Navigating Uncertainty: Risk & Opportunity in 2025

27 January 2025

Validus Secures $45 Million Growth Equity Investment from FTV Capital

10 February 2025INSIGHTS • 5 FEBRUARY 2025

Canadian Outlook: Rocky Road Ahead for the Loonie

Harun Thilak, Head of Global Capital Markets NA

The Canadian dollar, colloquially known as the "loonie," has faced significant volatility in recent times, influenced by a confluence of domestic political events, sluggish economic indicators and international trade policy threats. The impacts of each of these on the currency's recent performance is explored below.

Domestic Political Uncertainty Weighs on the Dollar

Recent political turmoil in Canada has significantly shaped investor sentiment and consequently the value of the Canadian dollar. The resignation of Deputy Prime Minister and Finance Minister, Chrystia Freeland, in December 2024 intensified pressure on Prime Minister Justin Trudeau, culminating in his resignation in January 2025. This triggered a leadership race within the ruling Liberal Party, scheduled to conclude in March 2025.

This leadership transition occurs against a backdrop of strong support for Pierre Poilievre and his Conservative Party, with most polls predicting a return to power for the Conservatives later this Fall.

Political instability often triggers capital outflows as investors seek more predictable environments and this has prompted sluggishness in the Canadian dollar, the weakest performer among the G10 currencies year-to-date (vs the USD).

Chart 1: Canadian dollar under-performance YTD vs USD

Source: Bloomberg

Canadian Economic Headwinds & Dovish BOC Policy Response

The Canadian economy has been showing signs of underperformance, with GDP growth hovering around 1.5%, unemployment rates meandering around a relatively elevated level (of 6.7%) and inflation dipping to just south of the Bank of Canada’s target of 2%. In response to these economic challenges and to stimulate an interest rate-sensitive economy, the Bank of Canada has adopted an aggressive dovish monetary policy stance, cutting rates by 200bps since 2024, contrasting with the more modest 100bps reduction by the US Fed. This divergence in monetary policy bias has further weakened the Canadian dollar. With markets pricing in an additional 50bps of rate cuts in Canada for 2025, compared to 40bps in the US, the Loonie is expected continue its trajectory vs the USD.

Chart 2: BOC vs FED Policy rates

Source: Bloomberg

Trump’s Tariffs on Canadian exports to the US

One of the most direct external pressures on the Canadian dollar has been the tariffs levied by the Trump administration on Canadian exports to the US. At the time of writing, the US administration has proposed 25% tariff on all Canadian imports, except for energy products, which would face a 10% tariff. In retaliation, Canada has imposed 25% tariffs against CAD 155 billion of US imports. If no agreement is reached, tariffs are expected to take effect on February 4th. With approximately 14% of Canada’s GDP reliant on exports to the US, the new tariffs pose severe downside risks to economic activity. While the US economy will also feel the impact, the effect is expected to be less severe, as exports to Canada accounted for only 1.3% of the US GDP in 2023.

Canadian Dollar Outlook

The interplay of the above factors paints a rocky road ahead for the Canadian dollar. Domestic political instability and economic indicators have set the stage for a weaker currency, and the external shock of US tariffs could act as a catalyst for further depreciation. The Bank of Canada's response through monetary policy has been one of attempting to cushion the economic fallout, but at the potential expense of currency value.

Looking forward, the trajectory of the Canadian dollar hinges on several variables: the resolution or escalation of political turmoil, the extent and impact of potential US tariffs, and how well Canadian exports adapt to new trade realities. If Canada can stabilize politically and economically, perhaps through new trade agreements or domestic policy adjustments, this could bolster investor confidence and support the loonie's value.

However, without such stabilization, the risk of further depreciation to the loonie remains significant, particularly given the current climate of rising protectionism and global economic uncertainty.

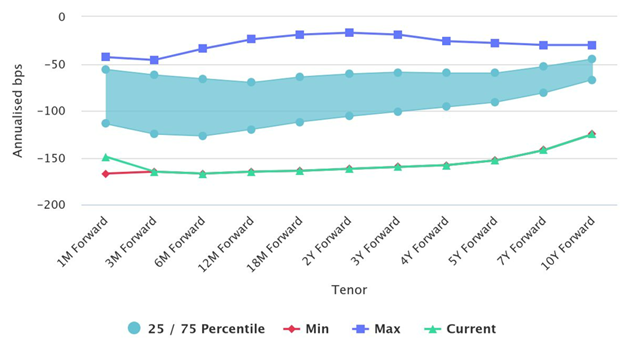

USD based investors can hedge for CAD weakness via FX forwards with FX forwards carry at extremely attractive levels.

Chart 3: USDCAD FX Forwards Carry Cost (in annualized bps)

Source: Bloomberg, Validus

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.