Iran-Israel tensions: are markets under-pricing escalation risk?

17 April 2024

Decoding the BoJ: what might Mr. Governor be thinking

30 April 2024RISK INSIGHT • 24 April 2024

Geopolitical Heat Up – What’s the Impact on Rates?

Louis Sangan, Senior Associate, Global Capital Markets

After Iran's unprecedented attack on Israel, everyone wondered: "what happens next?". We saw a glimpse of this, as Israel’s retaliated with limited strikes on Isfahan province in central Iran, where a significant amount of military and nuclear infrastructure sits. The response, despite pressure from Western leaders to "take the win" after a limited number of Iranian projectiles made it through Israeli air defences, was however on the lower end of what markets considered escalatory, with no evidence that nuclear facilities had been directly targeted. The Iranians downplayed the damage and seemingly indicated no further retaliation.

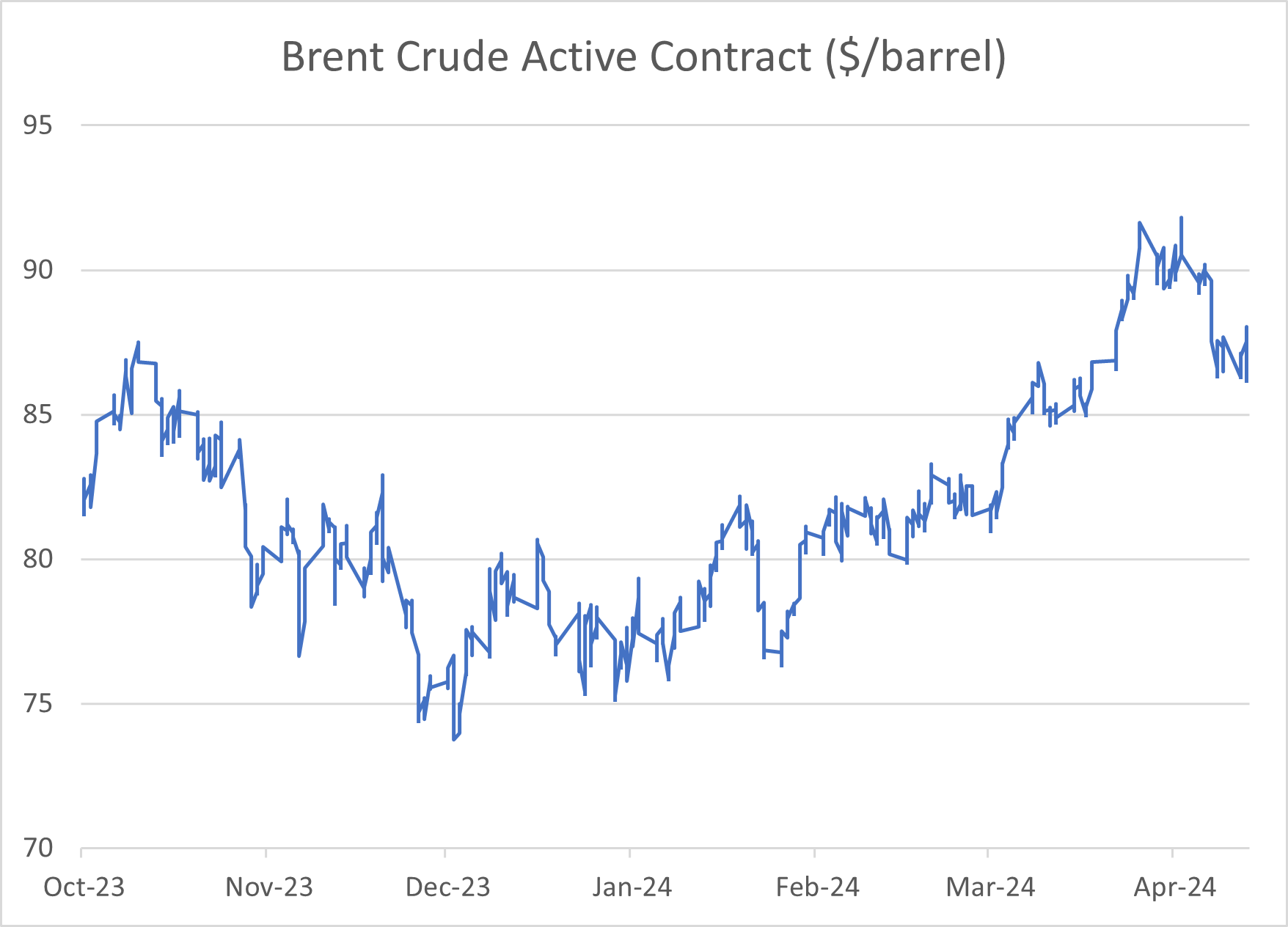

Markets quickly reversed any risk-off jumps seen on Friday morning, with Brent crude retracing to the level it started at the day before. However, whilst immediate tension may have subsided, as reflected in market pricing, the starting point for any escalation in the Middle East between Israel and Iran is now in a new paradigm, with both countries having struck each other's sovereign soil directly. As a result, any future boiling-over risks becoming more serious more quickly - tail risks are higher.

Chart 1: Brent crude active contract ($/ barrel)

Source: Bloomberg

As we have previously discussed here, rising geopolitical tensions can push interest rates in opposite directions. Rates could fall – an escalation may disrupt supply chains and economic activity, prompting central banks to lower rates to support employment and growth (notably the former being more important). However, rates could also rise – the impact of elevated energy prices feeds through to both headline inflation and core inflation (indirectly through higher food and transport costs for other goods and services).

There are two key points to consider here:

- Firstly, the world, especially the US, is less vulnerable to disruptions in Middle East compared to the 1970s – thanks to the US shale revolution, the US is now a net exporter of crude oil. Whilst a Strait of Hormuz closure would limit global oil supply, and US shale producers wouldn’t be able to fully compensate for the loss, the impact on oil markets and inflation likely wouldn’t be as severe as it was 50 years ago. The impact, however, would likely be different for the US vs. Europe - stemming from crude supply capabilities as well as increasing European reliance on liquified natural gas (LNG) with Qatar, a major exporter, reliant on the Strait of Hormuz - particularly as Europe pivots from Russian LNG supply.

- Secondly, the ECB and the Fed are primarily focused on price stability. The ECB is less likely to cut rates in response to geopolitical tensions compared to the Fed, as its primary concern is preventing inflation caused by higher energy prices.

Differing exposures perhaps explains the difference in some of the rhetoric between the Fed and the ECB. Both are data focused, especially on inflation prints, but ECB members have indicated that the June cut is at greater risk from geopolitical events.

However, the glaring conclusion from central bank rhetoric, despite geopolitical "noise", is one of divergence.

- The Fed: Originally expected to cut rates six times this year, it has changed course and now only one or two cuts are anticipated, with June unlikely to be the starting point.

- The ECB: In contrast, a rate cut in June seems almost certain, in the absence of aforementioned shocks, and the market is expecting a continuation of easing throughout the year.

The ECB’s willingness to diverge from the Fed is causing stir in the currency market, putting pressure on EURUSD, especially after US CPI printed strong for March on April 10th. A USD c. 2% stronger vs. the EUR could push up imported inflationary pressures in the Eurozone, even though the currency effect is more muted across the trade weighted basket of EU currencies.

A continued divergence and further EURUSD depreciation, whilst unlikely to change the ECB’s decision for June, may have an impact on the path of European rates later in the year, should it persist. As ECB speaker Rehn remarked, the ECB doesn’t make its decisions "in a vacuum" and whilst there is no particular EURUSD target, it does factor into policymaking.

This leads us to believe there is scope for less than the 3.1 ECB cuts currently priced by the end of the year, and it wouldn’t be an unfamiliar story. In the absence of accelerating disinflation, it would be an easy pivot for central bankers who can’t risk easing too early and seeing inflation return, especially with some green shoots in European economic activity following better than expected German PMIs this week. Coupled with greater inflationary risk to the Eurozone from a poised Middle East, now could be an interesting time for EUR interest rate hedgers to take advantage of a forward curve that prices in cuts later in the year too fast.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.