Validus named Risk Management Software Provider of the Year 2024

18 November 2024

US Elections: The European Story

28 November 2024INSIGHT • 20 NOVEMBER 2024

US rates markets weigh how much Trump will deliver

Louis Sangan, Global Capital Markets, Senior Associate

A Republican sweep of the Presidency, the Senate and the House has provided Trump with the clearest mandate to deliver on pre-election campaign policies. From an economic perspective, the three key policy pillars are US protectionism via tariffs, fiscal expansion through an expected continuation of the Tax Cuts and Jobs Act (TCJA) and a tougher stance on immigration.

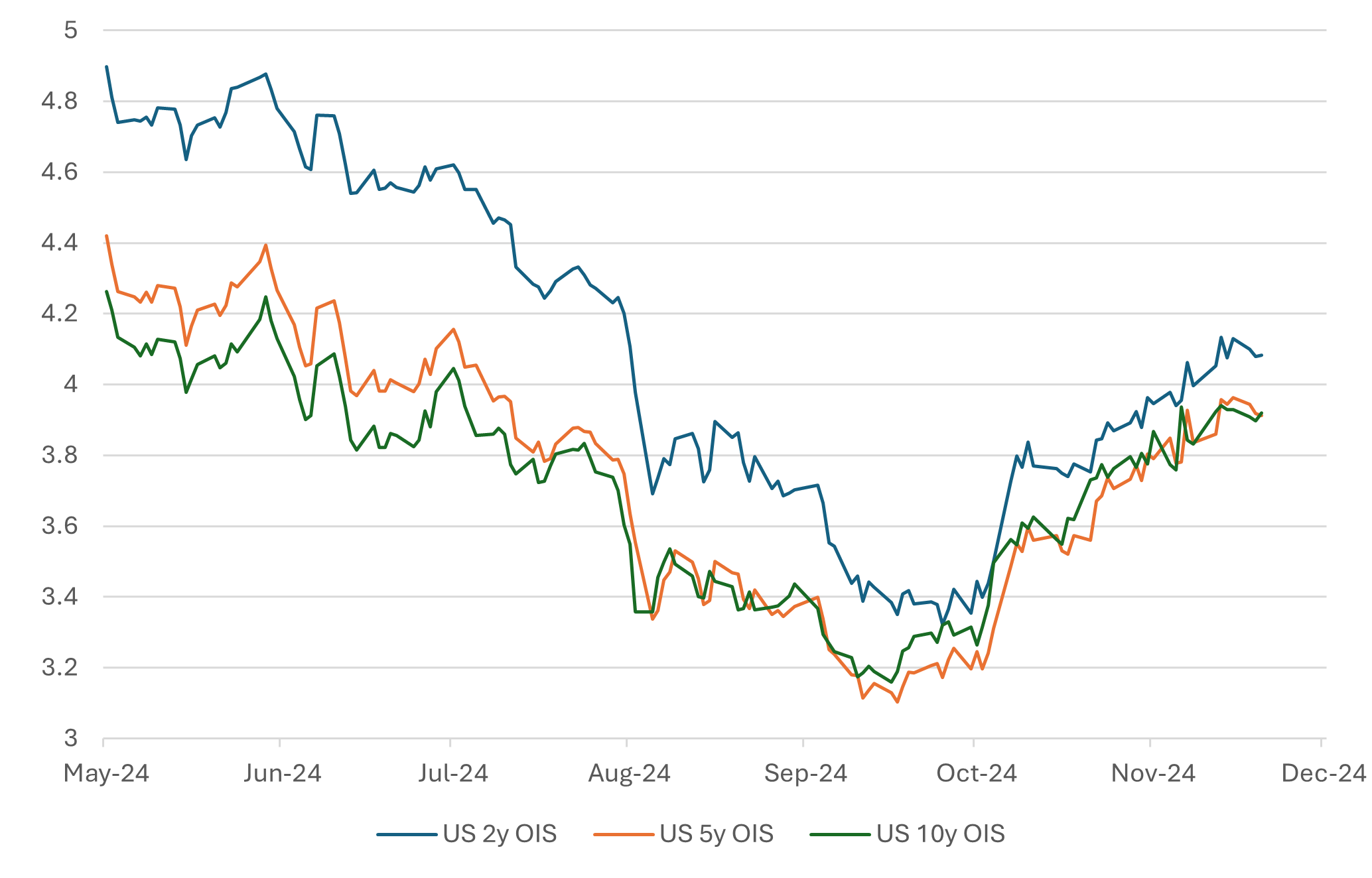

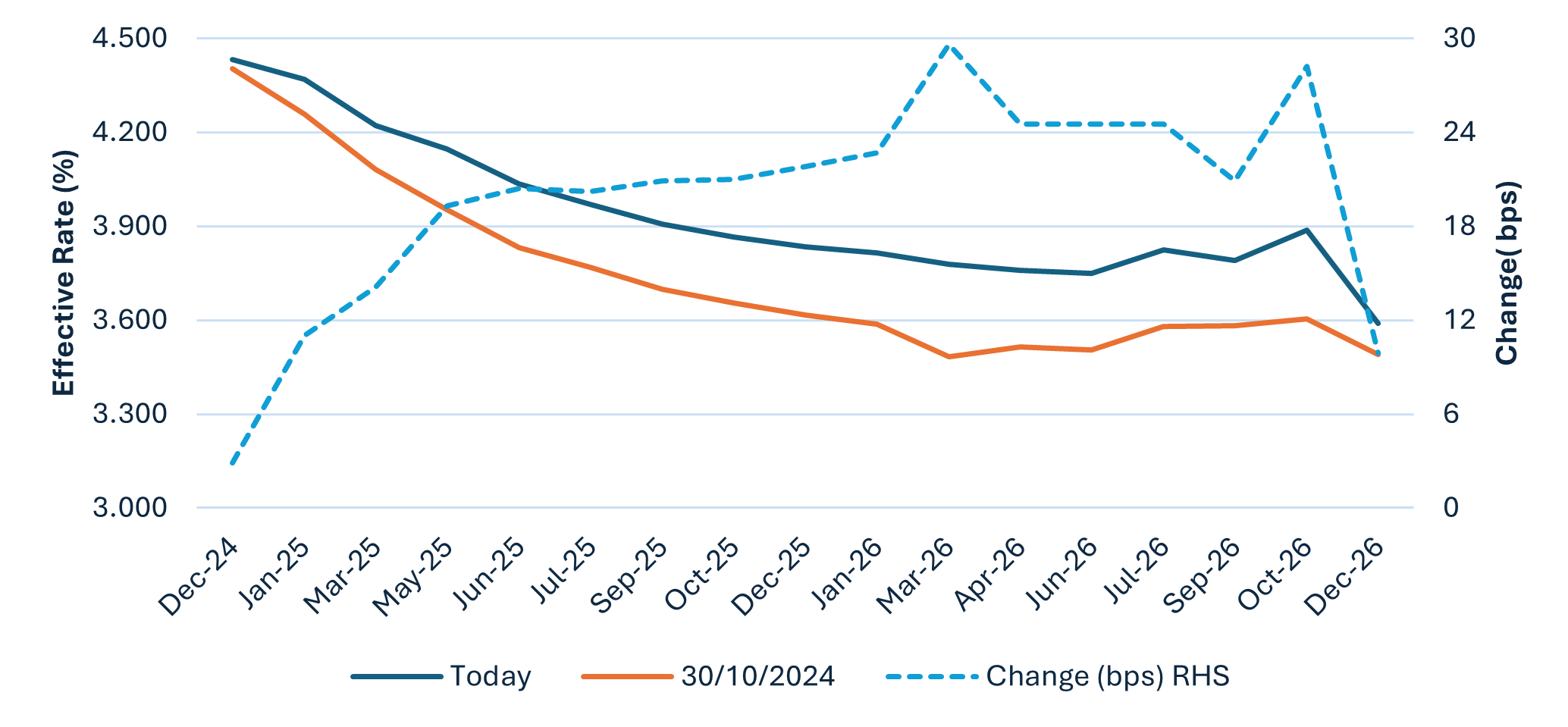

The impact on rates markets since the election has been somewhat orderly, with US 2y, 5y and 10y swap rates higher by 16bps, 13bps and 14bps respectively (Figure 1). This reflects the broad view that Republican policy will be inflationary and as a result will require the Federal Reserve to maintain a more restrictive monetary policy stance. Market pricing has taken out c.18bps of cuts by end-2025 (Figure 2), and swap pricing implies a higher longer term neutral rate for the US economy.

Figure 1: US Rates (01May24 – Present)

Figure 2: Market Implied Fed Funds Rate to YE 2026

Source: Bloomberg

US data since the election has continued to show resilience. Core CPI released on 13th November was in line with expectations at +0.3%, but notably the 3-month annualised Core CPI rate is at 3.6%, up from 1.6% annualised 3m ago at a time where the Fed appeared to be pivoting away from inflation and toward labour markets support within its dual mandate. Retail sales released on 15th November also pointed to a stronger consumer, along with continued consistency in US Initial Jobless claims alleviating some labour market concerns. Arguably, consistently strong data has contributed to higher US rates as much as, if not more, than expectations for future Republican policy and is evidenced by the broader US rates higher move experienced since mid-September (US 5y swaps c.80bps higher).

The extent and timing of policy implementation remains the key variable

In the absence of key data prints this week, market attention has turned to Trump cabinet picks as a barometer for aggressiveness of policy implementation. Protectionism hawks and less experienced / more radical choices have resulted in rates higher moves, but we still take the view that it will be some time for policy to be legislated and there remains significant scope for volatility in rates paths until the final outcome is more known.

- Tariffs:

An increase in the effective tariff rate is likely inflationary, largely owing to increased import prices for sticky supply chains and higher production costs. Whilst a stronger dollar / foreign currency depreciation would offset some of this price pressure, the 2018 experience of tariffs points to higher US domestic prices. There are 3 broad categories of tariffs that the market is contemplating:

- Tariffs on China are widely expected to be implemented

- Auto sector tariffs on the EU and Mexico have a significant chance of implementation

- A broader universal tariff is more uncertain, but has the scope to have a larger impact on US inflation than (i) and (ii). Exclusions from a universal tariff also adds further uncertainty regarding final impact on the effective tariff rate

Increased domestic inflation from tariffs is likely to lead to reduced monetary easing from the Fed, and in turn lead to higher US rates and a stronger USD. The extent of tariff implementation is a key variable for the inflationary and growth impact.

- Fiscal expansion

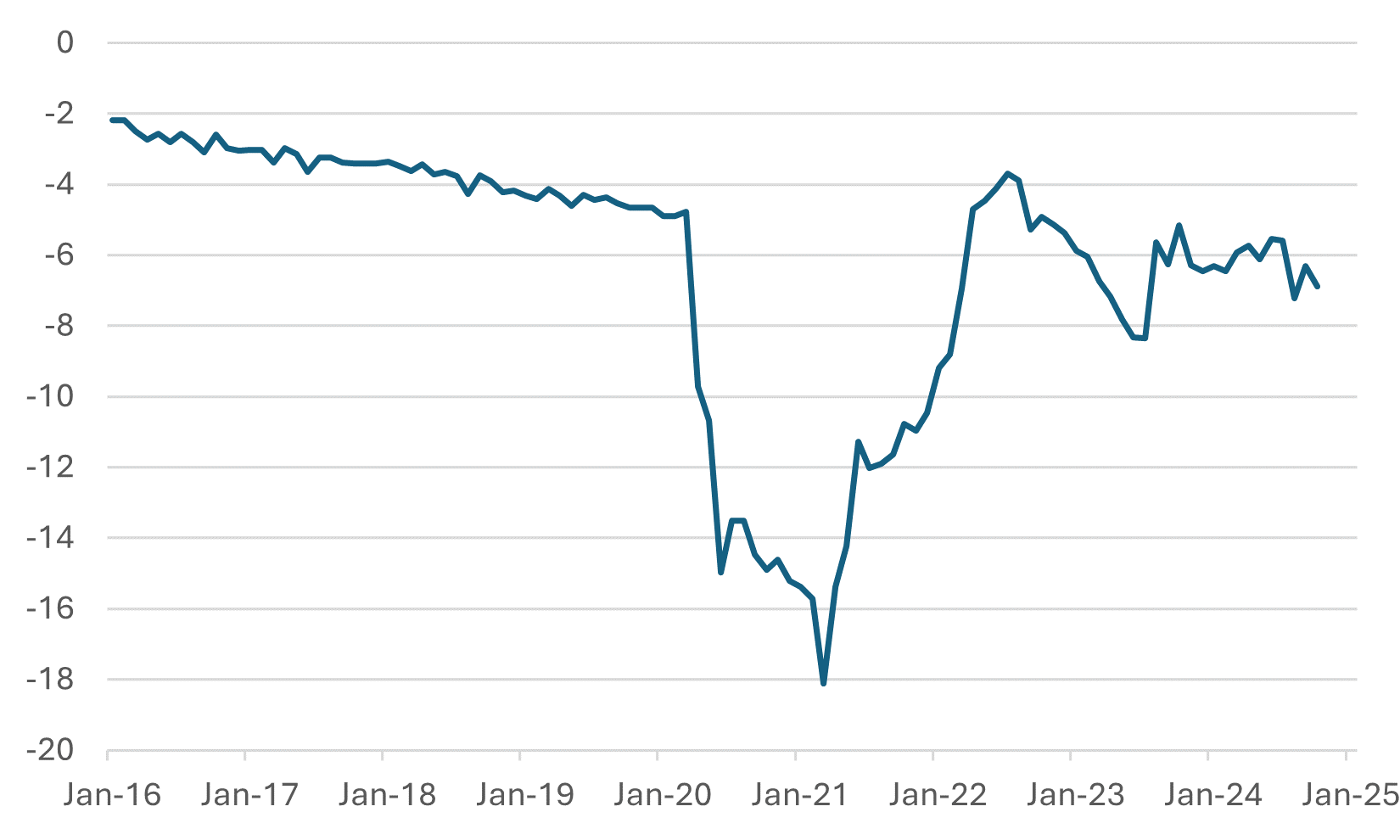

The US is in a different fiscal scenario from Trump’s first administration in 2016, with US government deficits trending downwards and increased market focus on long term fiscal sustainability, especially following the large fiscal response to COVID-19 coupled with higher rates to service the increased debt load (Figure 3). Even though Trump may desire an extension of the TCJA, there may be less political will to deliver such policy. Furthermore, with US economic exceptionalism proving resilient, fiscal easing is likely to prove more inflationary rather than growth generative this time around than it was in 2016.

Figure 3: US Budget Deficit, % Nominal GDP

Source: Bloomberg

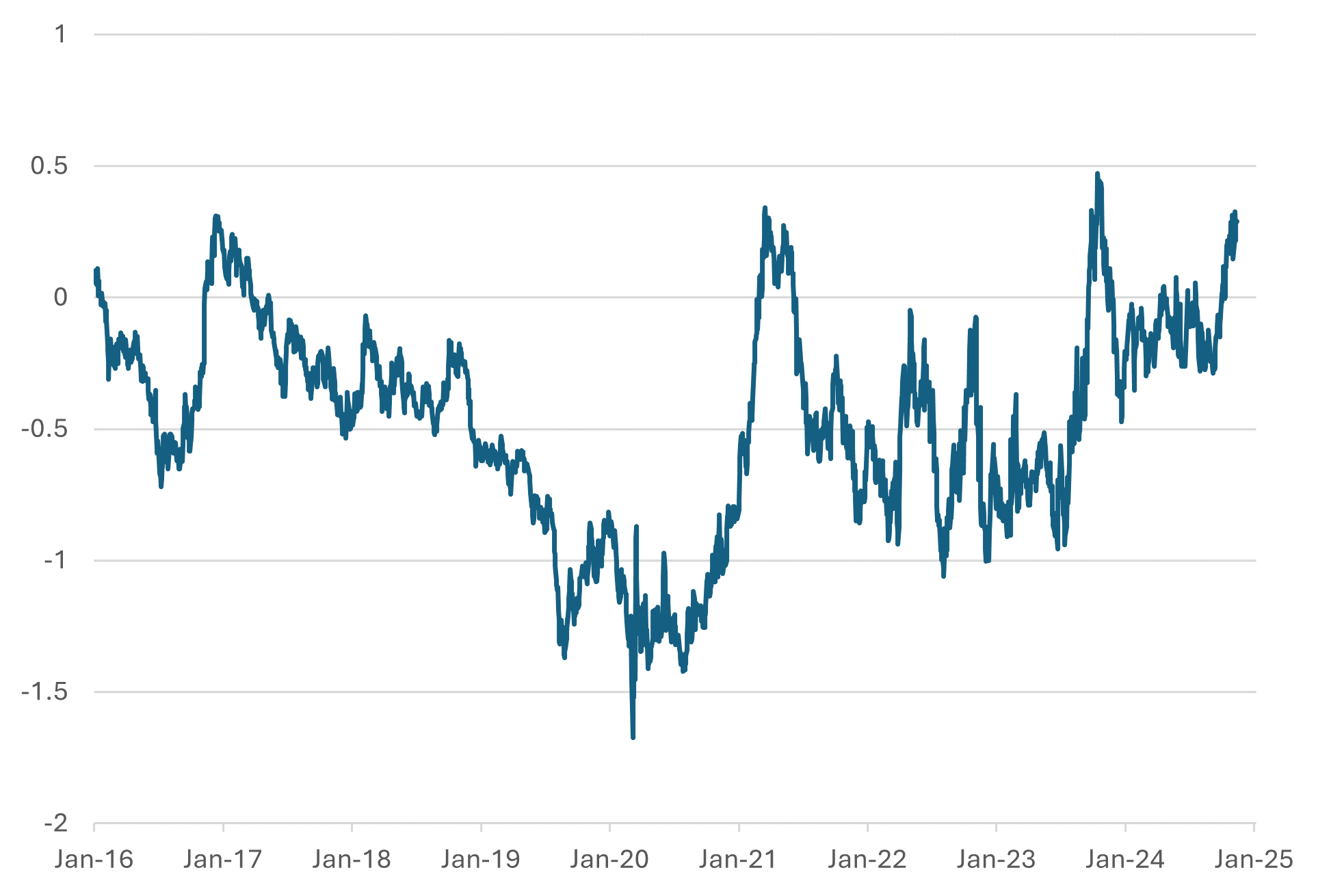

Should Trump force through fiscal expansion via direct pressure or cabinet appointees, there is a risk of a selloff in bond markets. As experienced in October 2023, fiscal sustainability concerns increased term premium (the compensation investors require to hold longer term USTs) and tightened economic conditions in the longer end of the curve. Indeed the Term Premium (estimated by the NY Fed) has risen from below 0 in September towards the peak set in October 2023 (Figure 4). The term premium effect may actually give the Fed more confidence in cutting rates should longer term borrowing costs increase substantially and provides another source of uncertainty for US rates based on the extent of implementation. This effect was experienced in Q4 23 with the Fed agreeing in principle that Term Premium increases reduced the need for additional tightening – logic that could be applied similarly for easing in the current part of the cycle.

Figure 4: ACM 10y Treasury Term Premium

Source: Bloomberg, NY Fed

- Tighter Immigration Policy

Whilst Trump may struggle to keep promises of mass deportations and removal of all illegal immigrants, it seems relatively clear that tighter immigration policy and some level of implementation will increase US labour market tightness. This can reasonably be expected to increase wage growth pressures through less labour supply, and as a result pass through to greater inflation.

The Fed continues to focus on long term data trends rather than expected government policy

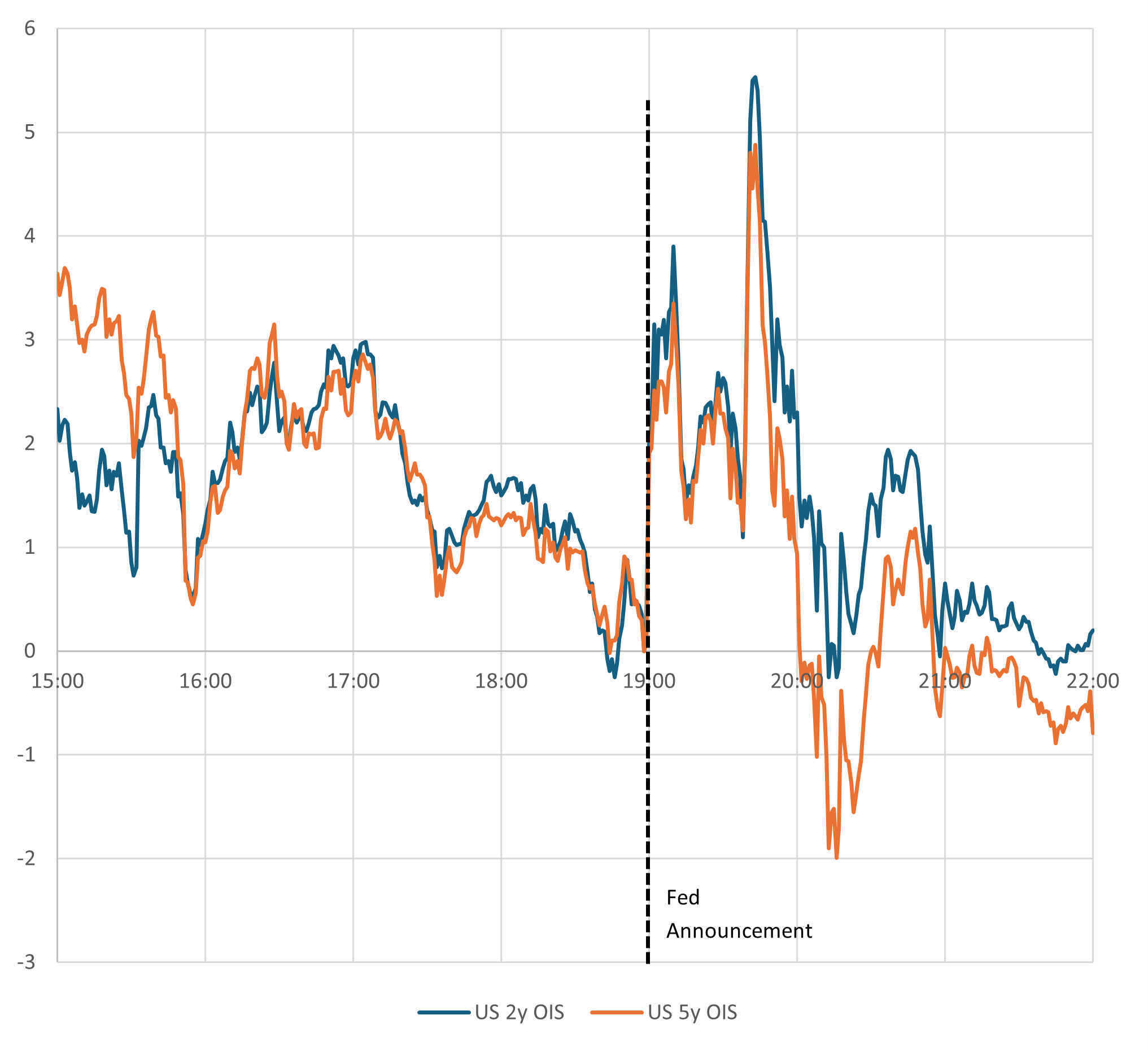

“We don’t guess, we don’t speculate, and we don’t assume”. Powell dismissed any impact on Fed policy on 7th November, adding “in the near term, the election will have no effects on our policy decisions”. Indeed, the market reaction over the Fed announcement and press conference was very muted (Figure 5), with most of the post-election rises in rates being given back prior to the announcement itself (we suspect on the basis that Trump policy implementation and timing is still too uncertain).

Figure 5: US Rates Impact over 7th October Fed meeting (bps, 19:00 = 0)

Source: Bloomberg

While the Fed remains cautious about guiding monetary policy based on uncertain future Trump effects, this may change if consumer and inflation expectations start to incorporate future government policy implications. We look to the December Fed meeting and in particular the Summary of Economic Projections (not released at the November meeting) for insights into how the Fed anticipates the election’s impact. If increased future inflationary pressures are acknowledged, US rates could rise further.

Implications for hedging

Uncertainty over government policy and the Fed’s reaction suggests a continuation of the two-way nature of rates markets that we’ve seen in Q3/Q4 2024. This is likely to be exacerbated through political volatility (the Trump “X” surprise risk) and increased geopolitical uncertainty globally. Current levels of rates volatility are not stretched by historical standards and as we enter Trump 2.0, it may be prudent to consider adding linear protection and purchasing optionality to design a hedging strategy that may perform in a variety of outcomes.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.