Bipartisan markets also hold risks

25 July 2024

Bank of England’s Balancing Act: Rates, Growth and Inflation

7 August 2024INSIGHTS • 31 JULY 2024

Low FX vols – exploring the opportunities

Ryan Brandham, Head of Global Capital Markets, North America

Last week we highlighted the low level of implied risks priced into several different asset classes in the current market environment, and explored how this might present some fragilities should an unexpected shock occur and cause volatility or panic in the markets – as any veteran trader knows, it has happened before!

This week, let’s take a closer look at FX vol across different currency pairs to identify potential trading opportunities. Several approaches can be employed to assess the opportunity presented by market pricing of FX volatility.

One method compares “implied vols” – the actively traded, market based volatility input into options valuation formulas that determine the premiums the market charges participants to buy options – to historical (realized) volatility in spot during the previous period. Another involves calculating the “breakevens” implied by the current level of implied vols – how far does spot have to move to break even on the purchase of an at-the-money straddle? This can also be thought of as the predicted range in spot, implied by vol market pricing. Finally, charting implied vols historical trajectory can reveal potential areas of support/resistance.

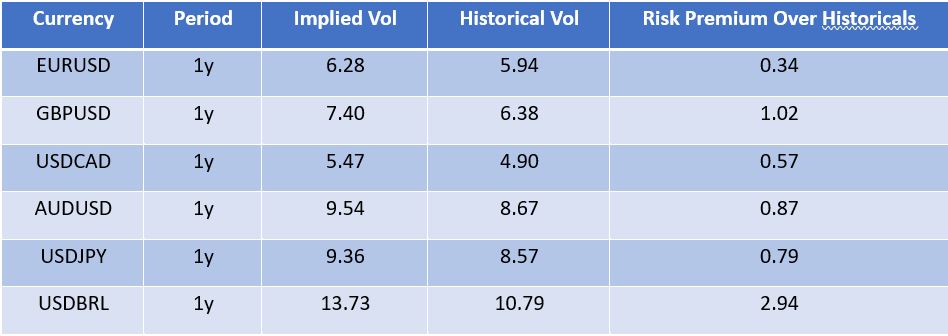

Chart 1: Comparing Implied Vols to Historicals

Source: Bloomberg

Summer 2024 hasn’t been completely quiet, but volatility has subsided compared to the frantic rate cut speculation of late 2023 and early 2024, when the market rushed to price in six US interest rate cuts for 2024 and then priced them right back out again. However, this quieter time has not lulled the options market completely to sleep. All 1-year implied vols carry a risk premium over the preceding 1-year realized FX volatility.

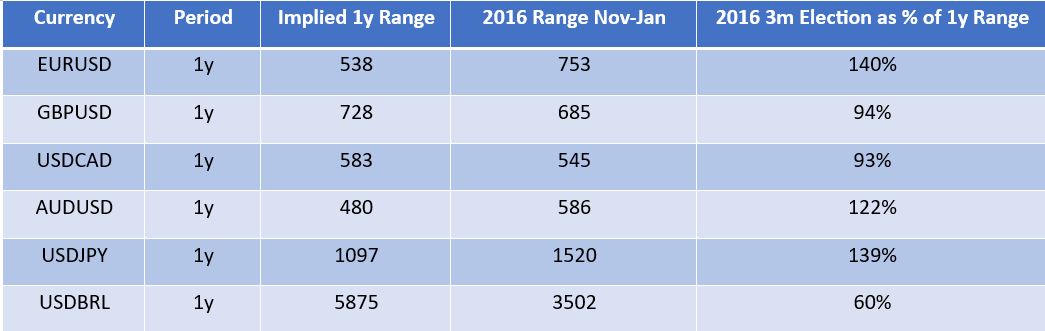

Chart 2: Comparing Implied Ranges to Recent Election Period Ranges

Source: Bloomberg

With the looming US election, let’s compare the current implied 1-year ranges to the ranges realized in the three months after the last two elections.

Other than USDBRL, all other currency pairs would approach or surpass their current 1y breakeven ranges if the 3m post election spot moves are as volatile as they were following Donald Trump’s unexpected victory in 2016. While it’s unlikely that this November’s election will produce the same level of surprise, the forecast does resemble a mirror image of the 2016 election. Donald Trump is the presumed favourite, more than three months out. If his lead holds up to election night, a Democratic upset could be just as shocking as Trump’s victory was in 2016.

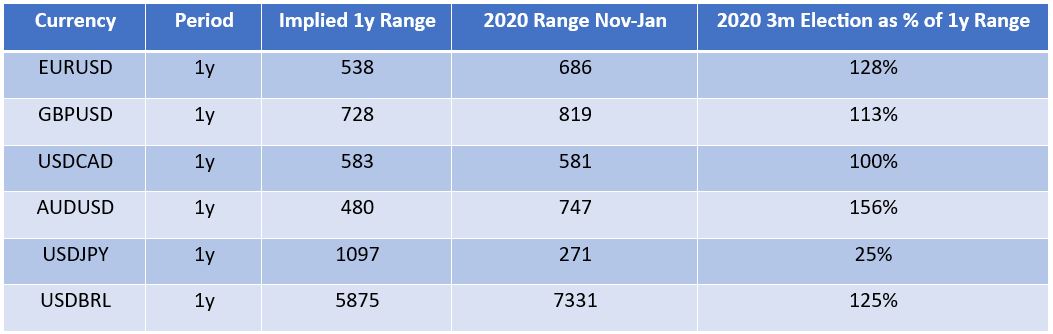

Chart 3: Comparing Implied Ranges to Recent Election Period Ranges

Source: Bloomberg

Even in 2020, the market moves over the three months following election night would easily break even on the current 1-year implied ranges by most of the currency pairs analyzed. USDBRL, in particular, highlights this opportunity. This is a compelling demonstration of value offered by current market pricing. It’s important to remember that these implied ranges are for non-directional straddles – for clients hedging a single direction, the spot moves required to break even are approximately half.

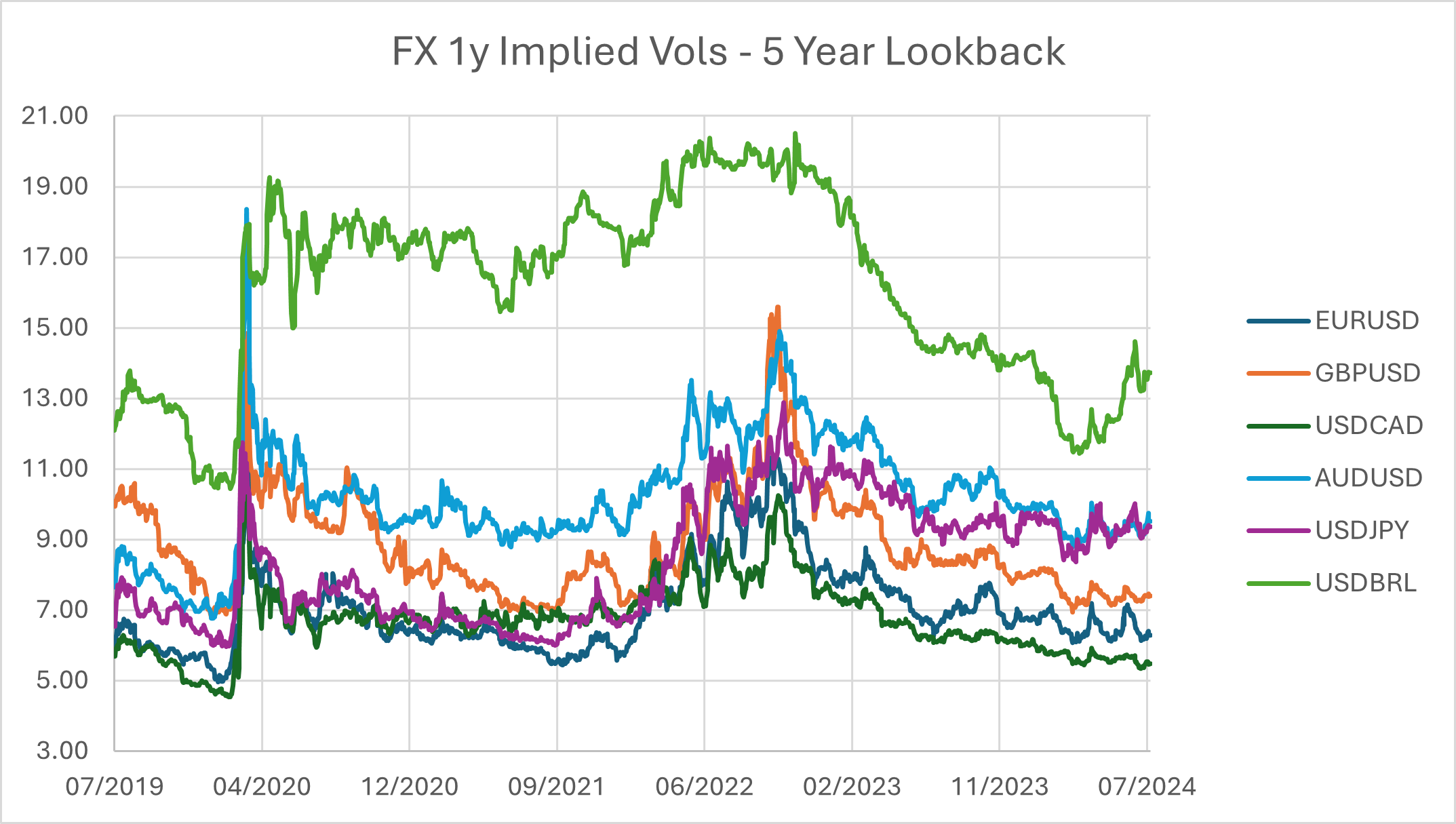

Chart 4: 5-year LookBack at Implied Vol Levels

Source: Bloomberg

Over the past five years, USDCAD, EURUSD, GBPUSD, and AUDUSD are trading near their lowest levels, with only the late 2019 period (where some all-time lows were tested) seeing comparable prices. This presents a rare opportunity to buy options at relatively low costs.

In contrast, USDBRL and USDJPY have experienced recent bouts of volatile spot movement, driving up the price of vol to where it is less compelling than the others.

Thoughts and Conclusions

There appears to be a strong market opportunity, by various measures, to utilize options for EURUSD, AUDUSD, GBPUSD, and USDCAD hedgers. Vols are demonstrably cheap despite a myriad of potential market disruptions – including the US election / political turmoil, potential trade conflict with China (and others), Russia/Ukraine conflict, Israel/Gaza conflict, different inflation, employment, and growth outlooks globally that are causing central banks to normalize interest rate policy at different paces, the risk of a more substantial correction lower in equities, among others. And of course, the unknown unknown – the most dangerous of market risks.

Risk managers could implement protective put strategies or explore more complex option-based approaches, including advanced multileg strategies that entail the net purchase of cheap FX vol – long vol strategies all generally retain some upside potential for clients. This relatively short analysis can be expanded to capture opportunities presented by skew, or vol term structure in certain pairs as well. Combining cheap outright vol with a favorable skew and even positive carry can result in very attractive risk reward opportunities for hedgers.

While options can introduce margin requirements, the potential benefits can outweigh the costs. There are also strategic implications around introducing options as a hedge for new risk vs rolling an existing forward hedge into an option exposure.

There are many factors to consider when weighing the benefits and costs of pursuing this market opportunity and we would be happy to talk these through with our clients.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.