Economic Special Edition: Winter is here

13 December 2023

To cut or not to cut (rates): Let’s flip a coin

20 December 2023INSIGHTS • 14 DECEMBER 2023

Post-pandemic inflation and the expansion of the private credit market

Louis Sangan, Senior Associate

The post-pandemic inflationary experience has been a key focus for policymakers and market participants alike. Following the highs of late 2022 and early 2023, inflation in developed economies has fallen significantly faster than expected, delighting politicians while surprising central banks (and many of us) anticipating a greater degree of stickiness and adjustment of forward-looking expectations.

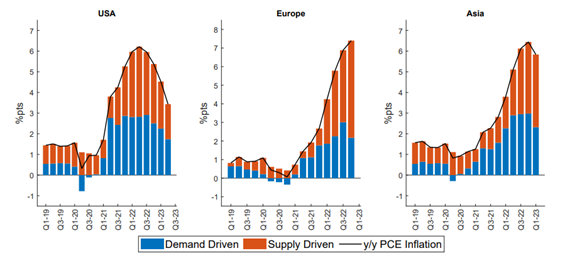

A working paper from the IMF published in October 2023 sought to break down the causes of post-pandemic inflation into demand-driven and supply-driven factors – looking at the US, Europe and Asia. This offers some potential insights into the sharp fall experienced in H2 2023.

Chart 1: IMF breakdown of post-pandemic inflation

Source: IMF

Notably, a large portion of the inflation peak can be attributed to supply-driven factors, ranging from global supply chain disruption to increased commodity prices and tighter labour markets (partially due to lower participation rates following COVID). It is commonly accepted that supply-driven inflation was more prevalent in Europe than in the US, with the latter having more robust demand-side drivers and economic growth. When considering the fall in the inflation rate, the IMF breakdown demonstrates a larger portion of it owing to a reduction in supply side inflation, particularly observable in the US given an earlier peak. We expect this trend has continued for the remainder of 2023 (not presented in the data) and in Europe.

Central banks predominantly rely on the blunt tool of interest rate hikes to stifle demand-driven inflation, whilst other government-level policy tools are used to combat supply-driven inflation. Some examples in the US include measures to reduce bottlenecks at West Coast ports for Asia-focused supply chains, increased domestic semiconductor capacity and the release of crude oil from the Strategic Petroleum Reserve (SPR). In addition, supply issues resulting from COVID and the Russo-Ukrainian War have, to a certain degree, eased from their peaks.

This begs the question: to what extent have interest rate hikes impacted the inflation rate from a demand side? And, given the fall in supply-side inflation, coupled with the widely accepted “long and variable” lags in monetary policy, what does the future outlook for demand hold?

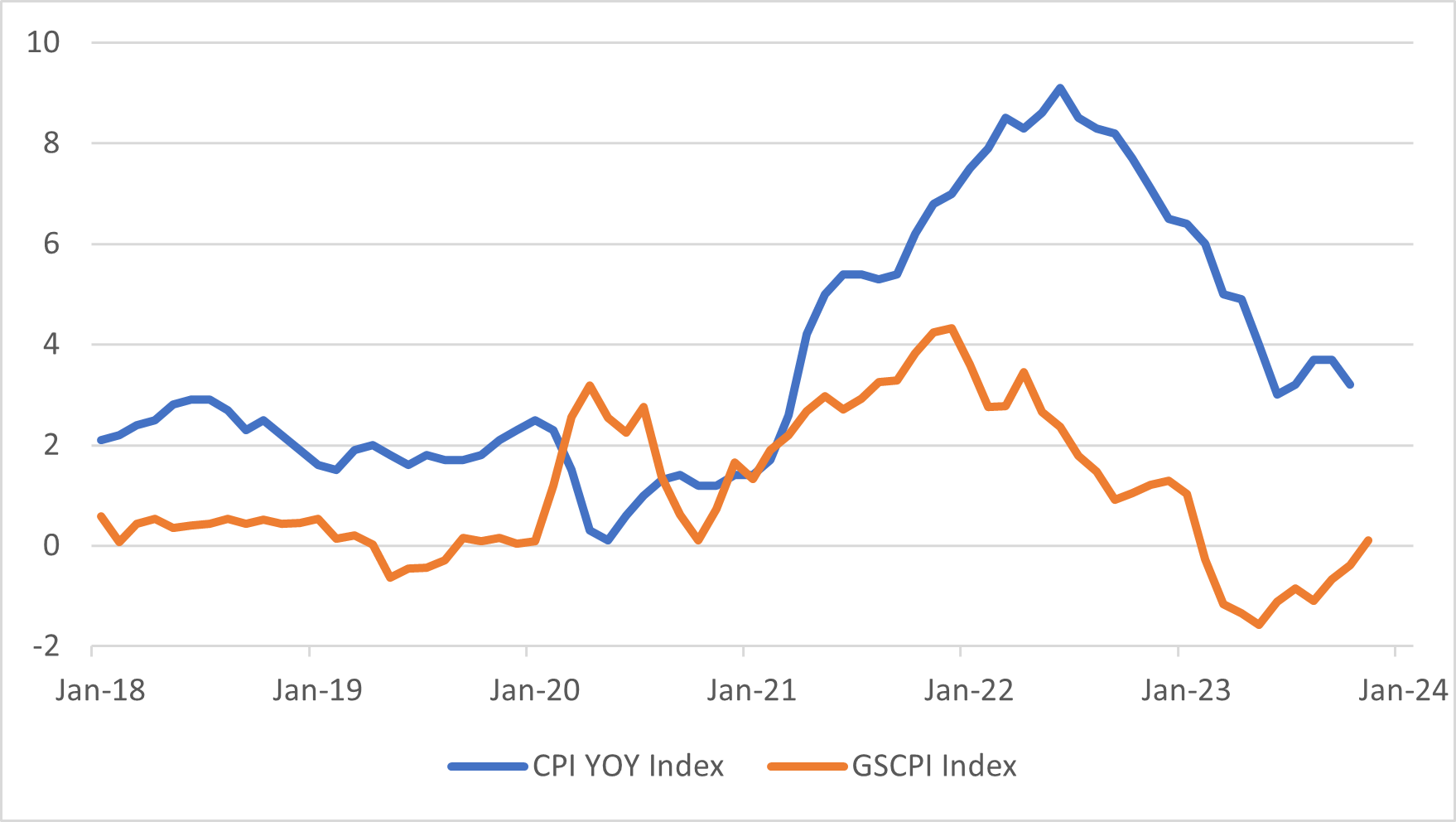

Chart 1: US CPI YoY (%) versus Bloomberg Global Supply Chain Pressure Index (US focused)

Source: Bloomberg

Milton Friedman was the first to use the term “long and variable lag” in relation to monetary policy, with a period of 18-24 months initially considered the time span required for the full effect of hikes to be felt by the economy.

However, changes in central bank communication and forward-looking statements mean this is likely to be shorter in the modern world. In January 2023, member of the Federal Reserve Christopher Waller estimated this lag to be between 9 and 12 months. Even with a shorter lag period, the full effects of hikes have not likely been felt yet by the broader economy.

Hard landing risk

Having built up their savings over the course of the pandemic, households across the globe have predominantly spent them in the aftermath – bringing savings back down to pre-pandemic levels. This has contributed to a boost in consumer demand over the last 24 months, and a degree of insulation to rising rates.

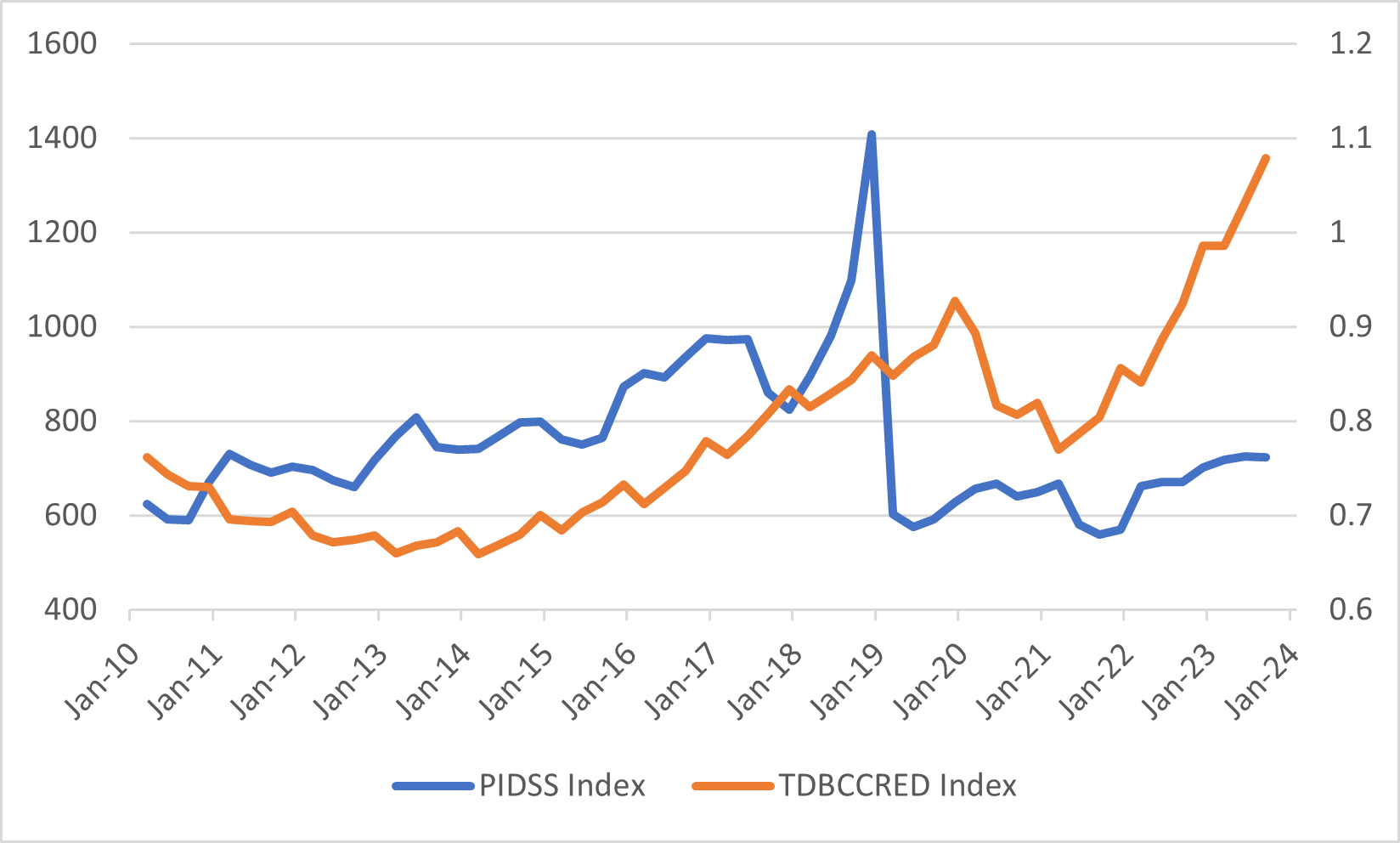

As seen in Figure 3, nominal savings in the US spiked during the pandemic and have subsequently fallen, whilst consumer credit – having seen a drop over the pandemic – has continued to rise to new highs (likely replacing depleted savings).

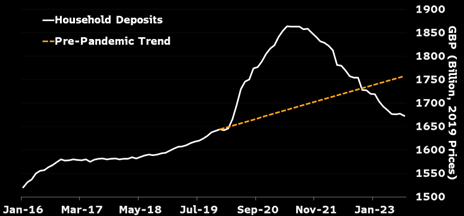

The trend is similar in the UK, as evidenced in Figure 4 – on a real basis, household deposits have fallen below the pre-pandemic trend level. Meanwhile, interest rates on consumer credit in the US have risen in line with base rates from c.14% to c.21% currently.(1) At the same time, expansionary fiscal policy from pandemic-era stimulus has seen the debt-to-GBP ratio increase further across developed economies, in particular the US where it reached highs of above 130% in 2020 and remains elevated above 120%.(2)

Chart 3: US Nominal Household Savings (LHS, $bio) and US Credit Card Balances (RHS, $trio)

Source: Bloomberg

Chart 4: UK Household Deposits, 2019 adjusted prices

Source: Bloomberg

Some of the components of demand-driven inflation are likely now receding, even in the absence of monetary policy, as pent up consumer demand tails off. Credit is now more difficult to obtain and finance due to increased interest costs. Governments are also looking to reduce deficits as well as deploy quantitative tapering policies. Whilst macroeconomic data has been robust (particularly in the US), a reversal of these drivers and the full effects of interest rate hikes feeding through present a sizeable risk to future demand and bring the concept of a hard landing via an initial soft landing to the fore.

This is being played out in the rates markets, where the extent and pace of cuts in 2024 is being discussed by market participants who have assumed peak rates have occurred.

Central banks have been steadfast in their fight against inflation and face a credibility crisis should they pivot too early. However, given the components of inflation, they risk being too restrictive in the upcoming quarters in relation to the proportion of persistent inflation that is demand-driven.

The market is pricing a faster pace of cuts in 2024 than policymakers are currently projecting and, given the lag of such monetary policy, such action may not be sufficient to prevent a hard landing entirely.

Credit Markets

Corporate bankruptcies have risen following the start of central bank hikes in early 2022 (3), and forward-looking economic indicators (PMI and consumer confidence amongst others) point to a slowdown in future economic activity. A recent study from Bloomberg tracking the warning signs of “weaker demand” in S&P 500 and Stoxx Europe 600 earnings calls revealed that such mentions are at post-GFC highs. This highlights increased levels of concern from corporations about topline going forward.

From a credit perspective, there have already been notable reductions in interest coverage ratios (ICR = EBIT/Interest Expense) and increases in leverage, particularly for high yield (“HY”) borrowers.(4) Fractures in future demand and higher input costs are likely to bring greater risk to EBITDA growth.

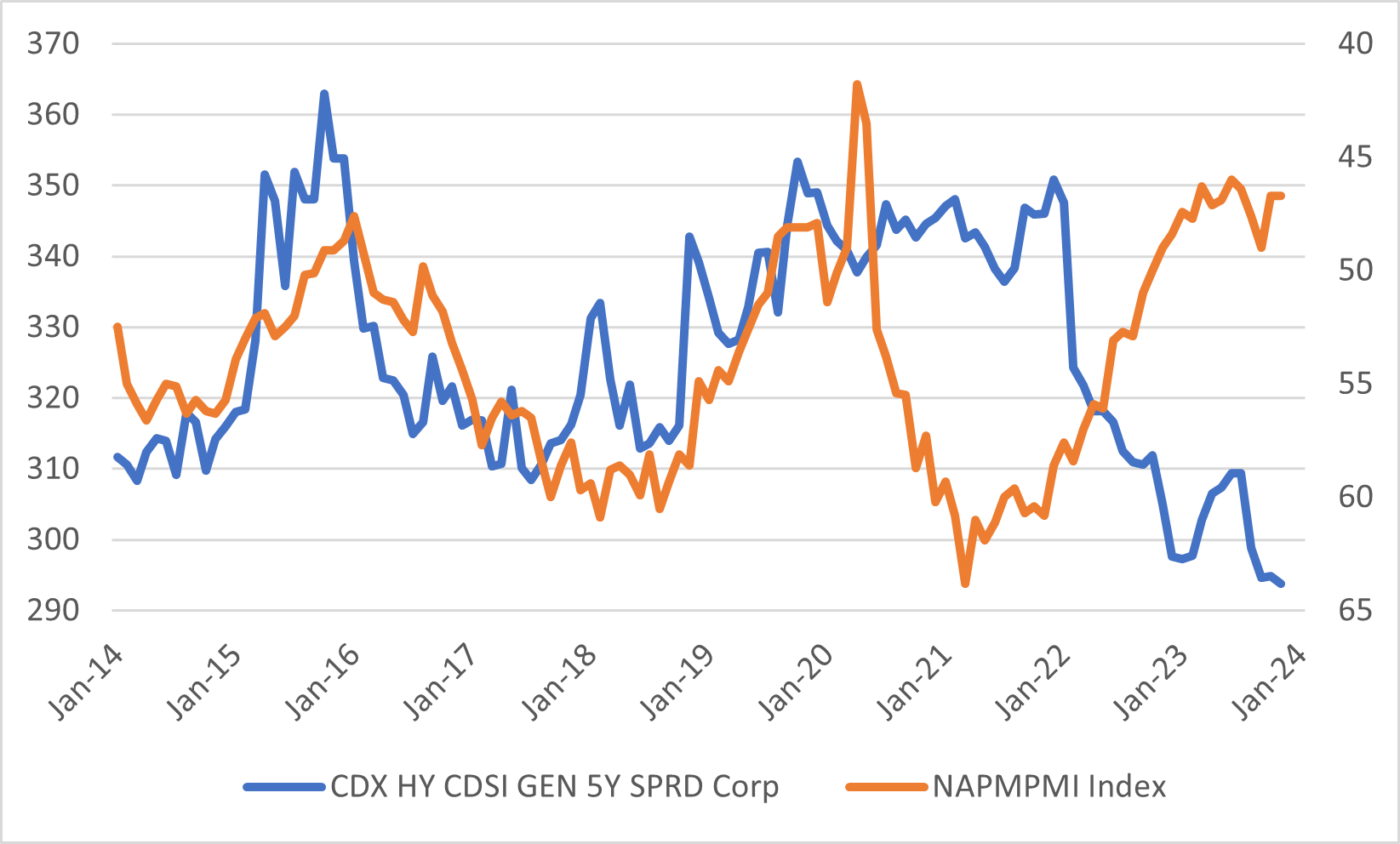

Higher base rates, felt immediately for unhedged floating rate borrowers and upon refinancing for hedged or fixed rate borrowers, result in higher interest expenses. Despite such developments, credit markets are, to an extent, decoupling from the economic trends as evidenced in Figure 5, where CDX HY CDSI has historically seen high correlation with PMI data (inverted).

Chart 5: US HY CDS index (LHS) vs US ISM Manufacturing PMI (RHS, Inverted)

Source: Bloomberg

The concurrence of elevated base rates with a potential slowdown in demand may also coincide with a significant maturity wall for high-yield borrowers. European HY companies have 24% of debt maturities in the next 2 years, and close to 50% expiring before 2026 (versus 12% in 2y These dynamics, whilst problematic for overleveraged companies with weak FCF generation and excessive reliance on future EBITDA growth, may present opportunities for specialised lenders and the continued expansion of the private credit market, which has accelerated exponentially in the last few years. Specialist lenders can typically offer more customisable debt packages that may be warranted in upcoming refinancings and have the in-house capabilities to assess risk and pick out countercyclical businesses. There is already evidence of this trend – for example a group including HPS, Ares, Oaktree and KKR recently provided $1.14b semi-PIK unitranche refinancing to HY aerospace company CPP, with flexibility being an attractive feature versus a traditional syndicated loan deal.(6) and 25% in 3y for US HY).(5)

Similarly, the role of interest rate hedging is likely to hold sustained weight during the refinancing process as both borrowers and lenders seek to control a key, increasingly volatile variable that has had such a significant impact on levered FCF and ICRs of late. With the expansion of private credit and, as a result, increasingly no natural hedge counterparties as part of the financing package, Validus can assist with developing strategies and leveraging market experience to find a hedging solution.

Sources: (1), (2), (3), (4) : Bloomberg (5) : https://bondvigilantes.com/

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.