Economic Woes Compound Sticky Inflation

4 September 2023

The Fall of Uncertainty

13 September 2023RISK INSIGHT • 6 SEPTEMBER 2023

Debt Fund Double Hit – Private credit prepares for rate cuts & missed payments

Shane O'Neill, Head of Interest Rate Trading

Mandatory hedging, rarely see in private lending over the last decade, is making a comeback as private debt funds brace for the cutting cycle approaching faster than priced and increased delinquencies.

The boom seen in private credit over the past decade or more has coincided with rates moving in one direction. For the first many years of the asset class’s growth, rates across the globe were rock bottom and over the last three or so years, as we are all aware, rates have shot higher. On balance, this has been great for private credit – in the early years, income volatility was minimal as investors become comfortable with a “new product,” and during the recent move higher, returns have rocketed. Most agree that this can’t last forever, and we are beginning to see signs that perhaps now is the right time to plan for a different future and a move the asset class has yet to experience – falling rates.

Signs of a slowdown

After months of consistently robust economic data, recent indicators are pointing toward a slowdown. Many market commentators have been predicting an upcoming recession from almost the minute central banks began raising rates but, as of yet, the worst has yet to materialise. However, the most recent PMI figures out of Europe and America don’t make for positive reading. Across the Eurozone we saw PMI figures miss target and come in under 50 (a sub 50 reading signifies contraction), with a particularly poor set of numbers coming out of Europe’s largest economy, Germany.

In the UK, we saw a similarly poor set of numbers with manufacturing performing especially poorly, coming in at 43.7 – the lowest level since Covid lockdowns of 2020. The US fared slightly better, with the composite number managing to eke out a tiny expansion (50.4). But even in the US, manufacturing numbers cannot break out of sub 50 territory. Markets tend to pay close attention to PMIs as they are considered forward looking indicators and more useful in judging what is to come than, for example, last quarter’s GDP growth.

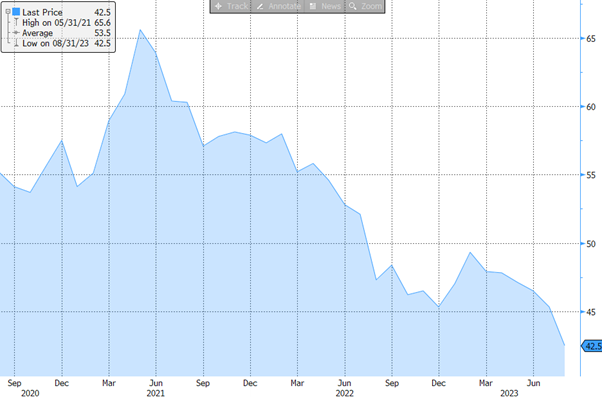

Chart 1: PMIs across the world have fallen recently, UK manufacturing PMIs (shown here) are at levels not seen since covid disruption of 2020

Source: Bloomberg

Debt-for-equity rise brings risks

Despite being somewhat sheltered from market volatility associated with economic downturns, we may be starting to see the signs of a slowdown in certain sectors of the private markets. There have been reports of a raft of private debt funds enacting their debt-for-equity clauses where they find themselves becoming owners of those firms struggling to repay their debt. These clauses can result in large upsides for the debt funds. If they can exit the investment, they may see returns more usually associated with equity funds. But there are risks – being part owner is not their aim and not what their investors expected when entering the fund, and there is unlikely to be the in-house expertise to manage the ownership and subsequent exit, if they manage an exit in these difficult market conditions.

Rate cuts: the go-to remedy

As economies start to stutter and companies begin to lay off staff, the go-to remedy is a rate cutting cycle from central banks – though the inflation fight is far from over, market consensus is for terminal rates in Europe, UK and US significantly lower than where we currently sit. If inflation does begin to moderate more quickly than we expect, and growth and employment continue recent moves lower, we could see this cutting cycle approach faster than currently priced.

This could leave private debt funds with a double hit – falling income from interest as base rates fall, and increased delinquencies due to a struggling economy. There are already signs that debt funds are preparing for these outcomes: mandatory hedging, rarely see in private lending over the last decade, is making a comeback and should protect borrowers from large moves higher in rates from current levels; and a bulking out of restructuring expertise in preparation for more portfolio company ownerships on the back of debt-to-equity clauses. But what about falling rates?

Floor spreads to the rescue?

Reports suggest that increasing the floor in financing agreements from their current common level of 0% has been a difficult sell to borrowers but there are alternative solutions the fund itself can turn to.

Fund managers can use floor spreads – selling the 0% floor present in the financing agreement to a hedge counterparty and buying a higher strike floor – to achieve an increase in the minimum level of interest income. On US Dollar lending a fund can increase the floor from 0% to 2% for an upfront fee of less than $1mio per $100mio of debt issued. Or alternatively, to avoid upfront fees, they can spread it over the life of the debt and pay a running cost of under 0.2% per annum. The benefits of using floor spreads over, for example, interest rate swaps are numerous. Investors retain their desired floating rate exposures – if base rates continue to climb, income continues to increase – and regulatory margining is less burdensome and known up front.

This is just one example but there are multiple structures available across all currencies and to suit all risk and cost appetites. Many risk managers were caught out by the speed of the move higher in rates, preparing now could help managers avoid the same fate in a falling rate environment.

Chart 1: Despite increasing realised volatility in the market, longer data implied vols in GBPUSD (above) and EURUSD remain subdued

Source: Bloomberg

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.