Transitory is back-proceed with caution

26 March 2025

“Liberation Day” – Post Event Update

3 April 2025RISK INSIGHT • 02 April 2025

Canada at the Crossroads – Potential Market Implications of the 2025 Federal Vote

Harun Thilak, Head of Global Capital Markets NA

The Canadian federal election, scheduled for April 28, 2025, is poised to be a pivotal event with significant implications for the Canadian dollar and domestic interest rates. Set against a backdrop of heightened tensions with the United States over trade and tariffs, this election pits the ruling Liberal Party, led by recently appointed Prime Minister Mark Carney, against the opposition Conservative Party, led by Pierre Poilievre. With recent polling data showing a very tight race between the Liberals and Conservatives, the final election outcome could influence monetary policy, fiscal stability, and economic confidence—critical drivers of currency valuation and borrowing costs. To understand these potential effects, it is useful to consider historical election contexts in Canada and analyze the fiscal policy, immigration, and tax proposals of the two leading parties.

Echoes of elections past

Canadian federal elections have typically revolved around domestic economic concerns and navigation of international pressures. The 1988 election, dominated by debates over the Canada-U.S. Free Trade Agreement, saw the Progressive Conservatives under Brian Mulroney secure a majority, bolstering confidence in cross-border trade and stabilizing the Canadian dollar. Conversely, the 1993 election marked a shift as the Liberals, led by Jean Chrétien, capitalized on economic discontent following a recession, ushering in a period of fiscal restraint. These examples illustrate how Canadian elections can act as inflection points, with policy shifts influencing investor sentiment and macroeconomic outcomes. The 2025 Canadian election, occurring amid U.S. tariff threats and a leadership transition from Justin Trudeau to Mark Carney, echoes these past dynamics, blending domestic priorities with international uncertainties.

Spending vs saving: Where do Carney and Poilievre stand?

The Liberal Party, under Carney, emphasizes strategic investment over widespread spending cuts. Carney has proposed a substantial fund to shield the auto sector from U.S. tariffs, alongside a dual-budget approach that separates capital and operational spending to bolster economic resilience. In contrast, the Conservative Party’s fiscal hawkishness, led by Poilievre, centres on eliminating the carbon tax, reversing capital gains tax hikes, and balancing the budget within a decade through spending reductions and deregulation.

While the Liberals aim to stimulate growth through targeted investments, the Conservatives prioritize fiscal discipline, potentially reducing government debt but risking short-term economic slowdown. A Liberal victory could sustain higher deficits, exerting upward pressure on interest rates and possibly forcing a shift from the Bank of Canada’s recent dovish bias. Conversely, a Conservative win might ease such pressures but could weaken the Canadian dollar if growth falters, leading to continued reliance on accommodative monetary measures.

Open doors or upper limits? Canada’s competing immigration approaches

Immigration policy also highlights stark differences between the two contenders. Despite recent cuts reducing permanent resident targets for 2025, the Liberals maintain a pro-immigration stance, framing it as essential for sustaining labor supply and economic vitality. Carney has acknowledged past strains on housing and services, suggesting a balanced approach. In contrast, Poilievre advocates capping immigration, criticizing rapid population growth for exacerbating housing costs and infrastructure strain.

A Conservative cap could slow labor force expansion, potentially dampening GDP growth and weakening the Canadian dollar against the U.S. dollar, especially if U.S. trade policies already constrain exports. Meanwhile, the Liberal policy, while supporting long-term growth, risks inflation if housing shortages persist, possibly prompting the Central Bank to raise rates.

The tax tussle

Tax policy further delineates the parties’ visions. The Liberals have retreated from some of Trudeau’s tax hikes, with Carney scrapping planned capital gains increases to bolster investor confidence amid trade tensions. Poilievre’s Conservatives promise broader tax relief, including ending the carbon tax and reducing regulatory burdens to spur industry and homebuilding.

While the Liberal approach may stabilize markets in the short-term, unchecked deficits could push up borrowing costs. Meanwhile, Conservative tax cuts could boost disposable income and business activity, potentially strengthening the dollar if paired with robust growth. However, strict fiscal tightening might limit public investment, tempering economic momentum.

Loonies and lending

The Canadian dollar’s trajectory will largely hinge on perceived economic stability and trade outcomes. A Liberal majority could initially weaken the currency, given higher spending and continued uncertainty over U.S. tariffs, though Carney’s global economic credentials may temper depreciation. A Conservative victory might bolster the loonie if markets embrace fiscal restraint, but any trade retaliation could offset gains.

Interest rates may face upward pressure under either scenario, particularly if inflation persists. Liberal spending plans could increase that pressure more than Conservative austerity, potentially prompting a shift from the Bank of Canada’s recent accommodative stance. The Bank has already lowered policy rates by 200 basis points since June 2024, and market participants anticipate another 50 basis point cut in 2025.

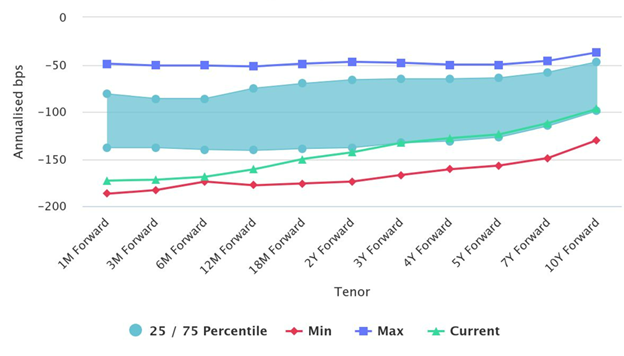

In conclusion, the 2025 election outcome will reverberate across Canada’s financial landscape. The Liberals’ investment-focused strategy contrasts with the Conservatives’ leaner fiscal vision, each carrying distinct risks and rewards for the Canadian dollar and domestic interest rates. Meanwhile, USD-based investors can hedge against CAD weakness via FX forwards, where carry levels are particularly attractive at present.

Chart 1: USDCAD FX Forwards Carry Cost (in annualized bps)

Source: Bloomberg, Validus Risk Management

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.