Central Bank Meetings and Stubborn Curve Inversion

2 October 2023

The Great Canadian Deleveraging: A Growth and Housing Crisis

10 October 2023INSIGHT • 4 OCTOBER 2023

Global Interest Rates: Is This the Top?

Shane O'Neill, Head of Interest Rate Trading

One message has permeated virtually every central bank meeting over the last year – rates will remain higher for longer. We have seen pauses in the US and the UK, and in Europe we are close to a near-term high – but all these decisions have been accompanied by central bankers' insistence that the fight against inflation is far from over and cuts are not on the agenda. Despite this, markets are still pricing in significant cuts across all three regions – and although recent price action has removed some of them, there could easily be further to go. Today, we will look at the risks to current curve pricing across Europe and the US.

At its most recent meeting, Fed Chair Powell & co. kept rates on hold for only the second time since they began hiking in March 2022. The pause was broadly expected but what came as somewhat more of a surprise was the level of hawkishness Powell presented at his press conference. Though he acknowledged that from here the Fed would need to “proceed carefully,” new projections show 12 of 19 officials expecting another hike this year and for rates to be 5%+ by the end of 2024, compared to their expectations in June of 4.5%. The market paid slightly more attention than it has in the past – cut expectations for 2024 were reduced, and the terminal rate in Dec 2024 is now priced in at 4.7%, up from 4.4% before the meeting. Though closer to the Fed’s projections, we are still 30-50bps below their base case scenario.

Traders focussed further out the curve appear to be reacting more forcefully to the latest messaging from the Fed – with the economy proving more robust and inflation looking like it will hang around for longer than hoped, treasuries need to yield more to represent an attractive return for the level of risk. As such, over the last week or so, we have seen yields on all benchmark treasury tenors print decade-long highs. The recent deal to avoid a government shutdown, the rally in oil and recent Fed member Williams’ comments (“I expect we will need to maintain a restrictive stance of monetary policy for some time.”) lend weight to the argument that the recent move higher may not yet be done.

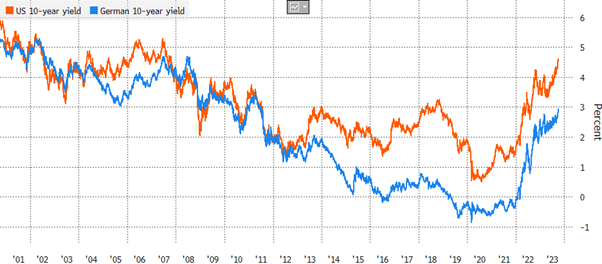

Chart 1: Long term yields have hit decade long highs in both Europe and the US

Source: Bloomberg

The US yield curve’s move was partially matched by European yield curves – following the recent ECB meeting we saw 10-year yields in Germany, France and the periphery reach highs not seen for over a decade. The governing council fulfilled the market’s expectations in September and hiked rates by 25bps, taking the depo rate to 4%. In a similar vein to the Fed, ECB President Lagarde was non-committal about whether this was the peak or if there were more hikes to come. What she was very sure about was the topic of rate cuts: “I repeat, we have not decided, discussed or even pronounced cuts.”

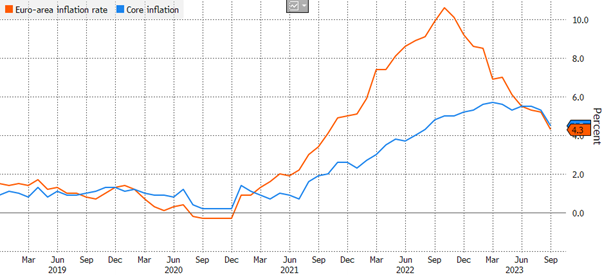

In another similarity to the US, the Euro yield curve is also pricing in cuts for 2024 – despite what the governing council says. In total, markets are pricing 75bps of cuts by the end of 2024. This market pricing was given support in the days after the meeting as we saw core inflation in the Eurozone fall to its lowest level in a year. Despite this, ECB members are reluctant to get ahead of themselves – many governing members accept that we are close to peak rates, but uncertainty remains, as Governor of the Croatian National Bank Vujcic put it: “You might get into a situation where the inflation rate — the disinflation process — stops at a level, which is not your target. Then it’s challenging for monetary policy, because it has to do something more to bring it all the way down to 2%.”

Chart 2: Eurozone inflation appears to have turned a corner, but ECB officials aren't celebrating yet

Source: Bloomberg

In the months ahead, risk managers have much to consider – the cuts priced into the curves present a potentially attractive purchasing opportunity. At the moment, those who fix their debt using swaps will be economically better off (ignoring charges) even if the Fed/ECB do cut, as long as it is by less than currently predicted. The effect is similar in caps – the current curve inversion cheapens caps and gives risk managers an opportunity to protect themselves against rate hikes for a relatively cheap premium. But as ever, no decision is without uncertainty – the main risks which could see rates begin to move lower would be a sudden and sustained increase in unemployment and/or a notable fall in core inflation, back to the banks’ target level of 2%. With this in mind, the US labour market data at the end of this week and European/US inflation numbers in mid-October are as important as any in recent months.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.