Bank of Japan: The Owner of Last Resort

12 July 2023

Have we seen the peak in UK rates?

26 July 2023INSIGHT • 19 JULY 2023

Is the fight against inflation in North America nearly over?

Ryan Brandham, Head of Global Capital Markets, North America

Since early 2022, when central banks first started hiking interest rates to combat inflation that was no longer deemed “transitory”, significant progress has been made towards bringing it back under control, particularly in North America. Indeed, it feels like we are approaching the end of the tightening cycle for both the FOMC and the Bank of Canada.

Taking a closer look, both countries have had similar paths through this fight against inflation. In early 2022, both started with policy rates set at 0.25% and hiked rates for the first time in March 2022 – which was probably a late start, as inflation was already well above target in both countries (5.7% in Canada, 7.9% in USA). Both hiked aggressively in the early moves, and have hiked close to 500 bps in total (only 475 for Canada). Headline inflation in both countries peaked in June 2022 (8.1% for Canada, 9.1% for USA), while core inflation continued to rise before peaking in late 2022 (5.2% in November for Canada, 6.6% in September for USA). In both cases, inflation has trended lower since the peak a year ago – with levels getting close to target ranges centered on 2% (latest reading 2.8% for Canada, 3.0% for USA). Finally, they have both benefitted from a pullback in oil prices to help tame headline inflation, shown remarkable and even unexpected resilience to rate hikes in terms of strong labor markets and resilient consumer spending, and seen sticky core inflation during the downturn.

Recent developments in the US

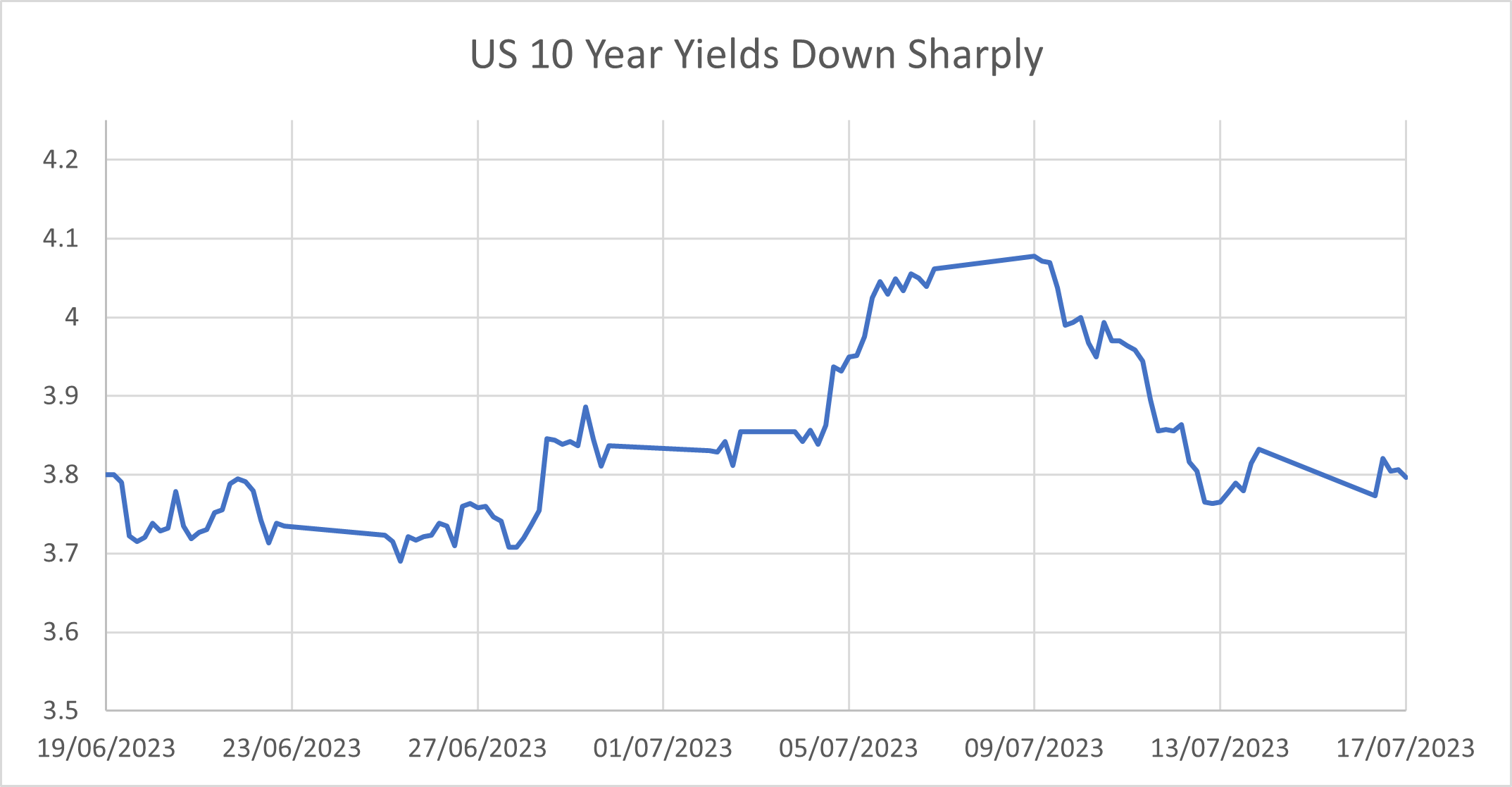

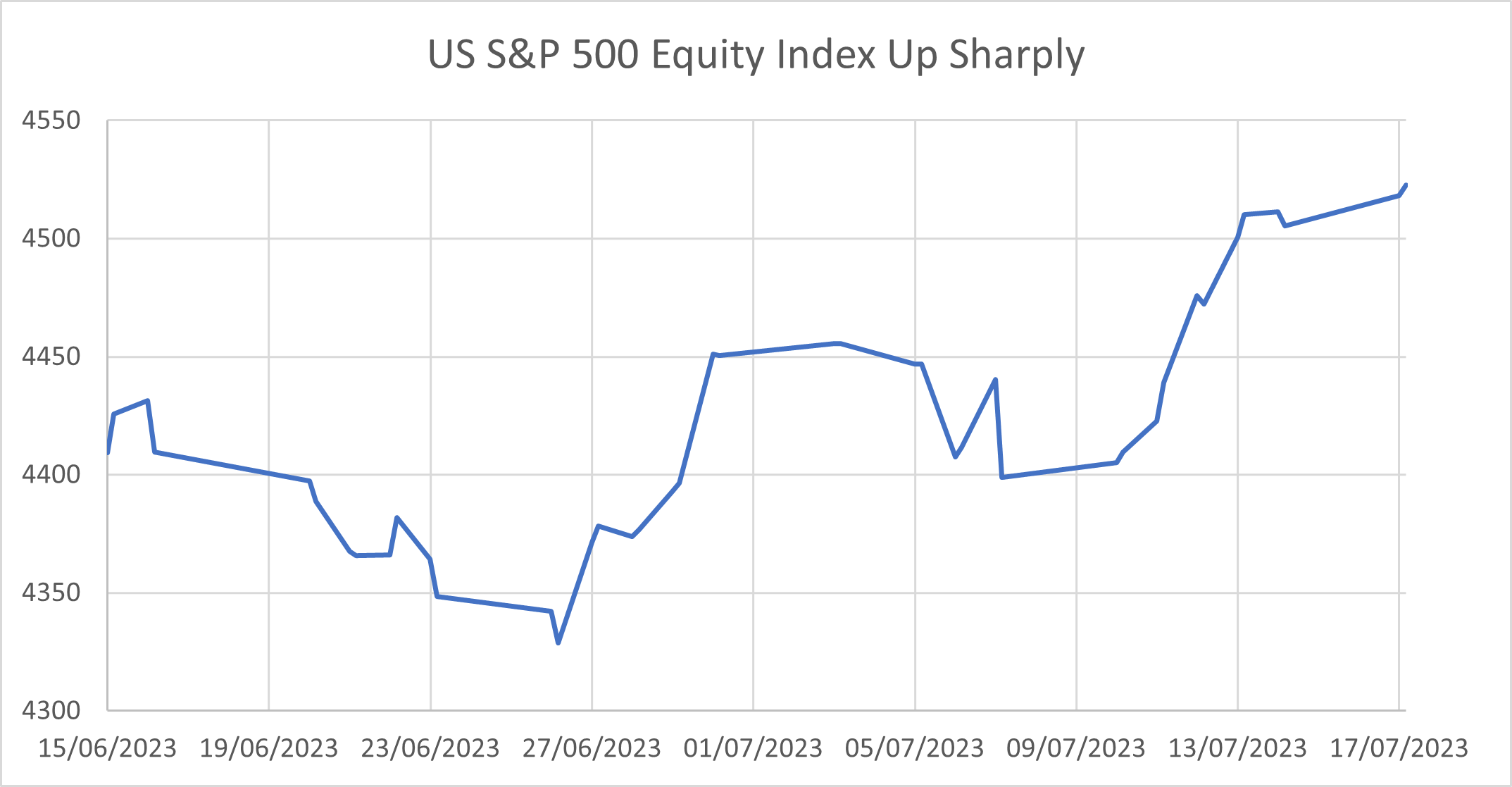

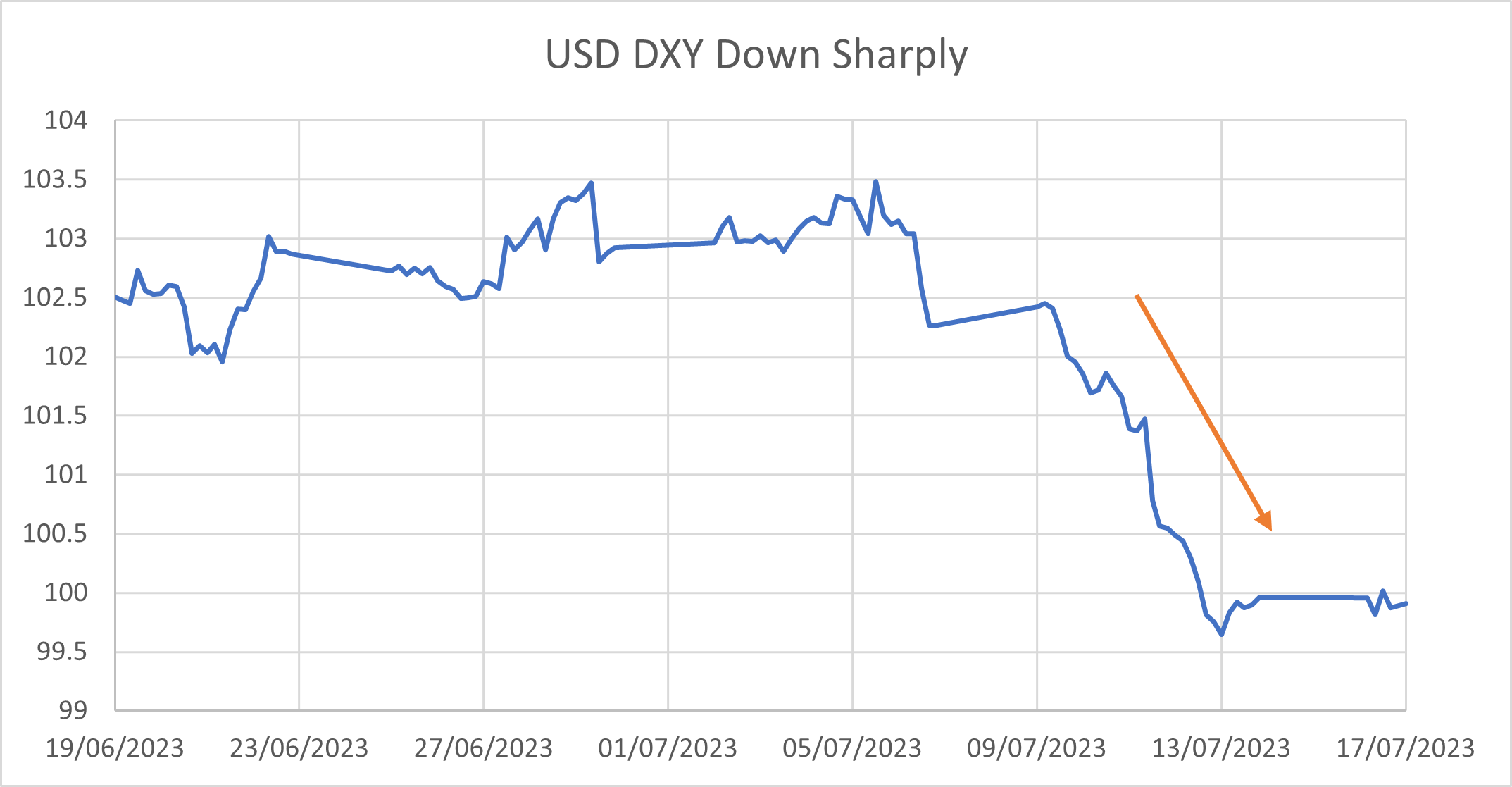

Some encouraging US data was released in July – including non-farm payrolls that were softer than expected but still strongly positive, a softer print in both headline CPI and core CPI, a softer print in PPI, and jobless claims falling back into line. Taken in sum, this would show the economy slowing but not suggesting a recession, with price pressures easing – a soft landing scenario. The market has taken this theme and run away with it:

Chart 1: US 10 Year Yields Down Sharply

Source: Bloomberg

Chart 2: US S&P 500 Equity Index Up Sharply

Source: Bloomberg

Chart 3: USD DXY Down Sharply

Source: Bloomberg

Recent Developments in Canada

There has also been some optimism in Canada since late June, even if not on as strong of a scale. We have seen a headline CPI print softer than expectations at 2.8%. With job gains also stronger than expected, this suggests a soft landing outcome could be in the cards in Canada. However, the BoC hiked rates on July 13th and, while this was mostly priced in, the market did not expect the rhetoric to be so hawkish. Although the BoC recognized that several things could take place to bring inflation down and all the way to target, and that it is trying to balance the risks of over-tightening vs under-tightening, the focus is clearly on potential future rate hikes – and it is clear the BoC feels it is far too early to think about any kind of rate cuts. The Canadian dollar rallied on this news, against a broadly falling USD.

If inflation is falling, why hike any further?

Central bankers have a tough job. National economies are very complex machines with a lot of interrelated parts, as well as impacts felt from exogenous global developments. They are tasked with targeting an inflation rate and sometimes maximum employment, and they only have a couple tools to use to do this – mainly interest rates and QE/QT. These tools are blunt, rather than precise, and even in the best of times create impacts that are felt with a long and variable lag. This is not as simple as looking at a speedometer for the economy, breaking or accelerating as needed to reach the desired speed.

Given this backdrop, and with the end of the hiking cycle for each of the central banks approaching, there is a wide range of opinions as to when and where interest rate hikes should actually stop, with no prescriptive path available in advance.

How much economic slowdown is already a result of the long and variable lags of previous hikes? Will further hikes break something, such as the banking sector, housing markets, labor markets, or something else, and spin the economies into a damaging recession?

We simply do not know, and for the most part, neither do the central banks.

The US rates market has spent a lot of time this year underpricing the FOMC Dot Plot and, to date, has been wrong every time. A more resilient than expected US economy has forced the market to price out and push back the cuts, and the USD has rallied as a result. As the market currently flushes the USD and US rates, will the FOMC this oblige this time by delivering a lower Dot Plot? There is currently a media blackout period, but at least two speakers have previously pushed back in a hawkish way – former Fed President Plosser reiterated his call for rates above 6%, and Current Fed Governor Waller still believes two more hikes are necessary.

Looking Ahead

The market seems focused on pricing future cuts into the US curve Yet even if inflation returns all the way to the 2% target, would that not suggest simply maintaining a neutral interest rate? Surely the bar to actually cutting rates would be inflation falling below target, in the absence of a major economic shock?

Both countries saw peak inflation in June 2022. Base effects will make it harder for CPI to print lower for the balance of 2023. Canadian households in particular are at risk of feeling the brunt of previous rate hikes as mortgage rates reset. The USD is broadly overvalued and needs to correct lower at some point. Is that time now? Or has the US rates market gotten ahead of itself again? Getting across the finish line on the inflation fight might not be as easy as it currently seems.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.