Germany’s election shake-up: Shifts across the Bloc

12 March 2025

Transitory is back-proceed with caution

26 March 2025INSIGHTS • 19 MARCH 2025

Equities are falling, but so is the dollar. What’s changed?

Marc Cogliatti, Global Capital Markets Director

Since the financial crisis, we’ve become accustomed to an inverse correlation between equity markets and the dollar. In a ‘risk on’ environment, where investor sentiment is positive and equities perform well, the dollar typically falls. Conversely, in a ‘risk off’ environment, where risk assets come under pressure, the dollar tends to outperform its peers. The rationale that we’ve all come to accept is that the dollar (or, more specifically, U.S. Treasuries) serves as the ultimate safe haven– where investors park their cash in times of stress.

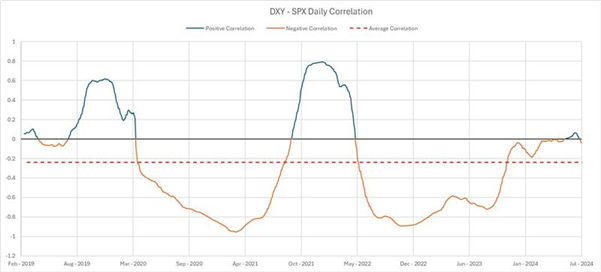

Like any relationship, though, this ‘correlation’ is far from perfect, and its strength constantly fluctuates. After a period of relative stability, we suddenly find ourselves at a point where the correlation appears to have broken, prompting us to question whether what we’re seeing is just a temporary shift–or the start of something more permanent.

A few points for consideration:

- Correlation hiccups

Over the past five years, there were two periods – H2 2019 and Q4 ’21 – Q3 ’22 – when the DXY and SPX had a positive correlation before reverting. What’s to say that the next 3-6 months won’t follow the same pattern? Experience suggests not getting too distracted by short term volatility. It’s also worth noting that while U.S. stocks (especially tech stocks) have been under heavy selling pressure, European indices have done relatively well over the past couple of months, suggesting a reduction of an overweight position in US equities rather than a broader ‘risk off’ move.

- The tariff angle–a reversal in sight?

Much of the recent market volatility has coincided with uncertainty surrounding Trump’s tariff policies. Whilst it might be presumptuous to think he’s simply calling everyone’s bluff and will revert to a more pragmatic stance, it’s not beyond the realms of possibility that he could abolish the tariffs that have been put in place, prompting a reversal in recent market moves.

- Yield differentials take centre stage

Between the Global Financial Crisis (GFC) and COVID, when global interest rates hovered near zero, risk sentiment was the primary driver in currency markets. As interest rate volatility has picked up, yield differentials have once again become the primary focus on a day-to-day basis and there’s no reason to think this won’t continue.

- De-dollarisation—momentum or mirage?

In recent years, there’s been plenty of big-picture talk around ‘de-dollarisation’ and the search for an alternative to the dollar as the world’s global reserve currency. Whilst this is not a process that happens overnight, momentum may be starting to build.

- The enduring appeal of U.S. Treasuries

The absence of an obvious alternative to U.S. Treasuries as a safe haven means there will continue to be demand for US bonds, even if its not quite as strong as it has been historically.

Chart 1: DXY - SPX Daily Correlation

Source: Bloomberg / Validus

Tech stocks pull back as Europe steps into the spotlight

In the short term, it’s clear that after two years of a remarkable bull run, investors are pairing back / taking profit on part of their extreme long positions in U.S. equities–particularly tech stocks. Having rallied around 60% between 2023 and 2024, and becoming the go-to for investors worldwide seeking attractive returns with little thought, it’s hardly surprising that we’re now seeing a correction unfold. With Europe suddenly looking more attractive, not to mention cheap, it seems logical for investors to diversify away from the U.S. and seek alternative opportunities.

From a currency market perspective, we still see scope for the dollar to weaken further in the coming weeks and months, especially if downward pressure on U.S. assets intensifies. Regardless, the dollar remains expensive relative to its peers on most PPP metrics and while positioning has flipped, with traders now net short the dollar (according to the latest CFTC positioning data), we are a long way from the extremes that would suggest a reversal is imminent.

However, from a short-term standpoint, it’s worth noting that both EURUSD and GBPUSD have reached key resistance levels in the past week and have yet to break higher. Given how sharply both pairs have rallied over the past month, a correction wouldn’t be out of place—and it wouldn’t derail our longer-term outlook.