Japan’s Leadership Battle: Implications for the Global FX Markets and the Yen’s Future

18 September 2024

Dealmaking and volatility are on the rise, PE firms must manage risks to seize opportunity

1 October 2024INSIGHTS • 25 SEPTEMBER 2024

The tale of two central banks – a new dynamic with UK and US rates

Marc Coglitatti, Head of Capital Markets - EMEA

Twenty-five or fifty? That was the debate going into last week’s Fed meeting. Most analysts polled by Bloomberg were anticipating a 25bps cut, while the futures market was pricing a 69% probability for a more aggressive 50bps cut. This level of doubt is unprecedented in an era of forward guidance – you have to go back more than 15 years to find a meeting where there was less certainty over the outcome.

Unsurprisingly, the Fed’s decision to take the more aggressive route and cut by 50bps sent ripples through both rates and FX markets. Three-year yields immediately dropped 9bps, and the euro rallied 60 pips against the dollar. However, these market movements were short-lived – both yields and the euro quickly returned to near pre-announcement levels.

A few points to consider:

- Unchanged rate outlook: Despite the unexpected 50bps cut, the overall outlook for rates hasn’t changed dramatically. Year-end rate expectations have remained relatively stable, dropping slightly from ~4.22% to ~4.15%. While the market initially anticipated a more aggressive rate cut profile, the current consensus is now for two 25bps cuts in November and December.

- Short-term cuts to alleviate long-term pressure: The Fed’s rationale for the more aggressive short-term cut is to potentially alleviate the need for continued cuts longer term. Market expectations for rates in July 2025 have remained relatively unchanged, suggesting that investors believe the current cuts are sufficient.

- Concerns about overly aggressive market expectations: We believe the market’s expectations for rate cuts are overly aggressive and see a risk that the Fed fails to deliver. Powell’s statement after the meeting was less dovish than anticipated, framing the decision as a “recalibration” and stating that “there is no sense that the committee is in a rush.” Despite concerns about the labour market, the economy continues to demonstrate strength – economic growth remains strong (7 out the last 8 quarters have seen annualised growth above 2%) – and inflation could still prove stickier than expected.

The Bank of England also met last week and as expected, maintained rates at 5.00%. The market was pricing just a ~15% chance of a 25bps cut (noting that they began their cutting cycle with a quarter point cut in August). Looking ahead, market expectations are for another cut at the November meeting, followed by four more cuts over the five subsequent meetings. This would bring rates down to 3.75% by June.

A few more thoughts on this:

- Pace of cuts remains uncertain: Bank of England Governor Bailey cautioned against cutting rates too quickly or aggressively, although he acknowledged the BoE “should be able to cut rates gradually over time.” Meanwhile, the committee voted to reduce its gilts holdings by a further £100 billion over the next year, maintaining the same pace as the previous twelve months). This suggests that while looser policy expected, the pace of rate cuts remains uncertain.

- Risks of slower cuts: As previously highlighted, we continue to see risks that the BoE fails to ease as quickly as the market is expecting. Despite headline inflation approaching the 2% target, core inflation and services inflation remain elevated. With average earnings still hovering around 4% and the unions still putting pressure on the new government for higher wages, inflation may not decline as rapidly as in other economies.

- Sterling rally and outlook: Following the announcement, sterling rallied and now sits at its highest level against both the dollar and the euro in almost 2.5 years. Given recent momentum, there is potential for further gains in sterling in the months ahead. We therefore maintain our bullish forecast.

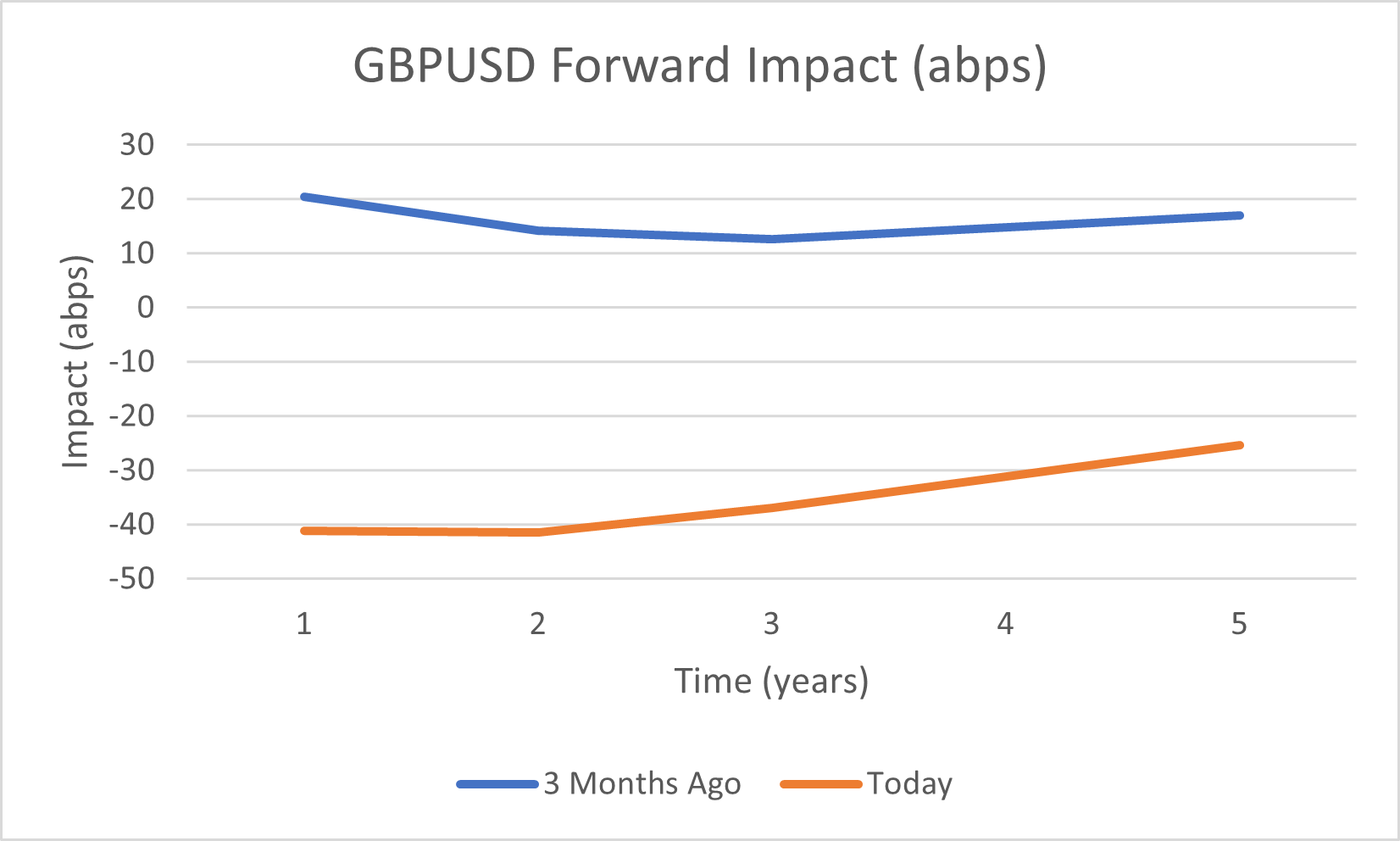

One final consideration – following the Fed’s decision to cut by 50bps and the BoE’s decision to maintain rates, UK rates are now higher than US rates all the way down the curve. From an FX hedging perspective, this means the pickup that USD denominated funds previously incurred when hedging GBP assets has now flipped to being a cost. The differential is relatively linear out to two years (around -41 annaulised basis points) before narrowing slightly (see chart below comparing the forward curve today vs 3 months ago).

Chart 1: GBPUSD Forward Impact

Source: Validus Risk Management