Fall of Uncertainty: Navigating Economic and Political Risks Ahead

11 September 2024

The tale of two central banks – a new dynamic with UK and US rates

25 September 2024INSIGHT • 18 SEPTEMBER 2024

Japan’s Leadership Battle: Implications for the Global FX Markets and the Yen’s Future

Harun Thilak, Global Capital Markets, Senior Associate

The Liberal Democratic Party (LDP), which has been in power in Japan since 2012, is set to elect its new leader on September 27th. Fumio Kishida, the current Prime Minister and LDP party head, has announced that he will not participate in the leadership contest. The vote, limited to LDP party members and lawmakers, will determine the next party leader, who will serve a three-year term. The new leader is likely to call a general election to seek a mandate for their government, following the precedent set by Kishida in 2021, as the LDP enjoys a comfortable majority in Japan’s House of Representatives.

This leadership change comes at a critical juncture in the Japanese economic landscape, as the Bank of Japan, traditionally one of the most dovish central banks globally, has raised interest rates twice already this year in response to persistently rising domestic inflation. Assessing the monetary policy positions of the leading contenders in this leadership race will be crucial in determining the course for the Japanese Yen and its impact on broader FX markets.

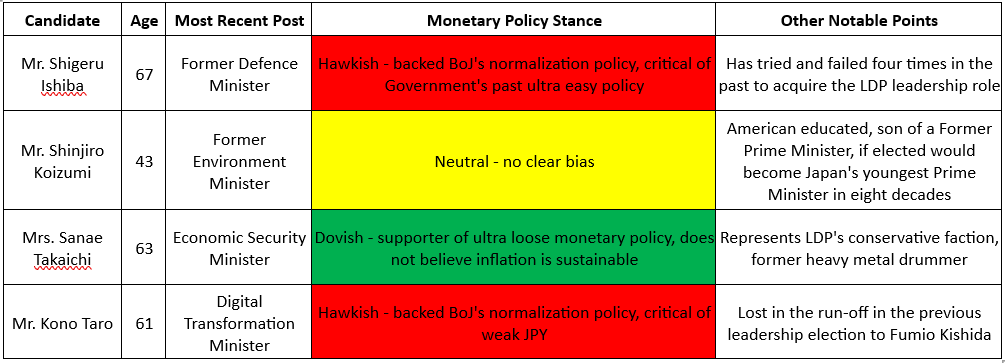

Key Leadership Candidates: A Monetary Policy Analysis

Although nine candidates are officially competing in the upcoming LDP leadership election, most Japanese political experts agree that the race is likely to come down to four primary contenders. Ranked in descending order of popularity, according to local opinion polls, these candidates are:

The Yen’s Fate: Hinged on Japan’s Next Leader

As previously mentioned, Japan’s financial markets are at a critical juncture. Persistent inflation, which has been rising since the COVID-19 period, prompted the BoJ to implement its first rate hike since 2006.

Chart 1: Japan CPI (YoY) vs BoJ Policy Rate

Source: Bloomberg

JPY weakened by approximately 57% against USD from 2021 until July 2024. However, a combination of factors – including a surprise rate hike by the BoJ, intervention in the USDJPY FX market by Japan’s Ministry of Finance, and a dovish stance from the US Fed – provided some relief for the pair. As a result, the yen has retraced back by about 12% to the current level in the 140 handle.

Chart 2: USDJPY Spot FX

Source: Bloomberg

With recent rhetoric from the BoJ indicating a continued commitment to policy rate normalization, and widespread market expectations that the US Fed will embark on its rate cutting cycle starting this week, the divergent US-Japan rate policies are likely to keep the USDJPY under pressure as we approach year-end. Given the differing monetary policy stances of the leading LDP leadership candidates, the outcome of Japan’s leadership race becomes critical – who will take the realm of power in the Japanese government? Their stance on monetary policy will influence whether they support or oppose the BoJ’s current path.

Historically, long USDJPY has been a favored FX carry trade amongst investors, who have capitalized on the substantial US-Japan interest rate differential. If the current BoJ policy normalization is upheld by the next Japanese Prime Minster, US-Japan market interest rates may begin to tighten more rapidly, potentially accelerating the recent downtrend in USDJPY. This could lead to further unwinding of long USDJPY carry positions. The related shock to the portfolio among investors could lead to forced unwinds of other FX carry trades, creating a dislocation in currency markets, in the context of heightened political uncertainty with the closely contested US elections approaching. Japan’s upcoming leadership election could be the first major event of a packed Fall political calendar, and its outcome could significantly impact the Japanese Yen and broader FX markets.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.