Shifting Focus: From Regional Banks to Central Banks

10 May 2023

Will the labour market be the answer to the MPC’s prayers?

24 May 2023INSIGHT • 16 MAY 2023

The US Debt Ceiling: Is the market worried? Should risk managers be?

Ryan Brandham, Head of Global Capital Markets, North America

The US government reached its debt ceiling limit of $31.4 trillion in early 2023 – meaning it cannot borrow any more money unless new laws are enacted to raise this figure. The Treasury has been surviving these past few months through cash on hand, and certain extraordinary measures that allow it to continue borrowing from places that do not count against the debt ceiling. However, it can only do so for a limited time, and it is thought that the government will run out of money sometime in the second half of this year, and possibly as early as June.

Market veterans and industry participants will have seen this movie before. Congress has acted countless times to address a potential breach of the debt ceiling since the cap was first instated in 1917, including some 78 times since 1960. More recently, it has been raised 15 times since 2010, so the drama of these fiscal cliffs is somewhat familiar. Yet, even if they go down to the wire due to political bickering, the US has never defaulted on its debt obligations – which is something most experts fear would set off a catastrophe across global financial markets.

US Secretary of the Treasury Janet Yellen has stated that if Congress does not enact legislation to raise the debt ceiling before the Treasury runs out of money, the US will suffer “considerable economic and financial damage”. However, she has been vague about exactly what would happen and what payments would be prioritized if the US were to run out of money. It makes some political sense for her to take this approach. Yellen does not want to take any pressure off lawmakers by providing the comfort of a contingency plan and, since some payments would be prioritized over others, details would surely draw the ire of special interest groups.

Is this time different?

Famous investor Sir John Templeton once warned that it is very dangerous to assume that “this time is different” when picking investments and expecting positive returns while ignoring warning signs from history. In this case, however, risk managers face a situation where the danger may be to assume this situation is just like previous ones, and that this risk too, will pass.

Indeed, reasons abound why this time might be different. For example, political polarization and the rise of populism in the US has been getting steadily worse with more people moving towards the far left and far right – and the number of those in the center, looking for discourse and compromise, dwindling by the day.

Many of the current issues facing the US today – such as widening wealth gaps, social unrest, inflation problems, printed money, bulging government debt and a weakening ability to pay internal and external obligations – have been associated with the fall of powerful empires all through history going back to at least the Roman Empire. So the risk is real.

Is the market taking notice? Equity markets continue to ebb and flow, but with major indices not far from multi-month highs it is hard to notice any equity risk premium being priced in at this point. US yields, similarly, are trading well below the Federal Open Market Committee (FOMC) dot plot, so there is no government credit risk premium being obviously priced into the US rates curve.

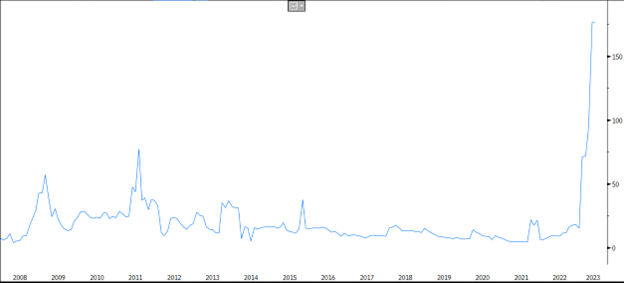

However, the credit default swap (CDS) market does show signs of risk. The chart below reveals that US Government Debt 1yr CDS pricing has rallied significantly as these stresses have appeared in 2023, blowing well past historical highs from previous debt ceiling standoffs such as 2011 or 2013. At roughly 175-180 bps, US CDS pricing is almost certainly wrong – it will ultimately either pay off several multiples of this price or be worth zero, like an insurance contract.

Additionally, JP Morgan CEO Jamie Dimon has said publicly that the bank has a war room set up to monitor and react as this situation plays out. Certainly, few expect an early resolution to this situation, and many expect political brinksmanship as a base case outcome to the issue.

Chart 1: US Government Debt 1yr CDS pricing

Source: Bloomberg

How should risk managers prepare?

Notwithstanding these factors, the most likely outcome is that this risk, like every time before, will come and go with no permanent damage to markets and all will be forgotten in a few weeks or months. With this in mind, what are risk managers to do?

This is not necessarily a black swan event – it is a known unknown and something that has to be calibrated and planned for. Still, predicting the effects on markets is not easy – volatile risk off scenarios typically result in the USD rallying and US yields trading lower as investors rush to the safety of US Treasury securities. If the US defaults, specifically how would it default? On debt service payments, or other budgetary commitments? Where would capital flock to? These questions are not obvious to answer.

Despite this challenge, risk managers will at least want to model out potential impacts on their portfolio investments, and plan for the risk of a potentially extended period of heightened volatility and decreased liquidity in the financial markets as the drama plays out. It is time to look at contingencies and backup plans for all active hedging programs.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.