From Paris to Frankfurt: ECB’s response to France’s political turmoil

10 December 2024

Navigating Uncertainty: Risk & Opportunity in 2025

27 January 2025INSIGHT • 18 DECEMBER 2024

Euro Under Fire – Key Considerations for Investors

Marc Cogliatti, Head of Capital Markets - EMEA

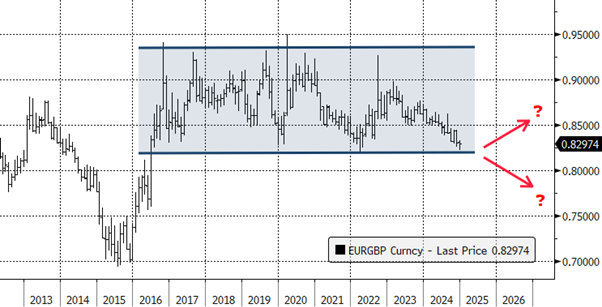

Last week, the euro fell to its lowest level against the pound in almost three years. Despite a strong end to Friday’s session, EURGBP still sits within touching distance of the bottom of the range that has governed for the past eight years. This raises a critical question: will the status quo be maintained and the pair rally back into its range? Or are we witnessing the beginning of a new era, potentially leading to significantly lower levels in the months ahead?

Figure 1: EUR/GBP 2013 – to date

Source: Bloomberg

Key Drivers

There is little doubt that the move lower in EURGBP stems from a weaker euro rather than a stronger pound. The euro has been under pressure against all its major counterparts, most notably the dollar, following 125bps worth of cuts since June. The ECB has adopted the most aggressive stance among all major central banks thus far in response to a sharp decline in Eurozone economic activity and sentiment, exacerbated by the looming threat of tariffs under Trump. Following last week’s rate cut, President Lagarde signalled further easing measures, with the market anticipating another 100 – 125 bps of cuts by the end of Q3 2025.

Meanwhile, the Bank of England is also in easing mode, though not to the same extent as the ECB. In the current cutting cycle, the BoE has only implemented two 25bps cuts to date, as the committee battles concerns about growth with stubborn inflation, particularly in the services sector. Consequently, the market is only pricing another ~3 cuts (-75bps in total) in 2025, which has widened the interest rate differential between EUR and GBP to 218bps (assuming a 1 year forward outlook).

Looking Forward

We’ve looked at how we got to where we are, but it would be naive to assume that this should dictate the trend as we head into 2025, given that its already baked into the price. It’s not beyond the realms of possibility that the differential could widen further – most likely because the ECB is forced to cut rates more aggressively, but potentially because the BoE is forced not to (or doesn’t need to). Instead, it’s entirely plausible that the differential starts to narrow as some of the ECB loosening is priced out or more aggressive easing from the BoE is priced in.

The purpose of this piece is not to shape our expectations for 2025 – that will be covered in our forthcoming outlook for 2025. Instead, we wanted to highlight three key considerations as we approach the year-end.

- Interest rate differentials and hedging costs: The widening interest rate differential has pushed hedging costs for a EUR vehicle with GBP assets to levels not seen in the past two years. While hedging remains crucial in this uncertain environment, considering a more dynamic hedging approach may offer greater flexibility to capitalize on more favourable conditions should they arise.

- Opportunities for unhedged GBP exposure: For EUR-denominated funds with any unhedged GBP exposure that arose when EURGBP was higher, the recent decline in spot presents an excellent opportunity to add cover. It’s also particularly timely for any unhedged income that needs to be converted before quarter end.

- Managing hedge portfolio risks: Market volatility necessitates a careful assessment of the consequences for any hedged exposure. That is then very quickly followed by what it means for the existing hedge portfolio. Most EUR vehicles with GBP hedges will now have a portfolio of hedges with negative mark-to-market valuations. Therefore, monitoring CSA thresholds / credit limits with hedging counterparties is a key priority. Posting cash as collateral is a costly exercise for any fund, so proactivity with regards to negotiating credit support or spreading the risk amongst relationships is key to minimising any adverse impact on the fund.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.