In a volatile world, are LATAM currencies a haven or risk?

29 March 2022

Five reasons why the dollar could weaken in the coming months

5 April 2022INSIGHT • 04 APR 2022

The dollar’s getting ahead of itself: three likely risk scenarios

Phillip Pearce, Associate Global Capital Markets

The dollar has had a stellar start to the year as it’s seen substantial strength as markets flocked to it as a safe haven, as Russia invaded Ukraine and has been bolstered by the aggressive narrative that the Fed has adopted relative to its UK and European peers. However, the situation is becoming fraught with risks as the market believes the ultra-hawkish Fed is steering us into a recession with the spread between 2-year and 10-year treasuries briefly turning negative this week. The Two-Ten spread has historically been a reliable indicator of a pending recession, as every recession in the past 70 years has been preceded by an inversion. The Fed has a different view and believes the US economy is strong enough to weather the coming storm, with markets expecting more hikes this year.

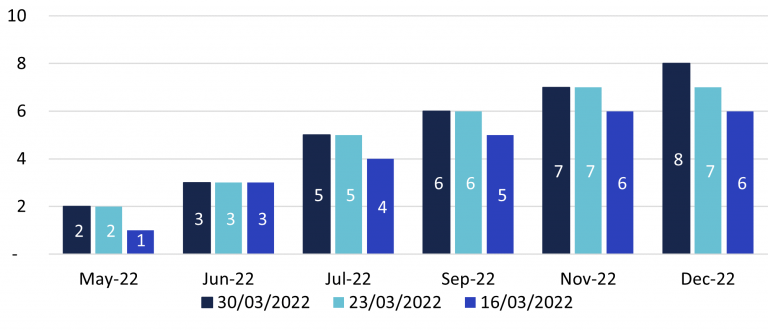

Expected No. of 0.25% hikes by the Fed for 2022

Source: Validus Risk Management

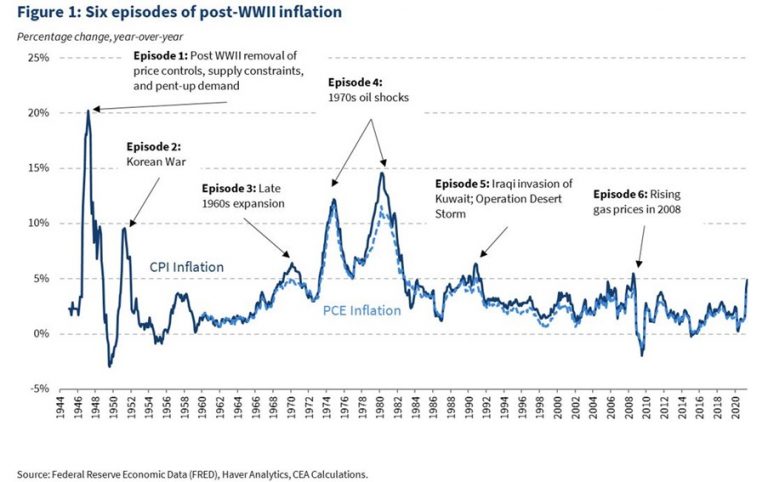

So, what does this mean for the dollar? Well, in the short-term, economic theory would dictate that higher yields relative to peers would favour the dollar as the forecasted year-end target rates for the US are predicted to be higher at 2.5% than the UK at 2% and EU at -0.2%. However, nominal rates are only half the story, inflation plays a key factor in real yields and ultimately how attractive a currency is. Since World War II there have been six inflationary episodes, the energy crisis we see today represents the 70’s episode, but the real driver of today’s inflation is the pandemic which looks a lot more like the post-WWII episode. The US should have a better handle on inflation as it’s more insulated to energy shocks than the UK and EU. However, both episodes I’ve drawn out led to a recession and would further complicate things for the dollar.

Based on the immediate environment, we have set out three possible ways forward for the Dollar in 2022, bearing in mind that recessions occur on average 18 months after an inversion:

Scenario 1: Russian/Ukrainian stalemate (70% probability)

If we see no progress towards a ceasefire in Ukraine markets could become complacent and the gains the dollar experienced as a safe haven should ease away with the odd bouts of volatility as positive headlines on the peace negotiations nudge investors towards risk assets or negative ones towards safe havens. Ultimately, the dollar remains elevated as the nearest “fire exit.

Scenario 2: Further escalation in Ukraine (15% probability)

Further escalation would lead to dollar strength as investors turn to safe havens, it also provides further inflationary pressures as energy commodity prices increase. The most affected region would be Europe as the ECB is put in a tight spot where inflation continues to soar but the threat of rationing energy consumption dampens growth. The US is more isolated, but price pressures will remain, possibly prompting greater hawkish rhetoric from the Fed and further strength for the USD.

Scenario 3: Concrete de-escalation in Ukraine (15% probability)

This is ultimately negative for the dollar as the benefits from being a safe haven dissipate, the effect being greater than the narrative of the Fed. Inflationary pressures remain, but central banks now have breathing space to maneuver.

The number of risk factors to consider keep increasing and adding to the complexities we find in today’s markets. Volatility to either side would be introduced by the Fed’s actions at its May FOMC meeting. If the Fed delivers a 0.5% rate hike, it’ll be supportive of a stronger dollar as markets keep buying into the hawkish narrative. If the Fed doesn’t deliver a 0.5% hike in May, markets would become tentative, and the Dollar would soften but the Fed would have a second chance to establish credibility with a 0.5% hike at the June meeting. If the June meeting doesn’t deliver an aggressive hike, markets would start doubting the guidance of the Fed and both rate expectations and the dollar will weaken. Ultimately, markets are continually being exposed to previously unseen event risks that could lead to greater volatility than we’ve seen in decades and requires expert insights to navigate.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.