Validus Launches ISDA Ops to Streamline Management and Monitoring of Complex ISDA Terms

14 October 2024

The Short Story of the Long End (of Yield Curve)

23 October 2024INSIGHTS • 15 OCTOBER 2024

The Fed’s Narrative: Market Confusion and USD Volatility

Ryan Brandham, Head of Global Capital Markets, North America

The market buzz heading into the September 18th FOMC meeting was different from most in recent memory. It was marked by unclear communication and the highest level of uncertainty over how the Fed would cut rates since 2007 (Source: Bloomberg).

A salient article

Despite the Fed’s previous denials of discussing a 50-bps cut, market participants were increasingly convinced of its likelihood. The shift in sentiment was largely attributed to Nick Timiraos’ article in The Wall Street Journal, which highlighted the difficult choice the Fed was facing and discussed the merits of both 25 bps and 50 bps cuts, ultimately implying the larger cut was coming. Timiraos’ reputation as “the Fed whisperer” for the accuracy of his articles led some to speculate the Fed might be using him to indirectly communicate with the market during media blackout periods – a process referred to as “Nickyleaks” by some market participants.

Regardless of the truth behind these speculations, it is safe to say that the Fed’s communication during this period was confusing. The unexpected 50 bps when cut highlighted the disconnect between official statements and market expectations. Had Timiraos’ article not been published, the market’s reaction would likely have been even more dramatic.

Timiraos sparks limited market reaction

Market expectations for Fed cuts were already high before the article was published, with more than eight cuts priced in by mid 2025. As such, the US rates market reaction was somewhat muted as the pricing only increased slightly to nine cuts. The article had a more pronounced effect on FX and other markets, including gold and equities. The USD index sold off almost 2% in the days following the article, reaching the lowest level in over a year and testing very long-term support around 100.00, which extends back 5 years from a technical perspective (not pictured).

The Fed’s supportive dot plot at the FOMC meeting saw interest rate pricing and the USD fail to extend these moves after the event, and both traded fairly level into the end of September.

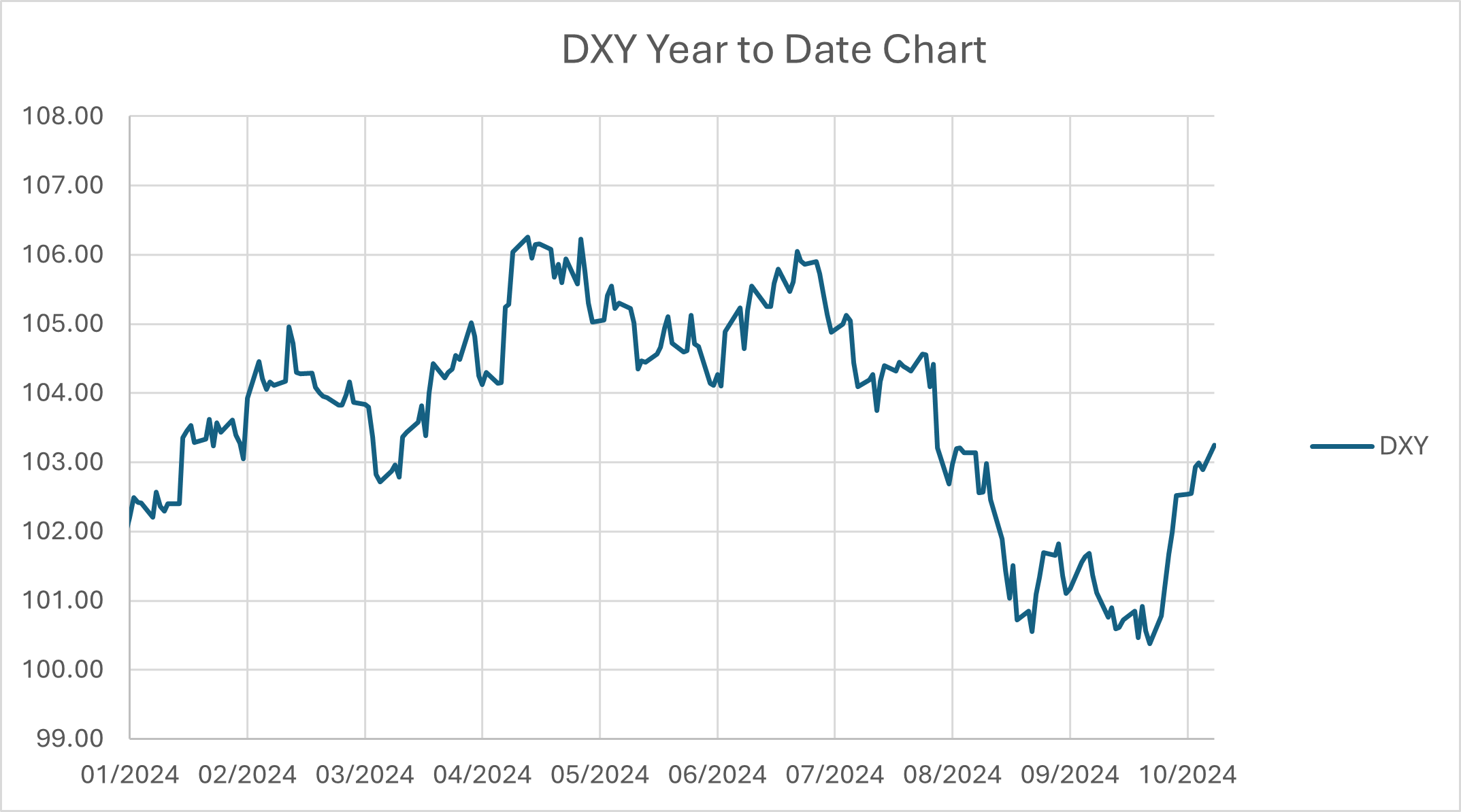

Chart 1: Market caught wrong footed as October data surprises

Source: Bloomberg

In October, it has been a different story. The Fed has always stressed data dependence, and the October data has been hawkish. The surprise upside in the Non-Farm Payroll report on October 4th and subsequent CPI data have led to a significant repricing of US yields and a strengthening of the USD. As a result, two cuts by mid-2025 have been priced out of the yield curve, and the USD has rallied 3% off the lows. The question facing markets is: will these moves continue?

Despite the excitement, these risks were on the radar. Our core views on the market are unchanged – our analysis suggests that the market is still likely underpricing the risk of higher US yields.

Market Psychology – the risk of anchoring bias

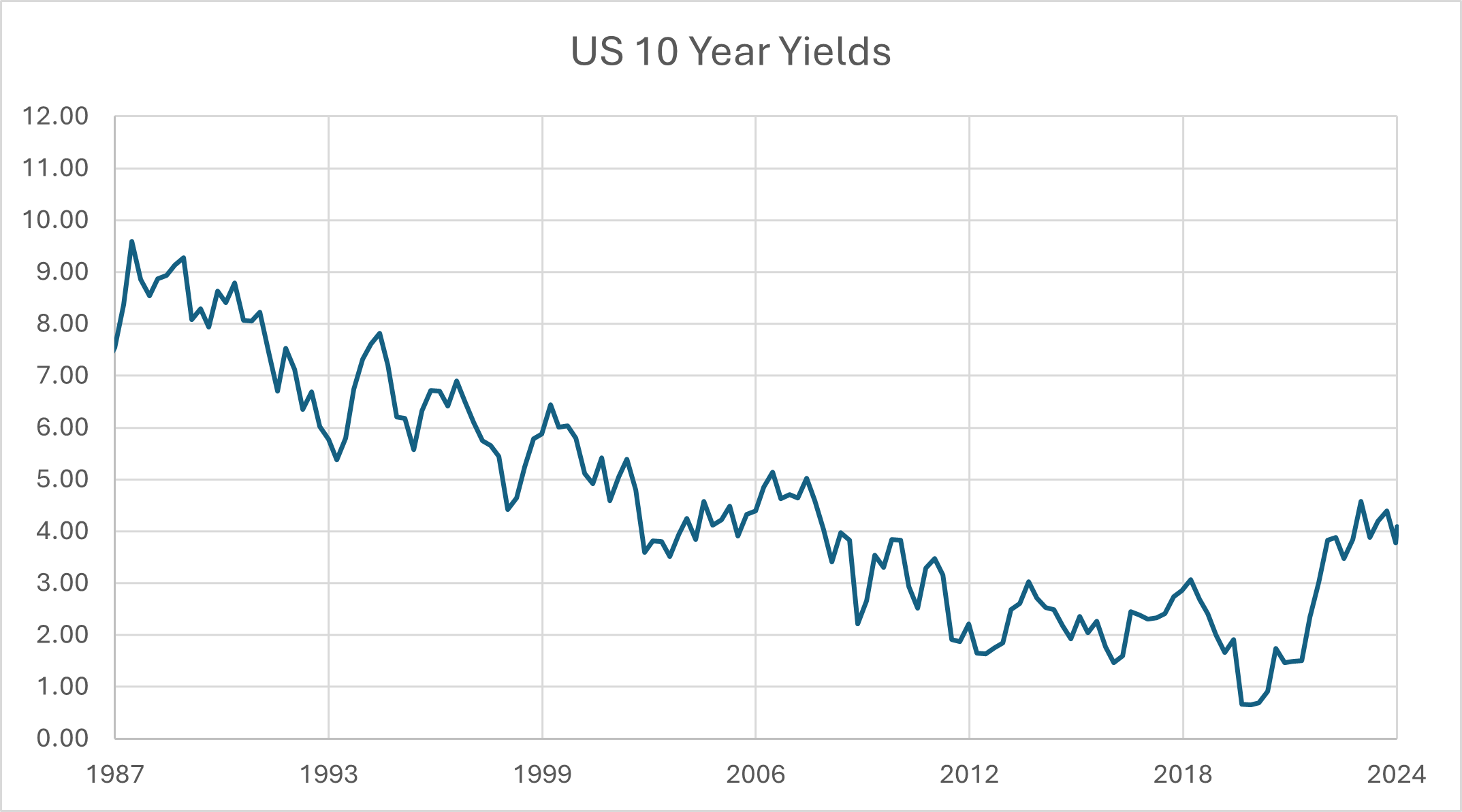

We have flagged in the past most market participants have only seen US yields fall over the last 30+ years, and there is a material risk that trend has broken in 2022. Yet, there may be a cognitive bias towards predicting lower US yields, and overpricing FOMC rate cuts, due to past experiences. This could lead the market to overestimate the number of rate cuts the Fed will implement. The Fed’s communication challenges may further exacerbate this bias.

Chart 2: US 10-Year Yields

Source: Bloomberg

US economy is healthier than portrayed, but inflation risks remain

In addition, the US economy seems to be running stronger than expected, with many participants continuing to overestimate the risk of recession, despite a backdrop of solid GDP growth. While inflation has been improving, several factors could hinder its return to target:

- Geopolitical tensions: Escalating international conflicts could fuel inflation.

- Uncertainty about the neutral rate: The Fed’s difficulty in determining the neutral rate and the true degree of restrictiveness in current policy creates uncertainty.

- Political risks: The upcoming US election, with candidates from opposing parties – we have written about both the Democratic and Republican candidates – introduces the risk of stoking inflationary pressures and a lack of fiscal restraint.

These factors suggest a term premium should be priced into the back end of the US yield curve. Recent gains in gold and stock markets may reflect this increased risk perception.

Market outlook: rising yields and potential Fed challenges

We believe the risks are skewed towards a rise in US yields and a Fed that may struggle to deliver on prevailing market pricing for interest rate cuts. Clients with floating rate liabilities should consider still attractive entry points on protective strategies.

As for the USD? It will depend on the credibility of the Fed and the reaction function. If these inflationary risks were to come to pass, would the Fed reverse course, abandon its single focus on the employment side of the dual mandate, refrain from cutting rates, and show an inclination to tackle inflation again? That would introduce risks of an extension of the USD rally of the past two weeks. If, on the other hand, the Fed does not have a credible response, either through lack of internal conviction or continued poor communication, then a tail risk lower for the USD begins to emerge. We have previously highlighted the risks to USD valuation if Donald Trump wins the election and interferes with Fed independence, but we have not tested the risk they do it to themselves. Clients are well advised to pay close attention to the evolution of what has become a clouded communication program from the FOMC.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.