Will the UK Government make the same mistake again?

6 March 2024

Where Next for EUR Rates?

13 March 2024RISK INSIGHT • 11 MARCH 2024

What’s in store for the US Dollar under Trump?

Philippe Miller, Senior Associate, Global Capital Markets

With Super Tuesday behind us, and Nikki Haley officially suspending her campaign, Trump and Biden are now set for a rematch in the 2024 US elections in November. Looking at the latest odds and polls, Trump seems to be the clear favourite to win the Presidential race.

What will a second Trump term look like? On the surface, his policies appear more populist and nationalist than in 2016. Key proposals include adding a 10% tariff on all imports coming into the US, adopting a 4-year plan to fully phase out all Chinese imports of essential goods, and stopping the flow of illegal immigrants into the US. His Trump Reciprocal Trade act, which would not allow the transfer of American jobs overseas, is also on the agenda. Other policies include cutting corporate tax from 21% to 15%, seeking a record defense spending budget and removing the US from international conflicts.

These are just a few of the policies he intends on pushing through should he become President. A lot will depend on how the Senate and Congress are split. Support will be required from the Democratic party on certain policies such as trade – since they are not purely budgetary, they will require 60 votes from the Senate to go through (implying a need for Democratic backing). Under a second term with Trump, everything points to more spending from his administration with less revenues raised from taxes, likely to result in a widening debt deficit in the US (not counting for potential offsets from additional revenues from tariffs, should they be implemented).

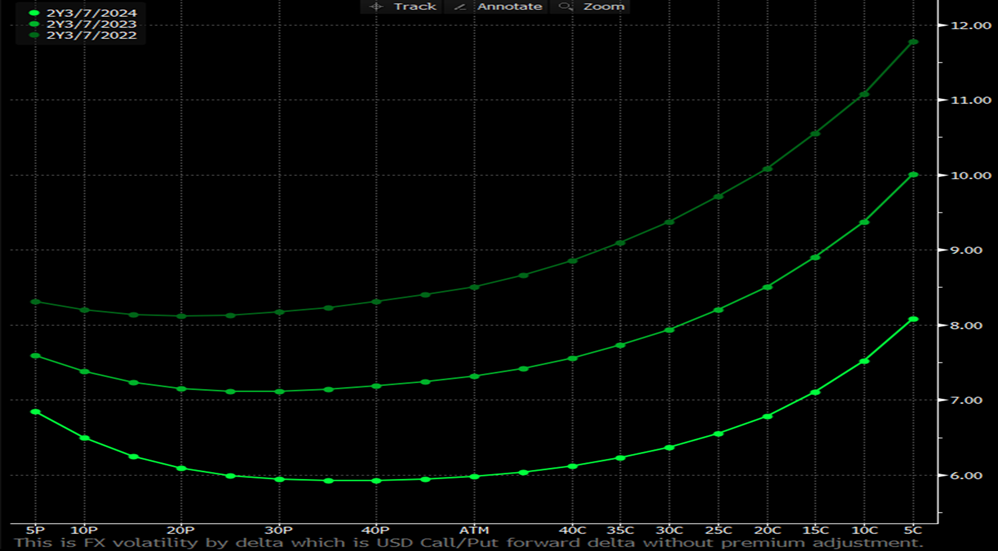

Trump’s agenda poses certain risks to financial markets. Over the short to medium-term, there is a possibility of seeing weakness in countries such as Mexico, China and Canada, which are important trade partners to the US. With Canada’s economy stagnating over the last quarters, additional 10% tariffs from a possible Trump administration could hurt the Loonie. As seen below, the current volatility smile on 2-year USDCAD options has shifted lower versus levels observed over the last couple of years. The current ATM USD call option trades around a mid of 5.98%, close to 30% lower than in March 2022. We see a potential opportunity there, with volatility to increase over the next 2 years under a Trump administration. The same trade idea is valid when looking at USDCNY options, although the pair does not move like USDCAD given it is not a completely free-float currency.

Chart 1: USDCAD vols have fallen steadily over the past two years, presenting a potential opportunity to hedgers exposed to USDCAD volatility

Source: Bloomberg

Over a longer-term horizon, the risks are greater to the downside for the Greenback. With Trump’s plans to increase the debt deficit to fund his agenda, market participants could lose confidence in the USD and its status as global reserve currency. More debt spending is no doubt bearish for the USD, which would need to be offset by higher yields to convince investors to continue buying US Treasuries. While higher rates often lead to a stronger currency, there is a limit to this thinking, as seen in spectacular fashion in the UK in September 2022, largely driven by an ill-thought-out budget. If this were to happen, where would money flow instead of towards the USD?

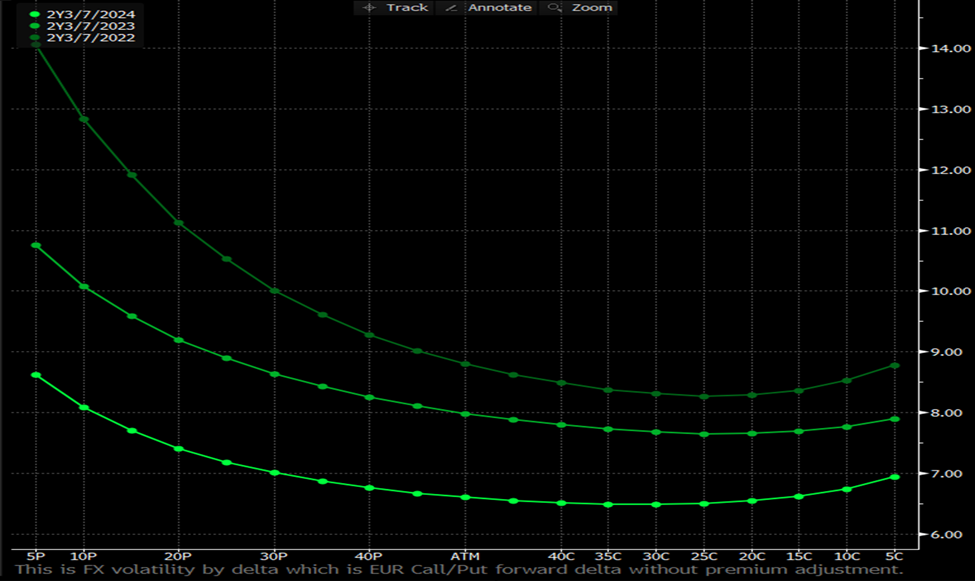

Like CAD, EUR options are trading at multi-year lows in volatility terms. If EUR were to see an increase in flows from the loss of confidence in the USD, the pair would benefit, making current 2-year ATM EUR call options attractive.

Chart 2: Low implied vols in EURUSD, and puts trading over calls, present an interesting opportunity for those concerned about a long-term decline in USD strength

Source: Bloomberg

There is still ample time between now and when the polls close on November 5th, 2024. One thing that is almost certain is that opportunities will continue to present themselves as markets go back and forth on the implications of a potential new, but well known, “most powerful man in the world.”

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.