The Mar-a-Lago Accord: Reimagining America’s monetary influence

5 March 2025

Equities are falling, but so is the dollar. What’s changed?

19 March 2025INSIGHT • 12 March 2025

Germany’s election shake-up: Shifts across the Bloc

Shane O'Neill, Head of Interest Rate Trading

It has been less than a month since we last took a look at the Eurozone’s state of affairs (Eurozone in Flux), yet so much has changed. The German election is now behind us, and its outcomes are already having a far-reaching impact on the Bloc’s macro environment. Meanwhile, Trump’s games continue to reshape the lay of the land for risk managers, making it feel as though staying on top of every new development is a never-ending challenge. With certain risk events behind us and many more looming, this is the ideal moment for risk managers to refocus their attention on Europe and pinpoint where their efforts should lie in the coming months.

A coalition puzzle ahead

Germany’s federal election delivered a fragmented outcome, pushing coalition negotiations to the forefront of an already uncertain economic landscape. The CDU, led by Friedrich Merz, won the largest share of the vote but fell short of an outright majority, setting the stage for protracted talks with potential partners. Meanwhile, the SPD and Greens underperformed expectations, reflecting voters’ frustration with recent economic stagnation. The business community will be watching closely: Germany’s pressing economic challenges—from high energy costs to restrictive fiscal policy—require urgent attention, and a lengthy coalition process could delay much-needed reforms.

Strengthening the Bloc: Europe’s renewed focus on defense and infrastructure

The ongoing conflict in Ukraine and President Trump’s geopolitical posturing—peaking in a disastrous Zelenskyy visit to the White House—have sparked a fresh commitment to defense spending across the Bloc. Multiple governments have announced increases in their military budgets, with Germany, having already committed to a €100bn special defense fund in 2022, now signaling further long-term investment beyond this initial boost. France has also accelerated spending plans, raising its military budget for 2024-2030, while Poland has emerged as one of Europe’s biggest spenders, targeting defense expenditure above 4% of GDP—double NATO’s guideline—amid the immediate conflict on their doorstep.

This military expansion is unfolding alongside Germany’s push for broader fiscal stimulus, with reports suggesting a proposed €500bn infrastructure fund designed to bypass the country’s restrictive debt brake. If approved, the fund would direct long-overdue investment into transport, digitalisation and energy infrastructure—sectors critical to reversing Germany’s stagnating growth. Together, these defense and infrastructure initiatives point to a major shift in German fiscal policy, carrying far-reaching implications for sovereign issuance and European interest rates.

Europe’s fiscal shift fuels yield surge

Europe’s changing fiscal stance has not gone unnoticed by bond markets, with yields climbing higher as investors factor in the prospect of increased sovereign issuance and a stronger inflationary impulse. German bund yields—which had been edging lower earlier this year amid recession concerns—reversed course following reports of the proposed €500bn infrastructure fund. Last Wednesday’s 30bps rise was the steepest single-day move since 1989, coinciding with the fall of the Berlin Wall. Amid the excitement surrounding fresh stimulus—particularly one designed to circumvent Germany’s debt brake—the markets are questioning how much fiscal discipline will remain as Germany pivots towards investment-led growth.

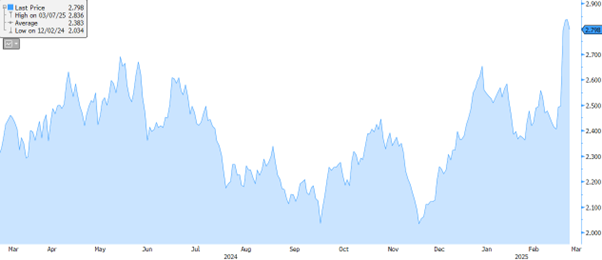

Figure 1: German 10y yields have jumped higher on the back of spending plans, with historic one day moves.

Source: Bloomberg

The ECB’s latest meeting saw a widely expected rate cut, yet the pace and extent of future easing have grown more uncertain. A more proactive fiscal backdrop could reduce the urgency for aggressive monetary policy, particularly if heightened defence and infrastructure spending begins to fuel inflation expectations. For the moment, markets are juggling two conflicting narratives: on one hand, sluggish growth and softened inflation data support easier policy; on the other, structural increases in government spending— combined with a potential surge in bond supply—may continue pushing long-term yields upward.

Euro’s comeback: The domino effect in action

After a dismal final quarter of 2024 saw EUR/USD tumble from $1.12 to $1.02—with many anticipating a return to parity—the single currency was shrouded in pessimism. However, as previously noted, market positioning and price action appeared ripe for a squeeze higher, provided the first domino fell. Recent developments in Germany and across the region proved to be that first domino. A rise in EUR rates, coupled with a drop in USD rates, prompted market players to unwind Euro shorts. As a result, EUR/USD spot rallied from below $1.04 to above $1.0850 at the time of writing, with positioning now neutral. The cost of carry has shifted substantially as well. While there remains a notable expense to fund in euros, the cost to hedge for three years has dropped by 50bps in just one week. As markets continue to digest the effects of increased borrowing by the Eurozone, expect continued volatility in this metric in the months ahead.

Figure 2: A historic move in EUR yields coincided with a drop in USD yields, causing a sharp unwind in EURUSD positioning and a squeeze higher in the pair.

Source: Bloomberg

Staying agile

In an environment of rapid economic and political shifts, risk managers must remain both agile and proactive in their approach. Europe’s evolving fiscal landscape—from increased defense commitments to Germany’s ambitious infrastructure drive—has introduced new complexities for markets to digest. Bond yields are swinging abruptly, while central bank policy remains far from certain. With these dynamics in flux, managing exposures effectively requires constant reassessment of rate expectations, currency implications, and broader macro risks. Flexibility and decisive action will be crucial in the coming months—complacency is not an option in a landscape when the ground beneath us keeps shifting.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.