Equities are falling, but so is the dollar. What’s changed?

19 March 2025

Canada at the Crossroads – Potential Market Implications of the 2025 Federal Vote

1 April 2025INSIGHTS • 26 March 2025

Transitory is back—proceed with caution

Kambiz Kazemi, Chief Investment Officer

“…it's appropriate sometimes to look through inflation if it's going to go away quickly without action by us, if it's transitory.”

Chair Powell, post FOMC press conference March 19th. 2025

As the uncertainty abounds around President Trump’s new tariffs — targeting both foes and allies alike—the latest inflation figures, though not yet alarming, appear reluctant to drift towards the self-imposed 2% target by central banks. In fact, at their latest meeting on March 19, the Fed raised its 2025 inflation forecast from 2.5% to 2.8%.

Meanwhile in Canada, February CPI figures surprised the market by jumping to 2.6% year-on-year (YoY) following a series of prints below 2% YoY since October 2024. In the UK, after a recent low reading of 3% in September 2024, the RPI has steadily edged upwards to 3.6% in February, prompting the Bank of England to hold firm with interest rates unchanged at 4.5% in March. Inflation in the Eurozone follows a similar pattern: after a low YoY HICP print of 1.7% in September 2024, subsequent readings have all risen above 2%.

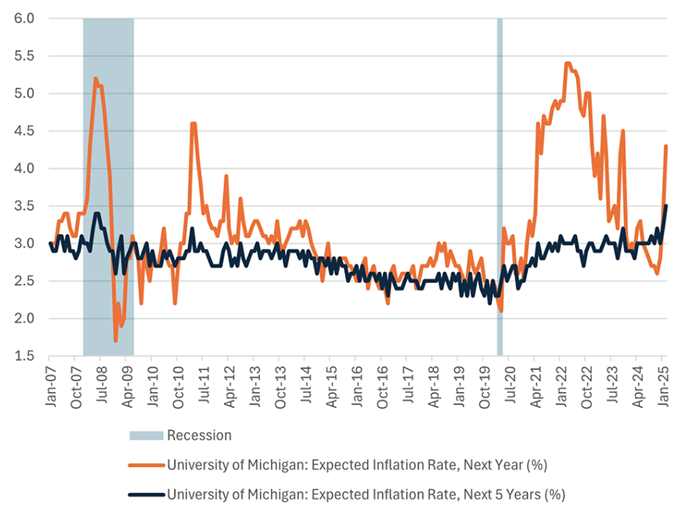

Although inflation may not seem to be a primary concern for institutional investors currently, consumers seem to have a different view. The latest University of Michigan survey shows five-year inflation expectations jumping up to 3.9%. The more volatile one-year expectation climbed to 4.7% from around 2.7% in December 2024.

Most troubling is that five-year expectations, which remained well anchored even through the post-pandemic (see chart) inflationary period, have now reached multi-decade highs. The raison d’être of monetary policy—and its success in the past few decades—has been to keep inflation expectations firmly anchored.

Yet once expectations become unmoored, they can themselves generate inflation, even if other catalysts—such as limited supply or tariffs—fade.

Chart 1: University Of Michigan surveys of consumers : Inflation expectations.

Source: University of Michigan

During the Fed press conference on March 19, the word “inflation” was mentioned no less than 95 times. Chair Powell suggested that the revision to the Fed’s projections, along with the stickiness of inflation, stemmed more from tariffs than anything else. Moreover, he maintained that any tariff-related inflationary pressures would prove transitory.

However, the last time Chair Powell (and many other central bankers, notably Ms Lagarde) described inflation as transitory—in 2021—one of the most significant inflationary periods since the 1970s ensued. At that time, we repeatedly warned that inflation had the potential to rise substantially and was unlikely to be merely transitory (Inflation: Gone but not Forgotten, Feb 2021).We are not suggesting that today’s circumstances are identical to those of 2021; indeed, the potential drivers of inflation differ. Nevertheless, we would caution against dismissing the threat of a renewed rise in inflation—even if it is likely to be less acute than the post-pandemic episode. Why?

Tariffs: drizzle or deluge for inflation?

Many analysts and policymakers seem intent on taking a firm stance on this question. The Secretary of the Treasury, for example, does not view tariffs as inflationary, while others debate just how inflationary they might be. In our view, it is important to avoid a dogmatic or strictly binary approach. Asking whether tariffs are inflationary is comparable to asking whether a lot of rain will cause a flood. In reality, it depends not only on how much rain falls, but also on how quickly it falls (flow), where it falls (the terrain), and whether there is sufficient infrastructure in place (dams, drainage, etc.) to cope with heavy rainfall. Likewise, the inflationary impact of tariffs depends on several factors: (a) the magnitude of the tariffs, (b) the speed at which they are imposed, (c) who is targeted, and (d) on what products. Under President Trump’s approach, these parameters remain largely uncertain. Nevertheless, based on developments so far and how other nations are responding, investors can expect the “tariff wars” to be inflationary, with effects likely to materialize after a lag of a few quarters.

Fleeting or here to stay?

Those who believe—among them Chair Powell—that tariff-related inflation will likely prove transitory base their argument on the idea that once the price increase takes hold, the tariff shock will ease as consumers (the demand side) and supply chains adapt to the new circumstances. This argument has merit, however there are notable caveats.

- The process or “adjustment” for consumers and supply chains can be lengthy. A prolonged transition is, by definition, not transitory and heightens the risk that consumers and markets reset their inflation expectations—a possibility we may already be seeing (though it remains to be confirmed in the coming months).

- As during the 2020 pandemic, in a deeply interconnected world, unintended consequences are not just possible but likely. We are still at the beginning of this saga, and many of these tariffs have yet to be fully implemented. Only when the system is put to the test under real-time conditions will we see any cracks appear. Such disruptions will not be “fixed” overnight, making the notion of transitory inflation feel optimistic at best.

Other inflationary forces

Beyond the issues stemming from trade wars, we still lack clarity about the new administration’s impact on the labour market. Permanent mass deportations will undoubtedly affect the labour force and likely push wages higher—an effect that is not transitory.

It is also important to note that the significant shift in US international policy is generating corollary effects that can be highly inflationary. Europe’s realisation of the end of ‘Pax Americana’ has already driven an increase in defence spending, and a geopolitical race to secure vital resources—including energy and minerals—no longer seems far-fetched.

To sum up our view, we believe the risks of a resurgence in inflation are far from negligible. Most concerning would be any de-anchoring of inflation expectations, leading them to move higher. Once again, it is prudent to prepare portfolios proactively; the cost of doing so preventively is lower than managing a risk once it materialises.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.