Bailey were not popular among Britons after he urged workers not to seek higher pay, to curb pay growth and prevent higher inflation.

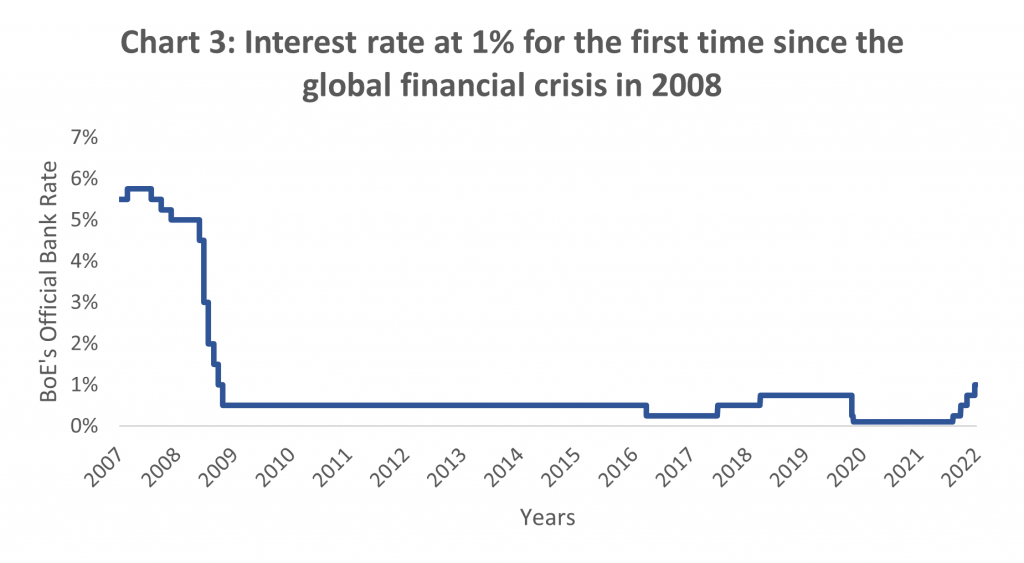

The last BoE meeting on 5th May did not help to re-build confidence and exhibited more uncertainty around the path that the central bank will take during the months ahead. Governor Bailey and the MPC delivered what most market participants were expecting, an increase of 25bps, bringing the key interest rate to 1.0% for the first time since the global financial crisis in 2008. However, the MPC continues to lack unity, sending a message of hesitation to the market. In the most recent meeting 3 members voted for a larger hike (50bps) and the prior meeting saw two members vote for no hike at all.

Source: Bloomberg

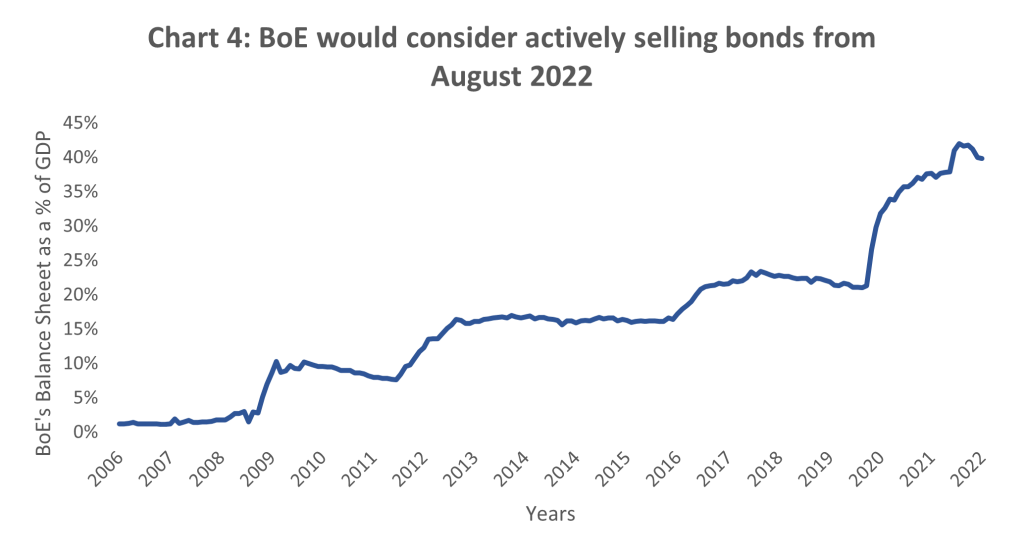

In addition, MPC gave little information around balance sheet reduction and the plan to sell the £20bn of corporate bonds back to the market. The central bank was cautious and pushed this decision until August, perhaps waiting to see what the Fed’s plan is around QT.

Source: Bloomberg

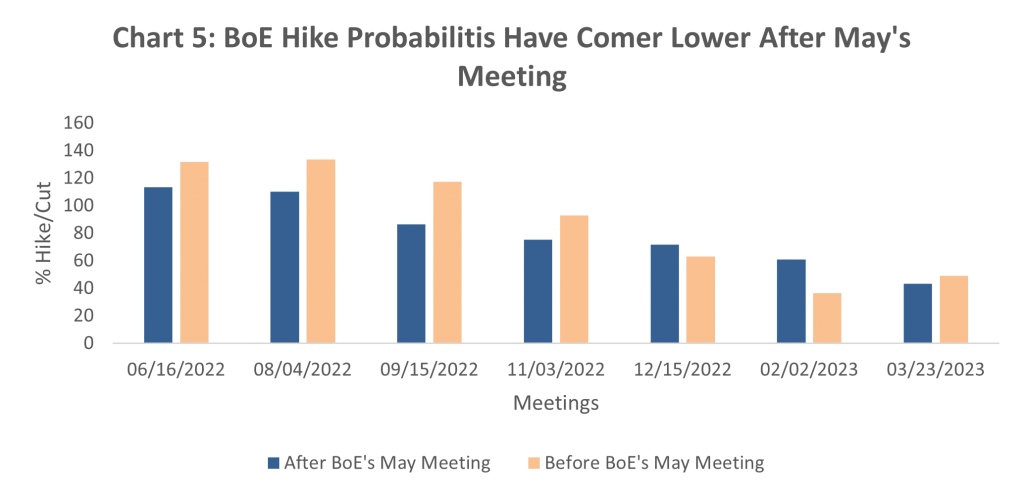

As a result, money markets took the last meeting as more dovish than expected and they are now pricing lower hikes for the meetings ahead.

The overall impression is that while the Fed is becoming more concerned about inflation, they still have room to hike more aggressively compared to the BoE as the US did not show signs yet of a slowing economy. Hence, two 50bps hikes at the next two meetings are already priced in. On the other hand, the BoE is facing the difficult task of trying to curb inflation while keeping the economy running even though it is already showing signs of slow down.

Source: Bloomberg

So, should the BoE speed up on tightening to contain inflation or should it pump the brakes to not worsen the slump?

It is well known that current inflation is due to the imbalance between supply and demand during the pandemic, worsened by the war in Ukraine and the surge in commodity prices. Hence, the BoE has little control over the supply side as they can only intervene to control demand.

Couple this with the increase in taxes from the government and it is clear the BoE’s task is even greater – if the central bank decides to continue hiking, it will only make borrowing more difficult and as result further the cost-of-living squeeze for lower-middle classes. This was backed by Governor Bailey’s comments yesterday afternoon where he said that “it is a very, very difficult place for us to be in” and this is the “biggest test of monetary policy that we’ve had in 25 years”.

Therefore, our base scenario is for a more cautious BoE during the second half of the year where we should expect some further modest tightening with a series of 25bps hikes from the committee to keep inflation in check. But further escalations in Ukraine and flagging UK GDP growth could result in a halt to the tightening cycle which started only a few months ago. We remain cautious around the prospect of Sterling in the coming months with some downside risk for the currency and increased volatility a likely prospect.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.