Growth or Inflation – The Central Banks’ Dilemma

20 September 2023

Central Bank Meetings and Stubborn Curve Inversion

2 October 2023RISK INSIGHT • 27 SEPTEMBER 2023

Is the Market Finally Seeing the Hawks Circling Overhead?

Ryan Brandham, Head of Global Capital Markets, North America

2023 has been an interesting year, marked by the US rates market continually underpricing the interest rate path followed by the Fed, despite their best intentions to clearly communicate FOMC expectations about the projected path. Indeed, as Chair Powell stated at the latest FOMC press conference, the Fed had to hike further this year than previously anticipated, and he recognized that “estimates are highly uncertain” and “forecasters are a humble lot, with a lot to be humble about”. With that being said, the market has consistently priced in a lower path than even the humble Fed forecasts….and has had to play catch up all year long. Is the market finally starting to see the hawks circling overhead?

On July 26th, the FOMC hiked rates 0.25% and then settled in for a long break until the next announcement and promised to watch the almost two months of data very carefully to update their understanding of whether more hikes would be needed to bring inflation back to their 2% target. We took stock of the inter-meeting data in a previous note here, noting the risk of a hawkish September outcome, and we highlighted opportunities to hedge against higher US rates in this note here.

Last week, we finally arrived at the long-awaited September 20th FOMC announcement. While there was little drama about the level of interest rates being left unchanged, and the changes to the dots and summary of economic projections were somewhat expected heading into the meeting, we did see some evidence of the market taking heed of Powell’s hawkish messaging and finally starting to realize that rates may have to stay higher for longer, even if the rates market didn’t reflect the full dot move and wasn’t quite as reactive as equities or FX.

How the Fed was Hawkish

The September meeting was a quarterly meeting where macro watchers could study an updated summary of economic projections, and a new dot plot of projected interest rates. Although this was expected pre-meeting and somewhat priced in, real GDP forecasts for 2023 and 2024 were marked higher, while unemployment projections for 2023, 2024, and 2025 were marked lower, and the median dot for both 2024 and 2025 rose by 0.5%, effectively taking out two projected cuts.

The real details were in the post-announcement press conference. Powell started off by saying the Fed had made a lot of progress on inflation and had earned the ability to “proceed carefully” regarding the next change to the policy rate. He went on to elaborate that growth in real GDP has come in above expectations, mostly due to an exceptionally robust consumer, and while they don’t target GDP levels as part of their mandate, they do assess in their projections if higher GDP levels are a threat “to inflation returning to the 2% target”. At another point, he mused that “the neutral rate could be higher than previously thought”.

Yet, it was the combination of the following comments that the market took to heart: rates will be “held higher until we are confident that inflation will return to target, and we are not confident yet", coupled with, “there is a long way to go to reach the 2% target.” What’s more, even though a soft landing is the primary objective of the FOMC, he said that it is not the base case scenario. Taken together, we wouldn’t blame anyone for interpreting that as saying the Fed will hike until inflation is under control, and it might break something as it does so.

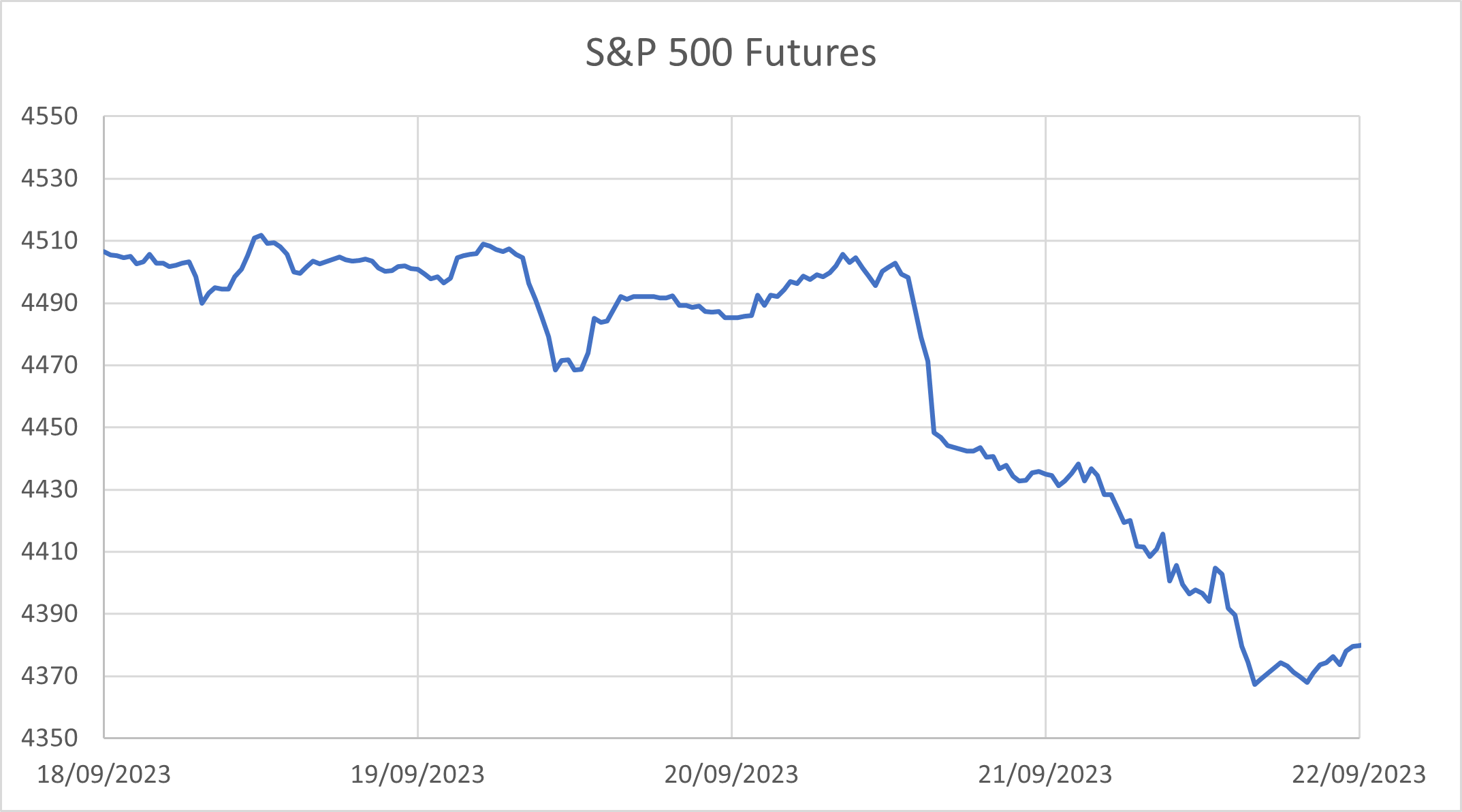

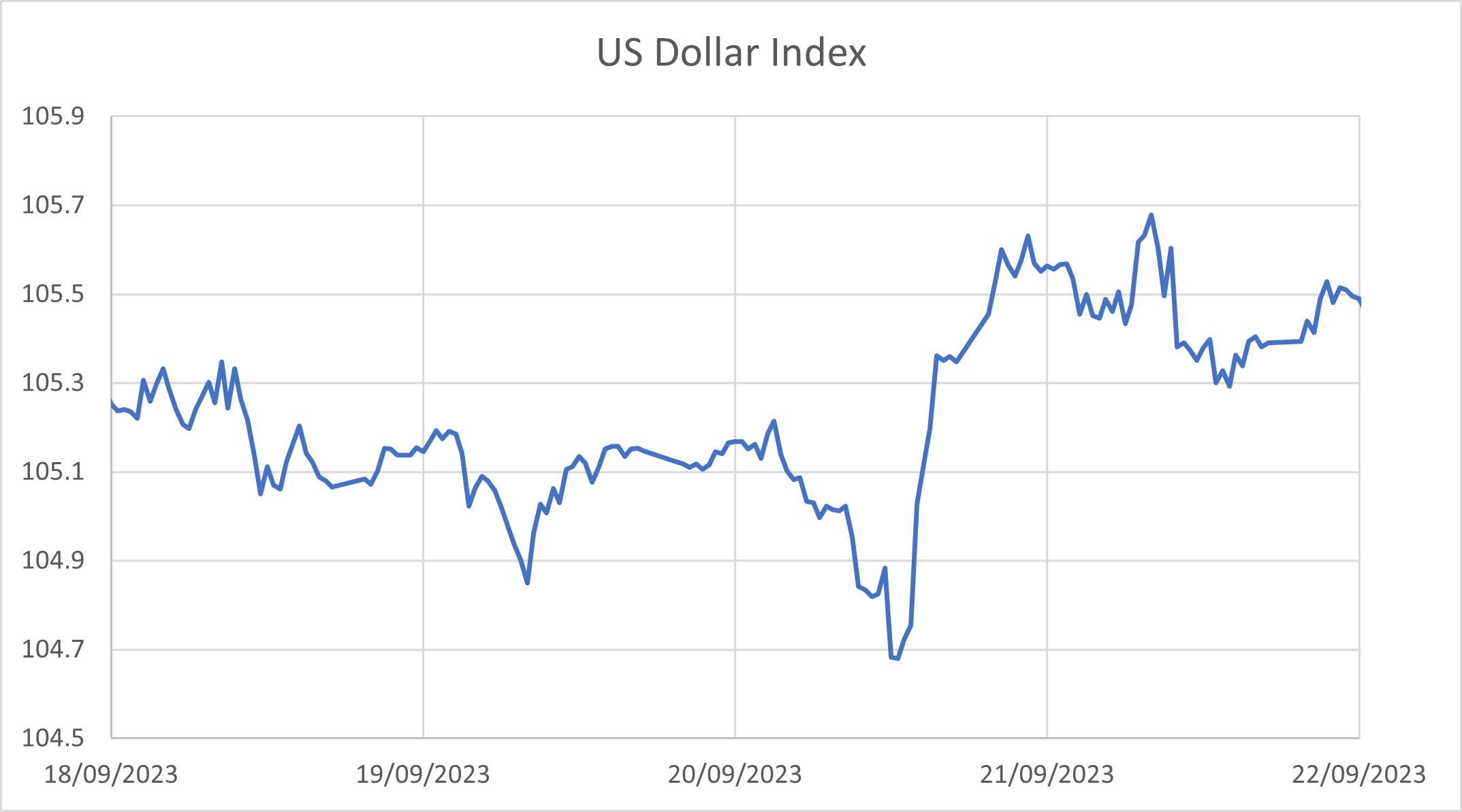

Stocks sold off on the remarks, US rates rallied 10-12 bps (not pictured) and the USD rallied smartly.

Chart 1: S&P 500 Futures 18-22 September 2023

Source: Bloomberg

Chart 2: US Dollar Index 18-22 September 2023

Source: Bloomberg

Not Just a US Problem

The problem of sticky inflation is present north of the border as well. As with the Fed, the Bank of Canada recently slowed the pace of rate hikes, as it appears to be reaching the end of its rate hiking cycle. However, a higher-than-expected inflation print for August showed that, like the US, inflation is bouncing in Canada and not continuing down towards the 2% target. The Canadian interest rate market has since priced in increased chances of another rate hike in October, despite the fact that the Canadian residential mortgage market is not nearly as insulated from rate hikes as the US. Canadian mortgages simply can’t be fixed for the long term in the way many US borrowers locked in low, long-term mortgage financing during the 2020 pandemic.

Despite the relatively insulated mortgage market, there are a variety of disinflationary risks on the horizon for the US – namely, the resumption of student debt payments in October, diminished US household savings (both of which could hit the “exceptionally robust” consumer), a potential US government shutdown, and the ongoing risk that some sector of the economy will break down as a result of cumulative interest rate hikes to date. For risk managers, it is a delicate environment to navigate, but they would be well advised to remember that if at least one of these risk factors doesn’t materialize – and here’s hoping none of them do – the potential for further interest rate hikes in the US is very real. The market is starting to realize this too.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.