The Short Story of the Long End (of Yield Curve)

23 October 2024

Validus appoints senior hires in response to continued business growth

12 November 2024RISK INSIGHT • 24 OCTOBER 2024

Mitigating Market Risk in Private Equity Acquisitions Through Deal Contingent Hedges

Ron Pathak, Event Driven Sales Lead

Introduction

Cross-border acquisitions are vulnerable to market dislocations. Sudden shifts in currency values, interest rates, and geopolitical uncertainties between signing and closing can significantly impact the cost and feasibility of a deal. To mitigate these risks, private equity (PE) funds often turn to deal contingent hedges (DCH); dynamic hedging instruments that offer protection while preserving capital flexibility. This paper explores how deal contingent hedging can serve as a strategic tool for mitigating market risks in PE acquisitions.

Understanding Deal Contingent Hedges

The deal contingent hedging suite of products were developed to effectively address the conditional market risks (e.g. FX or IR) inherent in the time period between signing and closing of M&A transactions.

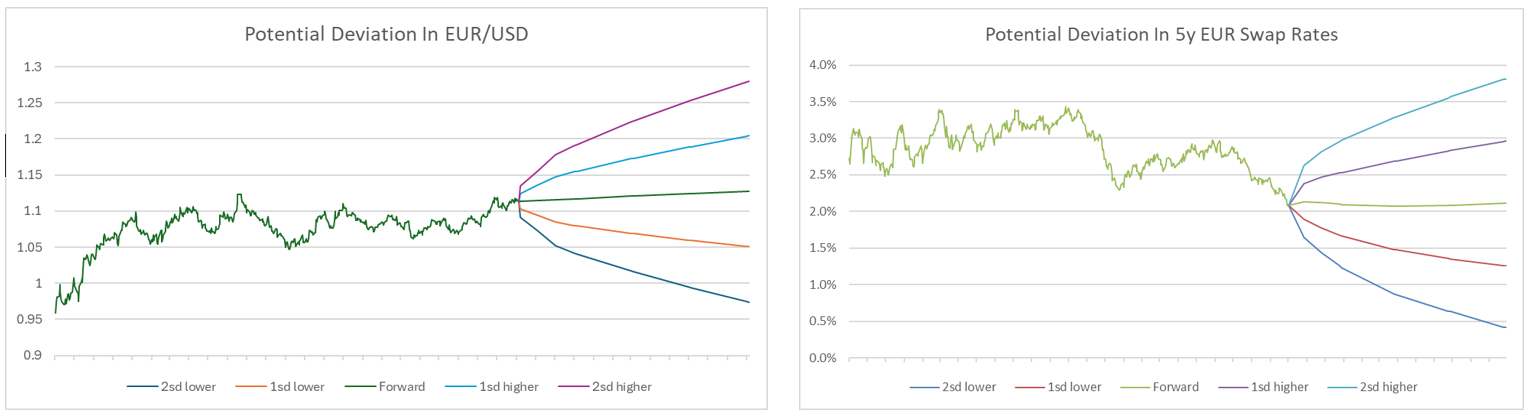

Note: Standard deviation (sd) measures the dispersion in a dataset. A 2 sd range should cover approximately 95.4% of the statistically expected range in the dataset.

A DCH offers the same hedge profile as a vanilla market hedge (e.g. FX Forward, FX Option, IR Swap or IR Cap). Where it differs from a vanilla instrument is that the DCH only becomes effective once ‘pre-defined conditions’ (such as regulatory approvals) have been met , and the transaction closes (the “deal contingent event”). The hedges are designed to expire without any financial impact if the underlying transaction fails to close.

The benefit of this is that the hedging party can avoid a scenario whereby the hedge incurs a cost (either a premium or a resultant negative mark to market) AND the underlying deal fails to close. This mitigates a scenario where a fund has lost money on a hedge without completing an acquisition ("dead-deal" costs).

How A Deal Contingent Hedge Works

Consider a USD denominated fund purchasing a EUR denominated asset (EUR 100mn). To ensure the deal meets the fund’s expected allocation and IRR requirements (in USD terms), the fund models the value of the asset assuming a particular EUR/USD foreign exchange rate, a particular interest cost of servicing the debt and subsequently a resulting quantity of debt (determined by debt serviceability) . These assumptions are typically based on the prevailing market rates at the time of modelling and submitting a binding bid for the asset.

Once a binding bid for the EUR asset has been submitted the fund is conditionally exposed to:

- Fluctuations in the EUR/USD exchange rate – Should the EUR strengthen between the time of submitting the bid and the time of financial close, the equivalent USD quantum required to purchase the asset will increase.

- Fluctuations in the Euribor rate and the EUR swap rate – Should interest rates rise, this will increase interest costs, reduce free cash flow, and reduce quantum of debt that can be borrowed given debt serviceability ratios.

Both of the above can have a meaningful impact on the overall IRR of an investment.

The complexity arises in recognising that the above risks are conditional – they will only impact the fund should the acquisition close.

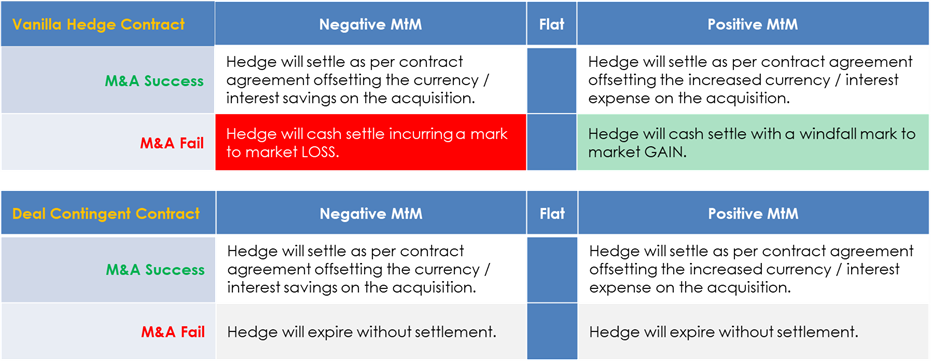

Should the acquisition close successfully, the market risks will materialise and the fund will be required to buy EUR to fund the acquisition and pay interest on the associated debt financing. Any hedging (irrespective of vanilla or deal contingent) will settle as per the agreement and offset the resultant market volatility.

However, in the event the acquisition does not close (e.g. failure to obtain regulatory approval, shareholder vote), the underlying acquisition and its associated risks would no longer prevail.

Had the fund hedged using vanilla instruments, they would need to unwind the respective hedges with any breakage value calculated based on prevailing market conditions. If markets moved adversely since inception, the fund would be required to settle a negative mark to market (MtM) despite not having the underlying exposure.

Options can certainly limit the negative impact on the fund but it still entails a potential ‘dead-deal’ cost.

Source: Validus Risk Management

A deal contingent hedge provides all the hedge benefits of a vanilla hedge whilst eliminating the obligation to settle a derivative contract should the acquisition fail to close. Should the acquisition fail to close, the fund can simply walk away without recourse (subject to the terms of the hedge documentation).

It’s crucial to note that there is no such thing as a free-lunch – whilst there is no premium paid upfront, the cost of obtaining this asymmetric hedge is factored into the underlying hedge rate.

Should the acquisition close successfully, the hedge rate secured will be slightly worse than a vanilla forward hedge. The cost of this conditionality is essentially offloaded to the hedge counterparty and embedded into the hedge rate.

Note, the embedded cost is only materialised if the acquisition is successful.

Transparency

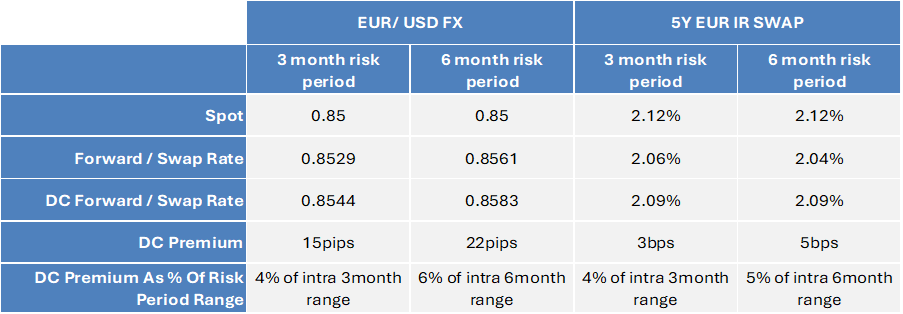

A cost that is embedded into the hedge rate and that is only materialised in the event of success sounds very attractive providing the embedded cost is reasonable - How much is this embedded cost?

Much like any insurance contract or hedge contract, the price will be a function of:

- The underlying risk

- The risk period

- The liquidity & competitiveness in price providers

Private equity transactions are often:

- Private – resulting in fewer counterparties being involved

- Complex – resulting in potentially longer risk periods

- Subject to numerous conditions – requiring time and sufficient due diligence for hedge providers to get comfortable with the risks. Some risks will be more manageable than others.

Subsequently, the price for deal contingent hedges can vary significantly. The private nature of acquisitions also makes it harder to gain transparency and competitiveness in pricing.

The table below gives some indicative levels using a deal contingent premium of circa 20% of the respective underlying option:

Source: Validus Risk Management

It is important to note that deal contingent hedges are bespoke products - depending on the terms of the underlying conditionality and underlying exposure, the deal contingent premium may be greater or less than the 20% pricing included in the illustrative table above.

Conclusion

Deal contingent hedges are an invaluable tool for private equity funds looking to mitigate market risks associated with event-driven exposures (e.g., acquisitions. By offering a flexible, cost-efficient way to protect against adverse movements in FX rates, interest rates, and other market variables, these instruments can help ensure that a PE fund's financial objectives are met even in the most volatile environments. Regardless of how the global financial landscape evolves, the strategic use of deal contingent hedges will continue to be an important staple in the toolkit of private equity hedging instruments.

The Role of a Hedge Advisor and the value that Validus can bring

Given the intricate and sensitive nature of structuring deal contingent solutions, hedge advisors can be instrumental in managing and streamlining the implementation process in the time leading up to the deal signing when in-house resources are most constrained. Additionally, a hedge advisor can facilitate competitive price-discovery while maintaining market discretion.

Validus is a leading independent financial risk management advisory firm, with extensive experience in foreign exchange and interest rate derivative solutions.

Our team brings years of experience from leading investment banks with extensive experience in providing deal contingent hedges. We are available to provide unparalleled market and analytical insights, product knowledge and a seamless, transparent framework of execution.

In our capacity as a dedicated hedge advisor / coordinator can assist in numerous ways, most notably in:

- Risk Assessment: Providing funds with quantitative support in identifying and analysing the risks

- Hedge Design: Applying our experience in structuring a hedge, and managing the implementation of the hedge

- Pricing and Negotiation: Utilising our market insights and independent pricing capabilities to enable price discovery.

- Discrete Competition & Liquidity: Leveraging our trusted partner relationships with leading investment banks to create a competitive pricing environment whilst maintaining the sensitivity of the private transaction and being respectful to all relationship banks.

- Seamless Execution: Assisting funds to execute the hedge in line with the deal timeline with minimal impact on constrained internal resources.

- Documentation Management & Hedge Monitoring: Processing the documentation (pre and post trade) from facilitating due diligence to negotiating legal terms in ISDAs and hedge contracts and monitoring the transaction through financial close.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.