Central Bankers and Cooling Data Set the Tone

8 November 2023

Where to Next for the Single Currency?

16 November 2023INSIGHTS • 15 NOVEMBER 2023

Central Banks call time on rate hikes

Marc Cogliatti, Head of Capital Markets EMEA

Could a vote of no change in rates be the catalyst for a change in FX?

Ok, the headline is slightly misleading… while both the Federal Reserve and the Bank of England voted to keep rates unchanged at their most recent meetings, neither explicitly ruled out the possibility of further tightening in the months ahead. That said, it’s not far from the truth, well not in the eyes of the market anyway. OIS curves for both US and UK rates are now remarkably flat with neither pricing in a 25-basis point move in either direction until July ‘24.

First up, a quick recap:

- Federal Reserve – The Fed kept rates unchanged as expected. The accompanying statement included one notable change and a reference to tighter financial conditions. Powell also described current policy as ‘restrictive’ (implying there may be scope for easing in the months ahead). That said, the statement was balanced, repeating the message that strong growth could warrant further tightening and highlighted that the FOMC is not yet confident that they’ve achieved a sufficiently restrictive tightening stance.

- Bank of England – The MPC voted 6-3 to keep rates unchanged at 5.25% (as expected). At first glance, an extra member voting for no change (the vote was 5-4 at the prior meeting) could be seen in a slightly dovish light, but this was countered by the fact that the Bank now sees headline CPI slightly above the 2% in two years’ time before edging back below target in Q4 2026. Meanwhile, Governor Bailey stated that policy will likely need to be restrictive for an extended period of time.

If the market is right, and the next move in rates is lower, what does that mean for FX? After almost three months of one-way traffic for the dollar against both the euro and the pound, the past week has seen a shift back in the other direction following the latest Non-Farm Payroll report. Most of us have enough war wounds to know not to get too excited about a one day move, but all the commentary I’ve read since indicates there’s an expectation that this could be an inflexion point for the dollar. One thing we do know, is that when sentiment changes, it does so surprisingly quickly. Even if its just a case of reversing the move we’ve seen over the past quarter, it would still be significant. And given the long term, overvalued nature of the dollar, a more drastic decline shouldn’t be ruled out.

What if the market is wrong and rates need to go up further? Regular readers will know this has been our strongest conviction this year (and so far, we’ve been right). Unsurprisingly, we still think there is a good chance additional tightening will be needed in the months ahead if inflation is to fall back to the 2% target both the Fed and the BoE have in their mandates. For now, we stick by our thesis that those currencies with the least priced in (in terms of tighter policy) have most to gain. However, we can probably take that one stage further and set aside the ECB who seeming have less need to be concerned about ‘sticky’ inflation. If that’s the case, we still see room for the dollar to strengthen further in the near term, even as the Greenback looks increasingly cheap on a long term, purchasing power parity basis.

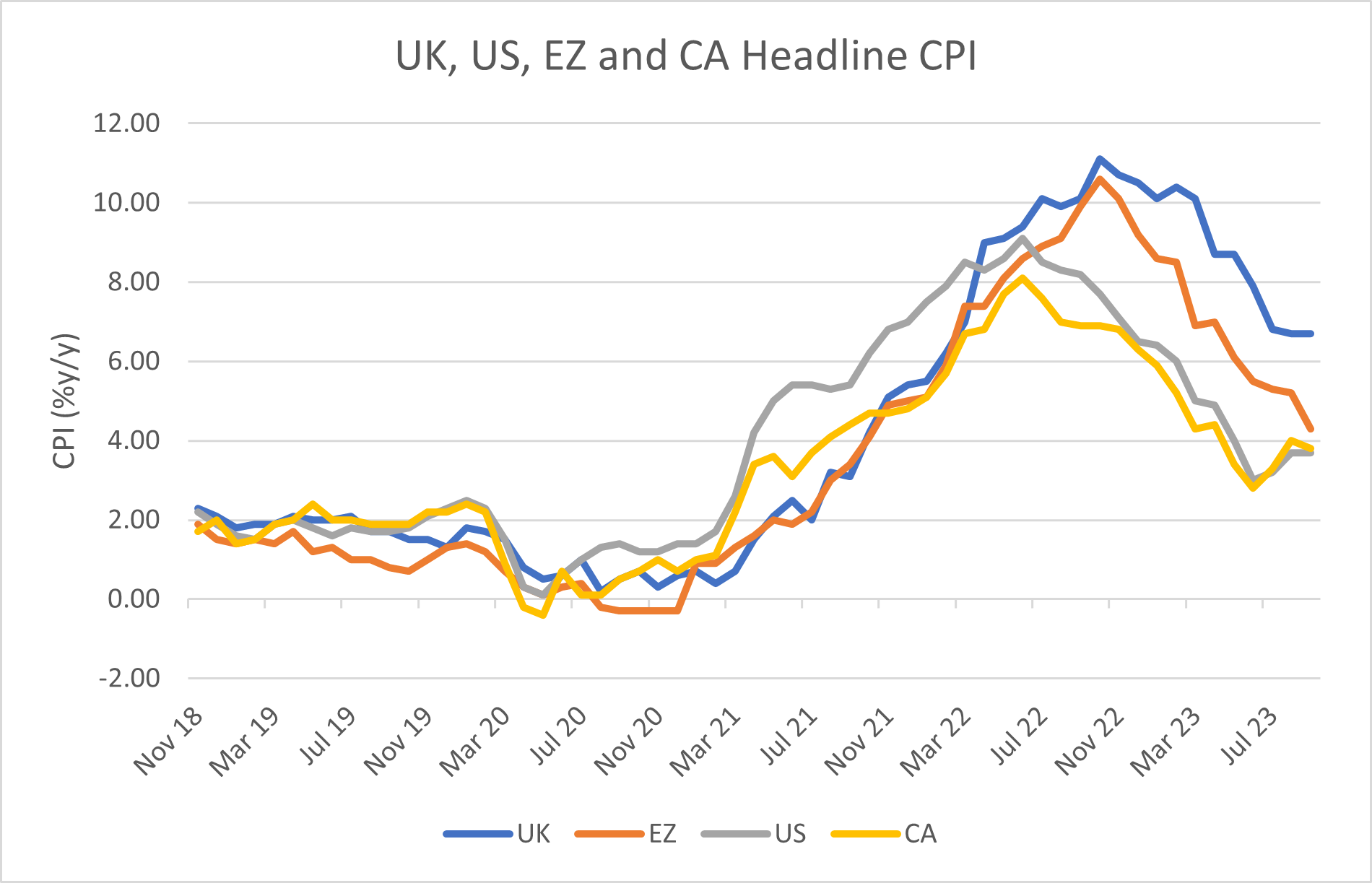

Attention now turns to today’s US CPI number where the headline reading is expected to fall to 3.3% y/y while the core reading is expected to be unchanged at 4.1%. The comparable figure for the UK is due out tomorrow and the market is looking for a sharp drop in the headline reading to 4.7% from 6.7% in September. Clearly the trend is moving in the right direction, but with the core reading still expected at 5.8%, we question whether the MPC’s job is done just yet.

Chart 1: Headline CPI

Source: Bloomberg

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.