US Elections: The European Story

28 November 2024

From Paris to Frankfurt: ECB’s response to France’s political turmoil

10 December 2024INSIGHTS • 4 DECEMBER 2024

Populist Economics in 2025

Andrew Spence, Senior Advisor

Populist economic policies often promise quick solutions to complex problems, working well initially but eventually giving way to lower growth and increased inflation.

Trump’s economic policy comprises four key components intended to boost the supply side of the economy and improve domestic conditions. However, these measures are more likely to increase demand and lead to overheating. These are: tariffs, mass deportations, deregulation, and influence over Federal Reserve policy.

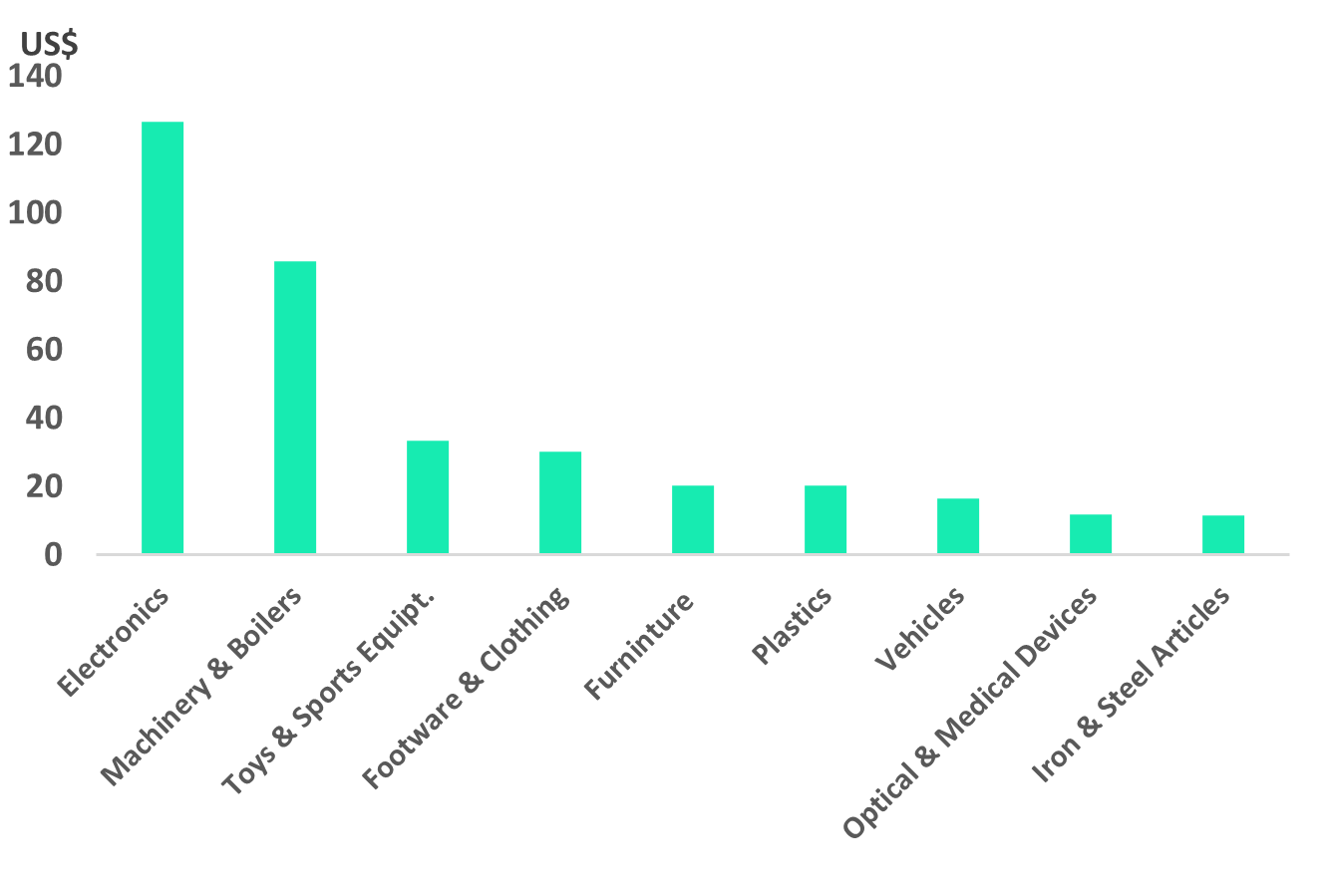

Tariffs

The U.S. economy is currently operating at its productive capacity. Introducing higher tariffs may redirect demand from imports to domestic production, but with domestic producers already operating at their limit, they will be unable to meet the increased demand. The result will be rising inflation, driven by supply constraints.

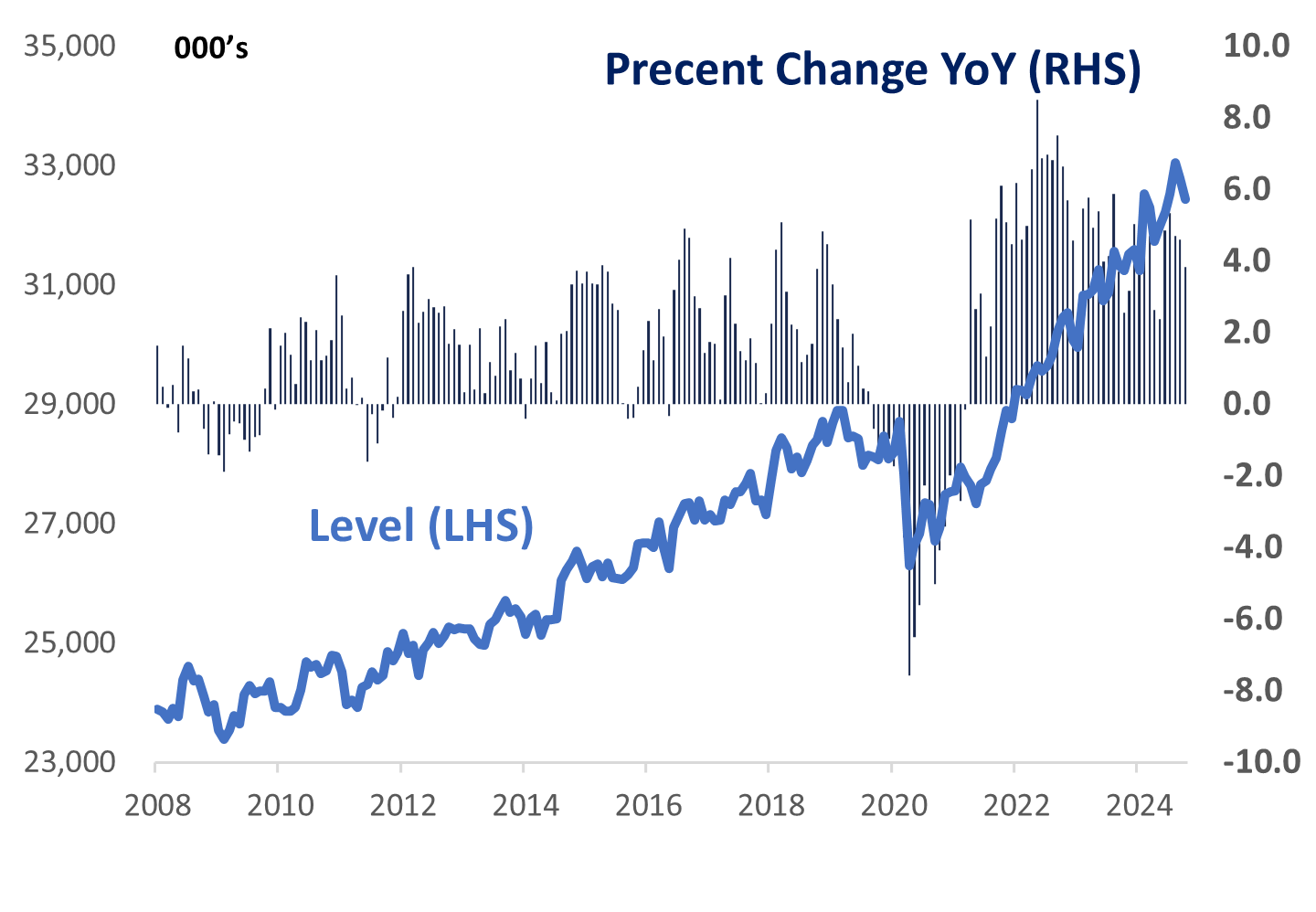

Mass Deportations

Trump’s promise to deport up to 11 million undocumented immigrants would reduce the labour force by about 5%. Such a significant reduction would intensify labour shortages, causing producers to compete for a diminished pool of workers and drive up wages. This could create a wage-price spiral, increasing the risk of that inflation will surge.

Deregulation

The deregulation agenda, widely supported by businesses for its promise of increased efficiency, carries risks of financial stability—particularly potential integration of cryptocurrencies into mainstream finance. Banking deregulation and broader adoption of cryptocurrencies, which currently lack the stabilising framework of conventional finance, could introduce significant vulnerabilities to the financial system.

Chart 1: Top 10 US imports from China

Source: US Commerce Dept & FRED Database

Chart 2: Foreign Born Contribution to US Labor Force

Source: US Commerce Dept & FRED Database

The Fed

The Federal Reserve will most likely be faced with an overheating economy in 2025. Although inflation has returned to the target range of 1.0% to 3.0%, many individual price changes retain excess volatility, deviating from what is typical in a stable 2.0% inflation environment. Trump’s preference for low interest rates may lead to potential conflict with the Fed, especially if rising inflation necessitates rate hikes to counter the overheating effects of these policies.

The Fed was able to bring inflation down without causing a recession because inflation expectations were stable at 2.0%. However, renewed conflict with the Fed would raise uncertainty over the permanence of inflation targeting, raise inflation expectations, and complicate macroeconomic management.

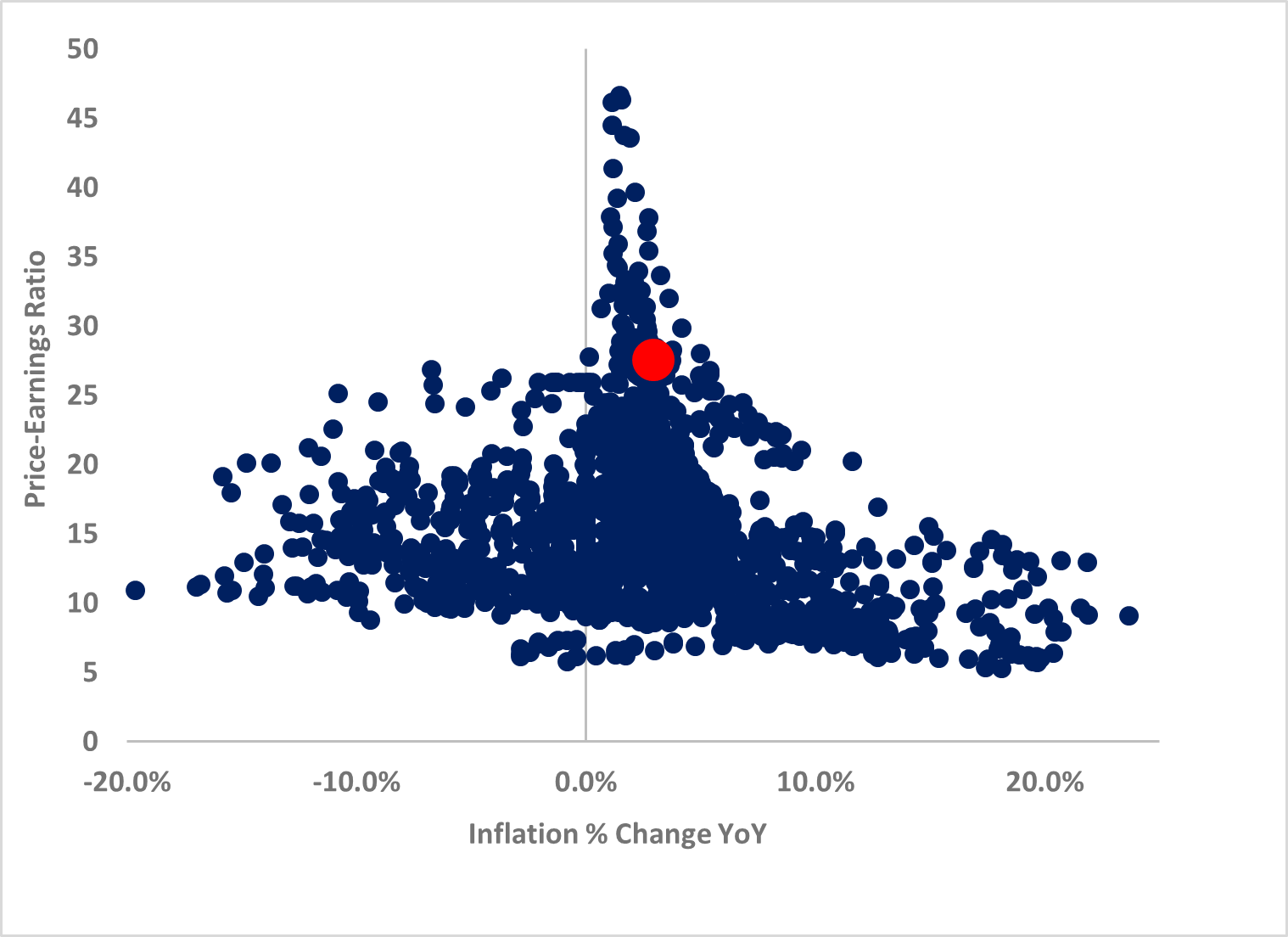

Equities

Equities are not currently priced to reflect the impact of rising interest rates driven by debt, as well as the inflationary pressures from tariffs and a labour market squeeze. These factors could weigh heavily on equity markets, leading to a downside correction as investors reassess their positions.

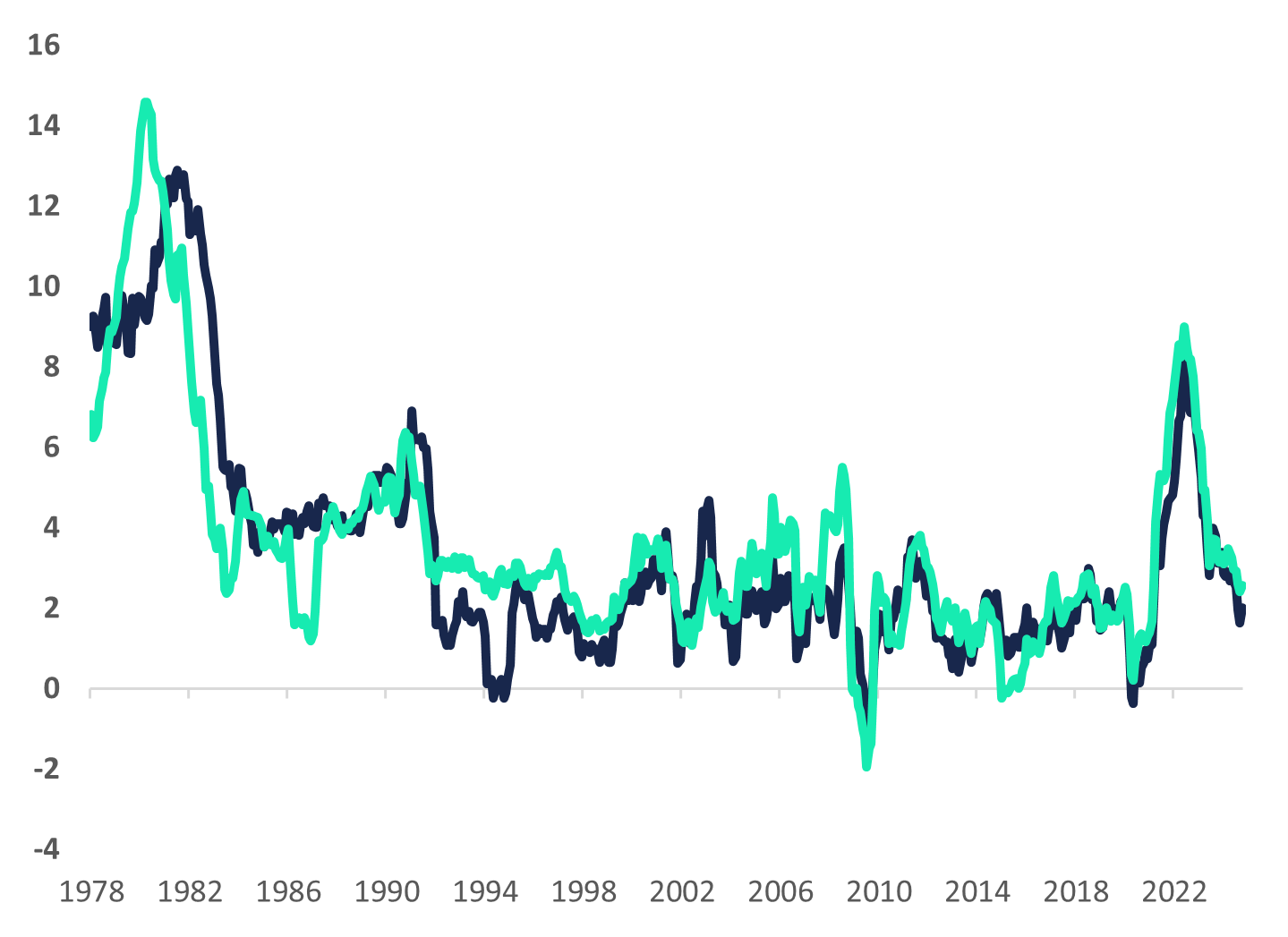

Canada

Canada would also be squeezed under these policies. Higher tariffs and retaliatory counter-tariffs would likely lead to a slump in growth and a weakening Canadian dollar. Over half of Canada’s inflation between 2021 and 2023 came from imports, and high inflation in the US would quickly spill over to Canada. The Bank of Canada would be in a tight spot, caught between the need to lower interest rates to support weak growth and the pressure to raise rates to contain inflation.

Chart 3: S&P500 P/E Ratio vs. Inflation 1882 - 2024

Source: FRED Database & Robert Shiller

Chart 4: CPI Inflation US vs. Canada

Source: FRED Database & Robert Shiller

Populist policies look for easy solutions to difficult problems, but history tells us that there are no easy solutions to tough economic challenges.

The possible combination of unsustainable fiscal policy and the potential for conflict with the Fed threatens to accelerate growth in the debt to GDP ratio by unhinging inflation expectations from 2.0%.

Asset prices are discounted at some spread to the risk-free rate, and presently many assets are priced to perfection. When value is poor, risk of loss is high. Investors should be paying close attention to the forces driving upside to US long-term interest rates, and downside to asset prices, which are an important source of risk in the months to come.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.