A tariff tale: Britain’s partial pardon in Trump’s tariff blitz

9 April 2025INSIGHTS • 16 April 2025

Opportunity and Obstacle: Can Europe handle a stronger euro?

Marc Cogliatti, Global Capital Markets Director

As we start a new week, with tariffs on pause for three months, which might suggest that financial market volatility could ease in the short term. Yet, so far, that has not been the case. The dollar remains under unrelenting pressure as sentiment shifts, and investors reposition themselves in anticipation of what lies ahead.

Only six months ago, the notion that investors might seek alternatives to the dollar’s safe haven and reserve currency status seemed remote (though, in hindsight, perhaps the warning signs were there). Today, this prospect seems much closer, even if it proves more challenging than it appears.

When the dollar first started to tumble back in January, following Trump’s inauguration, the euro struggled to gain traction. It was weighed down by assumptions that the Eurozone would be a primary target for tariffs, and that the European Central Bank (ECB) would need to adopt a more accommodative stance to shore up economic growth. Those assumptions turned out to be correct; however, since early February, the euro has been one of the G10’s best-performing currencies, outpaced only by the Swedish Krona and the Norwegian Krone.

A significant part of this move can be attributed to investors—particularly European investors—who had previously held large positions in US assets and are now rebalancing as American stocks and bonds lose some of their allure. How far this trend extends beyond hedge funds to more conservative, long-term investors such as pension funds, and ultimately central bank reserves, remains uncertain. Still, if market participants are indeed searching for viable alternatives to the dollar, the Eurozone stands out as the most credible option so far.

The question we find ourselves asking is whether the Eurozone economy can handle a strong euro.

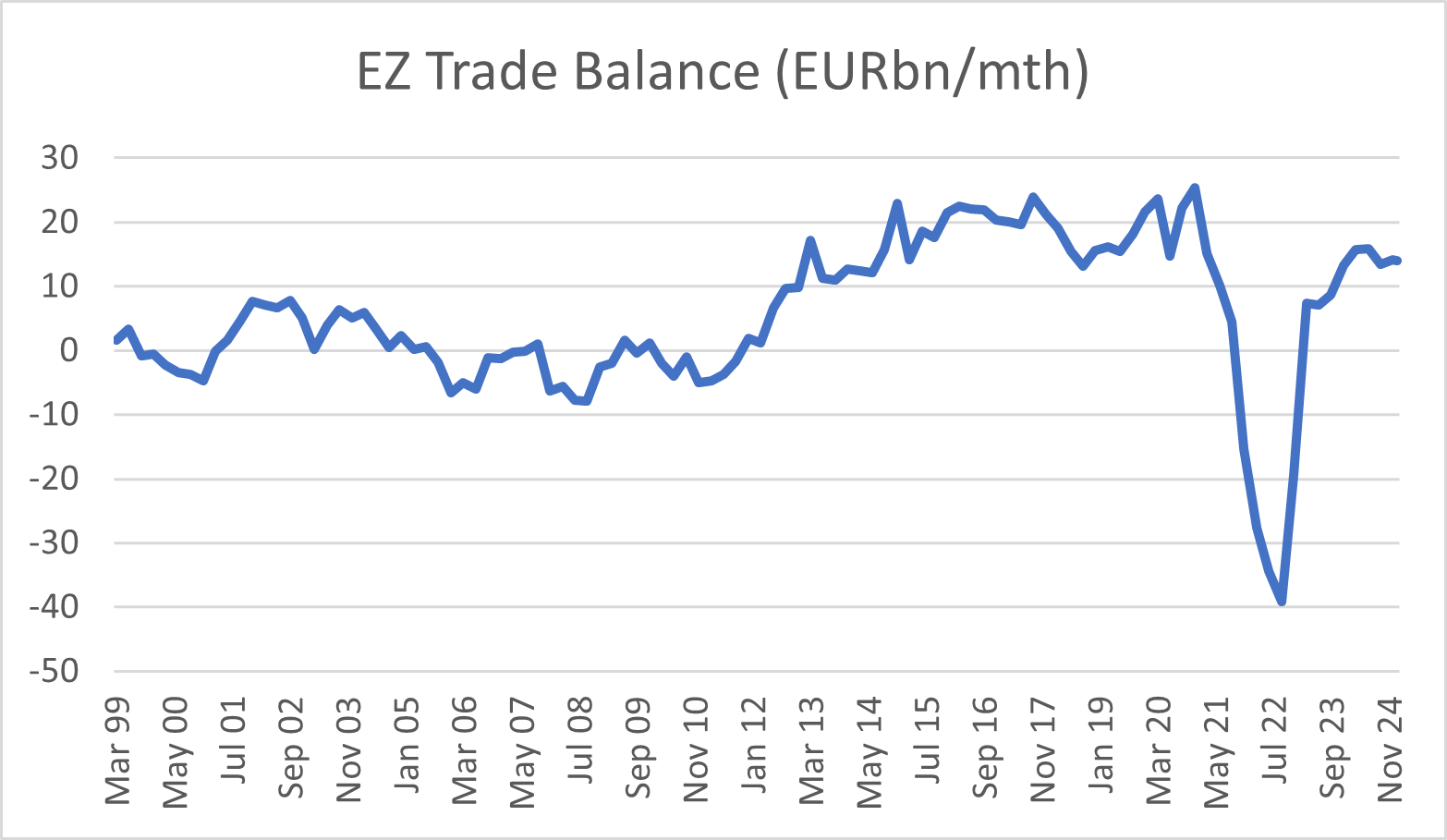

The Eurozone has long been a net exporter of goods to countries outside the European Union. Looking back over the past 25 years since the inception of the single currency, the average monthly trade balance has been ~€5.6bn. Narrowing this to the past 10 years, the surplus has more than doubled to approximately €11.3 billion per month, suggesting that trade has benefited from a relatively weak euro.

Focusing on the Eurozone’s trade with the United States, the monthly surplus stands at roughly €10 billion (much to the chagrin of Trump). Should he proceed with higher tariffs, that surplus is likely to fall, and a stronger euro would only add to the pressure. This, in turn, could weigh on growth and is fuelling fears of recession.

Chart 1:EZ Trade Balance (EURbn/ mth)

Source: Bloomberg

On the other hand, the EU runs a sizable trade deficit with China—around $8.5 billion per month—so a stronger euro would reduce that deficit in euro terms. It would also lower the cost of imported energy, a surge in which previously caused the overall surplus to dip into deficit back in 2021/22.

Of course, the impact of currency movements is far more complex than outlined here. Factors such as the pace of exchange rate fluctuations and the economy’s capacity to absorb them are vital considerations. We see this directly amongst our clients—less so in terms of balance sheet hedging but more notably with cash flow hedging. Ultimately, change is inevitable, so effective risk management involves ensuring enough time to adapt and smoothing out any transitions.

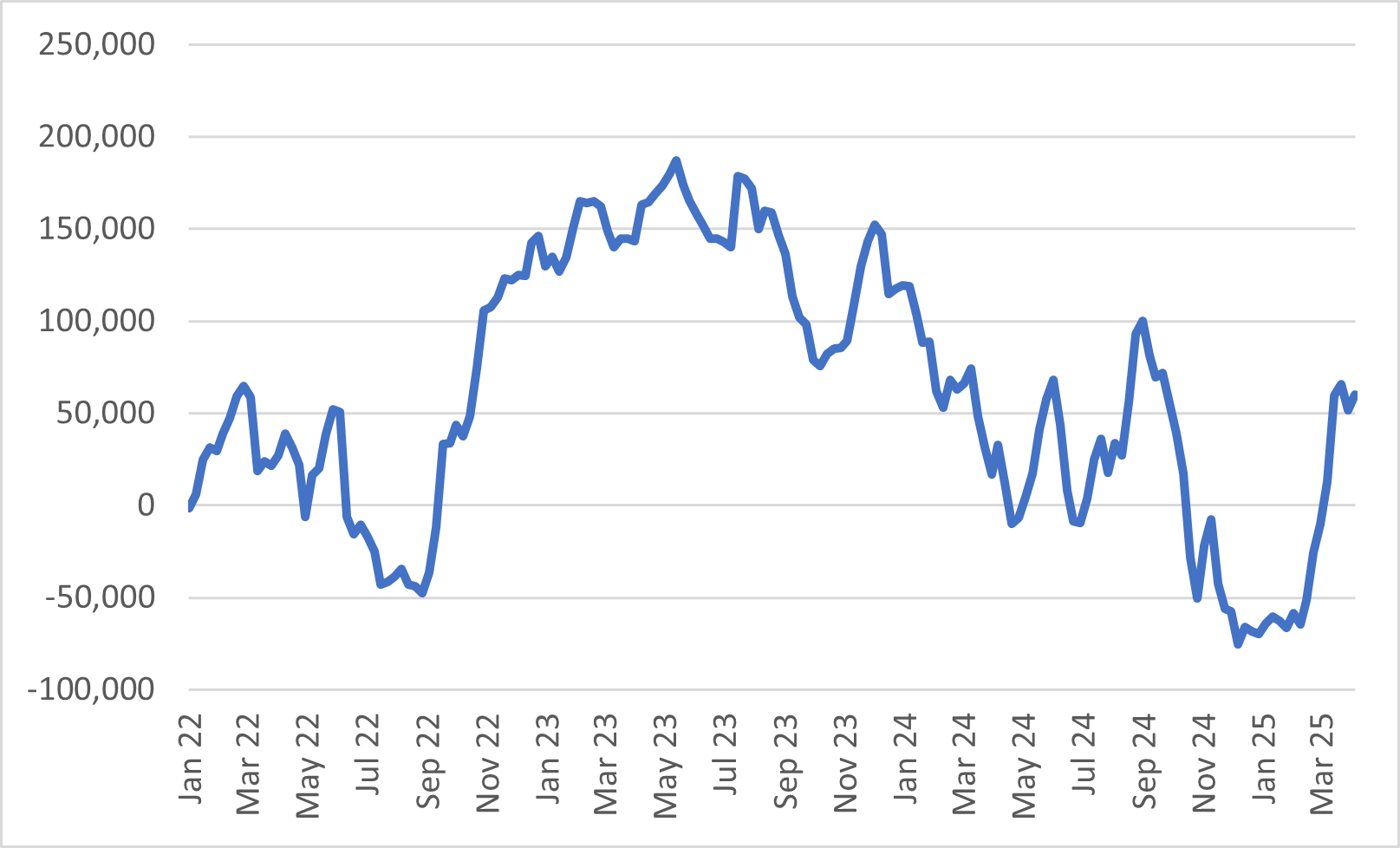

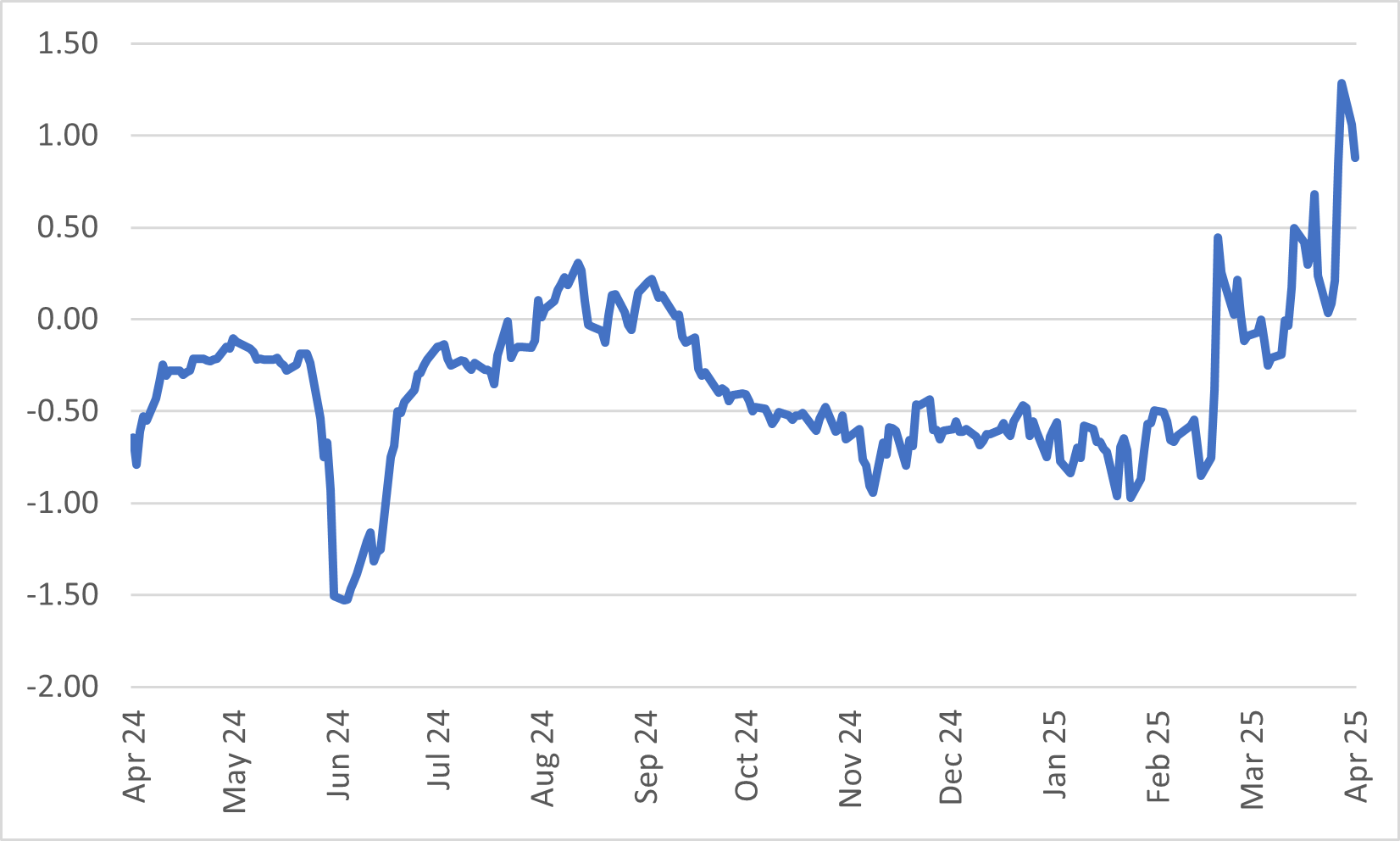

Looking ahead, most banks seem to have changed tack and are now calling for a stronger euro in the coming months, predominantly against the dollar. At the beginning of 2025, consensus forecasts pointed towards parity, but this has since reversed, with most targets now hovering between $1.15 and $1.20. This optimistic outlook is supported by futures market positioning and the skew in the options market, both signalling a bullish trend. Notably, neither indicator is at an extreme level, and considering that the euro remains about 8% undervalued on a purchasing power parity (PPP) basis, there is still significant upside potential for the currency pair. Consequently, our bullish forecast from earlier in the year could yet be surpassed.

Chart 2: EURUSD Positioning (CFTC Non Commercial Contracts)

Source: Bloomberg

Chart 3: EURUSD 25d Risk Reversal

Source: Bloomberg

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.