Market Overreaction or Necessary Adjustment? What’s Next for the Fed?

28 August 2024

Fall of Uncertainty: Navigating Economic and Political Risks Ahead

11 September 2024INSIGHTS • 4 SEPTEMBER 2024

What are the economic implications of a Kamala Harris presidency?

Ryan Brandham, Head of Global Capital Markets, North America

Earlier in July, we took a look at the potential market implications of a Trump presidency. Since then, Kamala Harris has secured the DNC nomination and pulled slightly ahead in most polls. Therefore, it’s worth us taking a closer look at the potential market implications of a Harris presidency.

What is Harris’ economic platform?

During Harris’ CNN interview, she spoke positively about Bidenomics. Bidenomics essentially focuses on three core pillars: infrastructure investments, educating and empowering the middle class, and promoting competition to lower costs. These tenets seem, at first glance, market friendly. In addition to Bidenomics, Harris has vowed to create an “Opportunity Economy” with some of the following proposals:

- Federal Ban on price gouging for food

- $25k in down payment assistance for millions of first-time home buyers, as well as tax credits for builders of starter homes

- Preventing landlord collusion on rental properties

- $6k Child Tax Credit

- Tax cuts for middle class, tax hikes for high earners and corporations

- No tax on tips

- Caps on prescription drug prices

- Cancelling medical debt

- Raising the minimum wage

- Commitment to Federal Reserve independence

How might this impact markets?

A significant departure from Bidenomics, which focused on competition to bring down prices, is the suggestion of price controls on food. Price controls can cause issues such as shortages of supply, black markets, lower quality products, and a reduction in research and development. All of these factors could make US food markets less competitive over the longer term and are potentially USD negative.

While, as with Trump, there is a mix of inflationary and deflationary policies in Harris’ economic platform, and many ultimately come down to the details on how they’re paid for, some proposals are worryingly inflationary. Giving out cash for homebuyer assistance would run the risk of supporting or driving higher already expensive house prices, for example. Cancelling medical debt for a large number of Americans, assuming this is done by the government buying up and cancelling debts, is another potentially inflationary program. Raising the minimum wage, no matter how one feels about it from a fairness or social justification perspective, raises costs for businesses and raises incomes for consumers, both of which would risk creating inflationary pressures.

Beyond inflation, several of these policies also raise concerns about driving US deficits, and the US national debt, ever higher. And we already know it is currently on an unsustainable path.

Both the inflation and deficit concerns are similar to the risks we flagged previously for Trump’s policies, even if they are for very different reasons. However, one big difference needs to be highlighted – the commitment to Federal Reserve independence. Unlike Trump, who reportedly may seek presidential control over interest rates, Harris has said she will never interfere in Federal Reserve decisions. This removes a key USD negative tail risk that we had flagged with a Trump presidency – if Harris’ policies do turn out to be inflationary, the Federal Reserve will be free to raise (or not cut) interest rates as necessary in response, which would support the USD valuation and put upward pressure on US yields.

Putting it all together

Overall, Trump’s policies would appear to be very inflationary and very pro-business, which by default would be very USD and US yield positive, with a big tail risk that could interfere with central bank independence a pursue a weak USD policy which in tandem could have dire implications on the value of the USD. There are also serious US deficit / US debt concerns with his agenda.

Harris, on the other hand, could be inflationary, is arguably less business friendly, less free market, but committed to Federal Reserve independence. If inflationary forces were stoked by her policies, the Fed would be free to react accordingly which would be USD positive in that scenario. On the other hand, the USD Smile Theory says that if the US economy significantly outperforms or underperforms globally, the USD will strengthen, but if the US plods along, globally the USD will weaken. It seems likely that the type of slower economic growth Harris’ platform would enable could land in the middle of the US Dollar smile, which would be USD negative. So perhaps Harris is a mixed bag for USD valuation. There are also serious US deficit / US debt concerns with her agenda too.

One risk that investors should monitor

However, there is one additional risk that investors should definitely monitor. The Federal Reserve recently announced at Jackson Hole that “the time has come for policy to adjust” and “the direction of travel is clear”, signaling that they will start cutting interest rates in September and focusing more on the softening US labour market than the fight against inflation.

Yet, consider the following factors:

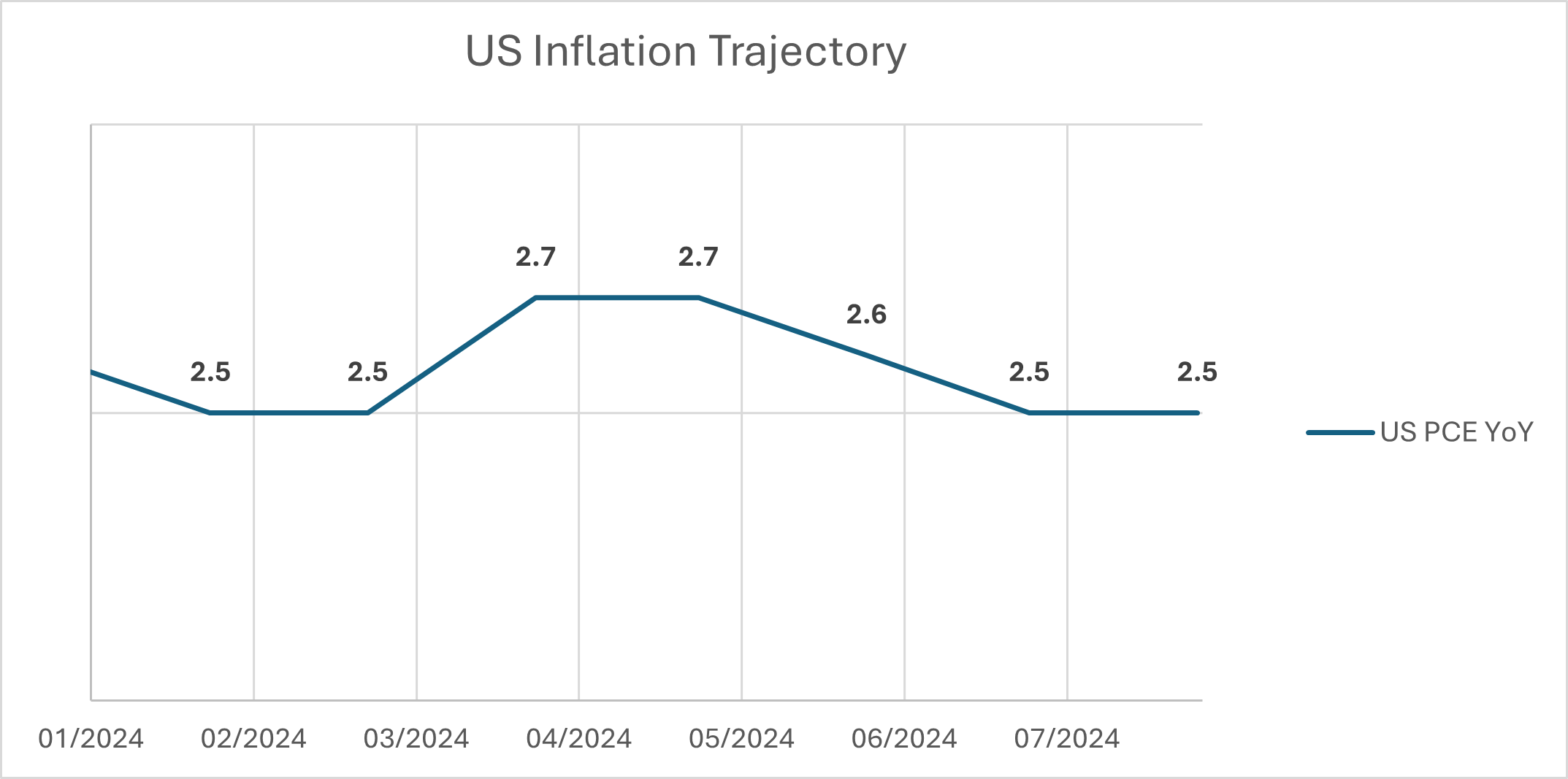

Although progress has clearly been made in the fight against inflation, PCE (the Fed’s preferred inflation measure) is still printing well above the 2% target and has made no YoY progress in 2024…does the chart below suggest that the last mile to 2.0% is a foregone conclusion, even if the Fed maintained the current stance of monetary policy?

Chart 1: US Inflation Trajectory

Source: Bloomberg

The Fed is about to start a rate cutting cycle, albeit one where the pace will be data driven. Meanwhile, both presidential candidates seem to offer risks that they could reignite inflationary forces with their policies and neither candidate seems likely to improve US deficits or do anything to alter the concerning trajectory of the US national debt – which would argue for the return of a term premium and a steepening of the US yield curve.

Against this backdrop, US rates markets have 8 cuts (or 2.00%) priced in by mid-2025 – right when the winning candidate will be implementing their new set of policy proposals. At the beginning of 2024, US rates markets had far too many interest rate cuts priced in, and the USD rallied smartly as they were priced out of the curve in the spring. If either winner of the election could spark inflationary pressures, are the risks skewed, yet again, towards the Fed being unable to deliver the cuts implied by market pricing?

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.