Dealmaking and volatility are on the rise, PE firms must manage risks to seize opportunity

1 October 2024

Validus Launches ISDA Ops to Streamline Management and Monitoring of Complex ISDA Terms

14 October 2024RISK INSIGHT • 9 OCTOBER 2024

Has Sterling's Bull Run Come to an End?

Shane O'Neill, Head of Interest Rate Trading

A little over a week ago, the commentary around sterling was focused on the currency being the top performing G10 currency of the year – to the end of September GBPUSD was up over 5% YTD with little to suggest the trend was about to reverse. Since then, the pair is down over 2% with speculators rushing for the exit. A confluence of events has caused this sudden reversal, but is the move an overreaction? Or should we brace for a potential return of GBPUSD to the low 1.20s?

Diverging and Converging Central Banks

As we have recently covered, the bull run in sterling was super charged by diverging rhetoric from the Fed and the Bank of England. While the Fed aggressively cut interest rates, the BoE adopted a more cautious approach. Speaking to the markets, BoE chief Andrew Bailey cautioned against cutting too quickly, acknowledging that gradual cuts over time should be possible.

Market sentiment created following that BoE meeting was quickly reversed last week after Bailey’s interview with The Guardian. The resulting article – which included his views on the conflict in the Middle East, the need for infrastructure investment in the UK, and addressing claims he was part of the “deep state” – had a comment on the pace of cuts. Bailey indicated that the central bank might be more willing to accelerate cuts if inflation continues to moderate. While not a complete about turn, the markets took it and ran.

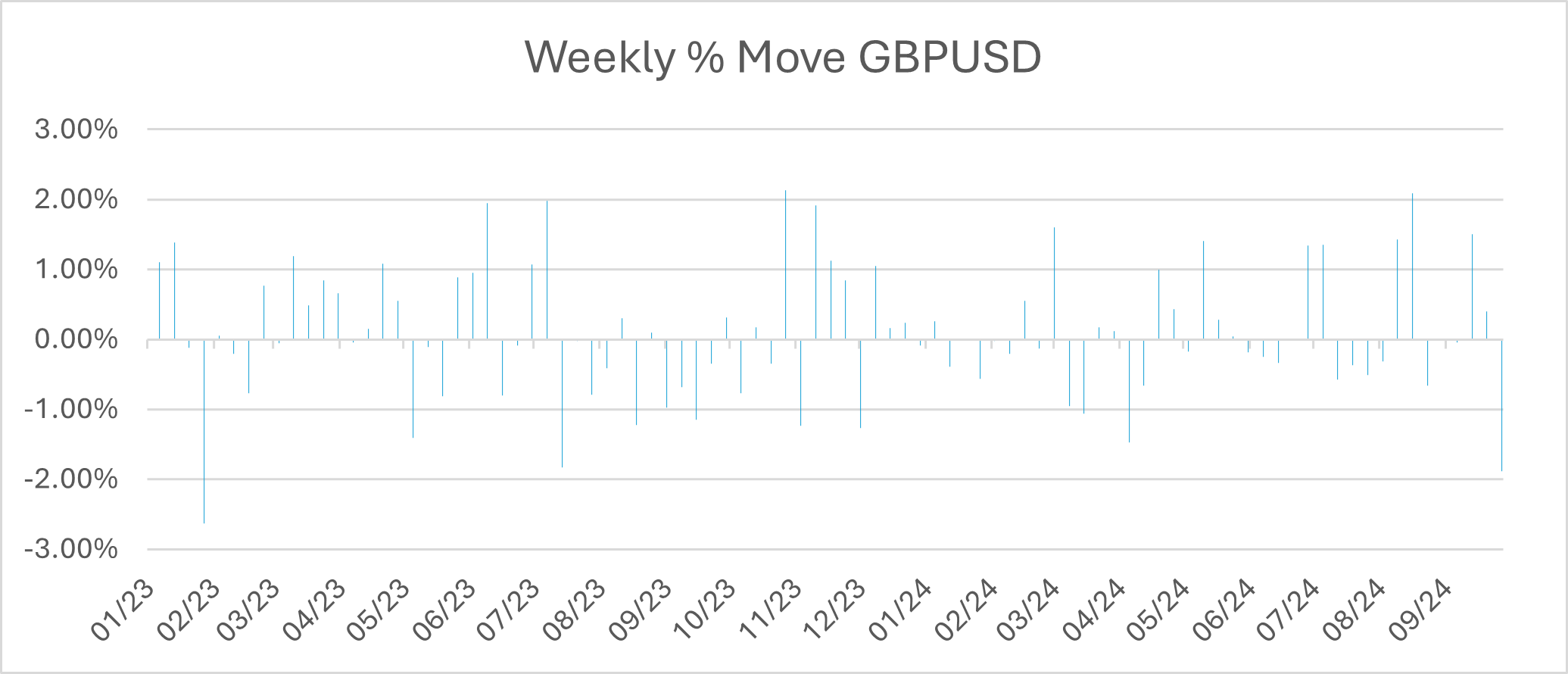

Chart 1: : Last week saw GBPUSD have its worst week since mid-2023 on the back of Bailey's comments

Source: Bloomberg

GBP fell against the dollar some 1.25% following Bailey’s remarks and we saw options traders continue to buy protection against a further decline in sterling, funded by selling upside participation. These structures, risk reversals, went from “calls over puts” in the month of August to “puts over calls” very rapidly – the markets’ way of warning investors which direction it deems most likely for the coming months. Market commentators also jumped on the band wagon, with prominent money managers calling for a 10% fall in the medium term.

Too Far, Too Fast

We believe the recent move in sterling has been an exaggerated one considering the major driver was Bailey’s comments. This was brought to light the day after The Guardian article, when BoE Chief Economist Huw Pill spoke to the Institute of Chartered Accountants. Pill warned against going “too far or too fast,” preferring instead to implement a “gradual withdrawal” of restrictive monetary policy. As one of the more hawkish members of the Monetary Policy Committee, Pill is concerned about the risks of more persistent inflation.

The BoE has drawn up three scenarios it believes could play out – inflation regulates naturally driven by pay growth decline and services inflation falling away; inflation falls but is driven by restrictive rates; and “deeper structural changes” keep inflation elevated longer than expected. Pill sees the second scenario as most likely, but is hesitant to assign too low a probability to the third.

Pill’s beliefs are well-founded. Whilst pay growth is regulating, with growth numbers falling back to mid-2022 levels, they still sit at 5.1%. This growth, far above target inflation, is coupled with unemployment figures still close to historic lows at 4.1%. Adding to concerns, services inflation is struggling to moderate – the most recent print saw the number climb to 5.6%. Whilst improvement is still needed in growth, it remains robustly positive (in contrast to Germany, for example), and the outlook remains tentatively positive. These factors indicate the BoE may need to maintain rates relatively restrictive whilst it ensures we are not amid a “deeper structural change.” When this “disappointment” feeds through to the FX market, we could see a new lease of life given to sterling.

Risks on the Horizon

Several risks loom on the horizon, both domestic and international. Closer to home, the upcoming UK Budget presents a potential challenge. While the exact details remain uncertain, tax hikes and some spending moderation seem almost certain to be on the agenda. The details of this will no doubt be a driver for UK growth prospects in the coming months and years.

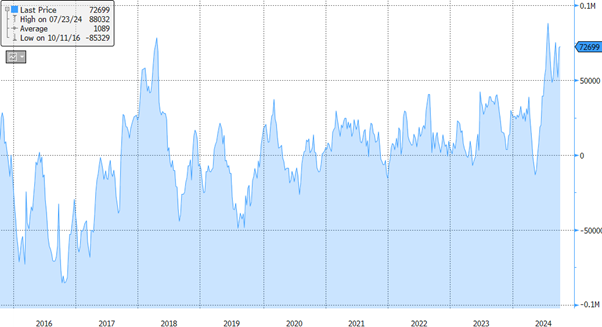

Internationally, tensions in the Middle East continue to escalate, posing a significant threat to global stability. European dependence on oil from the region is well known, and disruptions to this supply would be detrimental to growth and the fight against inflation. The US is comparatively energy secure, so one could easily see the dollar benefit at the cost of sterling and euro. In the markets, positioning in GBP is also becoming stretched, with long positions reaching levels not seen since 2018. The bullish sentiment has undoubtedly contributed to the recent rally, but from here additional marginal buyers may be hard to come by and there could be further fast unwinding of positions if we see negative headlines.

Volatility is set to continue in sterling for the coming months, driven by a confluence of factors. The path forward is likely to be anything but straightforward. Those exposed to fluctuations in sterling would be well advised to consider their positioning now ahead of a busy end to the year.

Chart 2: GBP long positions are at highs not seen since 2018

Source: Bloomberg

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.