Populist Economics in 2025

4 December 2024

Euro Under Fire – Key Considerations for Investors

18 December 2024RISK INSIGHT • 11 DECEMBER 2024

From Paris to Frankfurt: ECB’s response to France’s political turmoil

Harun Thilak, Head of Global Capital Markets NA

While European lawmakers were coming to terms with the ramifications of the political uncertainty in Germany, France’s government collapsed last week following a vote of no-confidence in the country’s Prime Minister over a budget dispute. The political vacuum in the two largest economies in Europe would potentially require sustained monetary policy support from the ECB in a year where growth and economic activity in the EU has remained sluggish.

France’s Political Crisis

France has been rocked by a no-confidence vote (over a budget dispute), a rare event that hasn’t occurred in over six decades. This move, driven by a coalition of far-right and left-wing parties, has left the country in a state of political limbo.

French President Emmanuel Macron now faces the task of appointing a new Prime Minister who can secure parliamentary support in the lower House to pass a stopgap spending bill before the year end. This could be an arduous task, given it was Barnier’s budget bill, which contained EUR 60 billion of tax increases and spending cuts to rein in the deficit to the EU regulation of 5% of GDP, which effectively sank his tenure.

The last time Macron had to pick a Prime Minister (following the snap Parliamentary elections in July), it took nearly two months before Barnier was accepted by a slender majority. This time, however, things may need to move much quicker as the new Government would need to pass a stopgap spending bill in a divided parliament before year end or find suitable alternative measures to keep the country running.

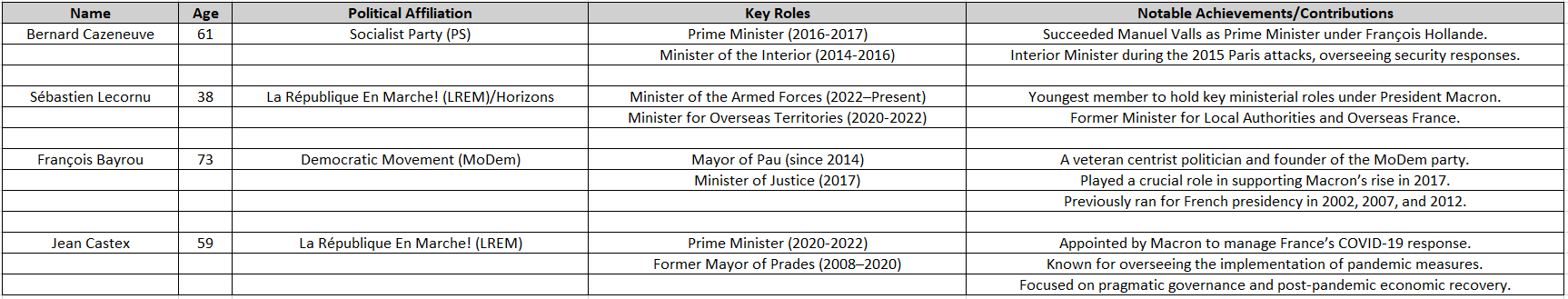

Chart 1: Leadership candidates

Implications for the Eurozone Policy and Economy

The ECB is approaching a crucial crossroads in setting monetary policy within this context. Eurozone inflation has slowed faster than expected towards the target range of 2%. The ECB has already lowered borrowing costs three times since June and is widely expected to do so again this week.

Chart 2: Eurozone CPI vs ECB Deposit Rate

Source: Bloomberg

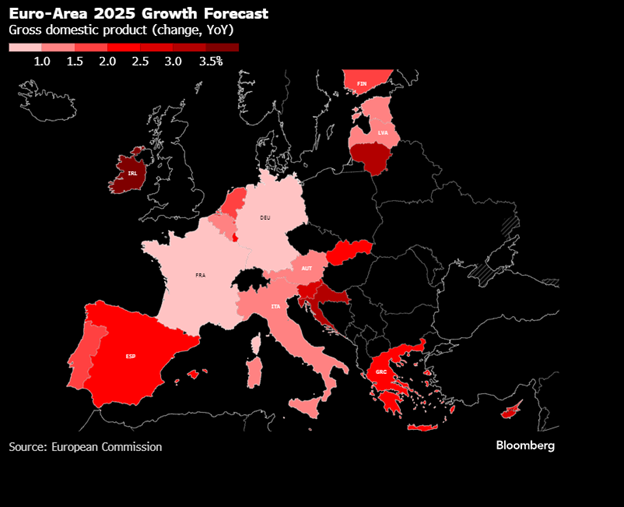

Chart 3: Euro-area growth is forecasted to remain sluggish in 2025

Source: European Commission

A Dovish ECB and a Weakening Euro

Amidst this backdrop of falling inflation, weak growth forecasts and heightened political uncertainty in the two largest European economies, investors can expect the ECB to remain on a sustained dovish trend. Markets are pricing in about 150bps of cuts from the ECB until end 2025, significantly more than the Fed’s projected 80bps of cuts. This rate divergence should lead to EURUSD spot remaining under pressure in 2025. USD-based investors looking to hedge against EUR weakness may consider using FX forwards as they benefit from the recent pickup in EURUSD FX forwards carry seen from the rate divergence.

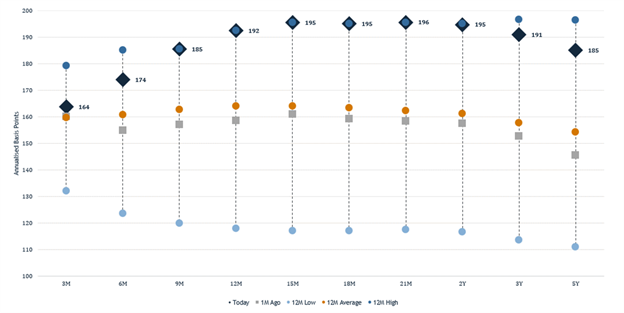

Chart 4: EURUSD FX Forwards Carry (in annualized bps)

Source: Bloomberg, Validus Risk Management

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.