The Canada/US (rate) Divergence

14 February 2024

To cut, to hike or to hold? 2024 rates outlook and implications for FX markets

29 February 2024INSIGHTS • 21 FEBRUARY 2024

The Case for Higher US yields

Ryan Brandham, Head of Global Capital Markets, North America

As risk advisors helping our clients to navigate the opportunities and perils of the Global FX and Interest Rate markets, we think probabilistically about the future paths the world may take, compare those paths to market pricing, and stay humble and flexible in our approach. Most economic forecasts and models (even the ones used by central banks) would be well served to consider a similar humble mindset: didn’t everyone think we would have a US recession by now?

In this note, we take a closer look at something we’ve been highlighting for a while, that has been ignored by markets to varying degrees but is starting to come to the fore – the risk that US yields could go higher. This may seem counterintuitive as markets are set on talking about rate cuts – and to be clear, we are not calling for rate hikes from the Fed – however, we believe it is just as important to highlight and discuss the risk that US market yields could go higher from present levels.

How did we get here?

For much of the final quarter of 2023, US inflation data improved while economic data remained strong, getting the market excited about the prospect of a soft landing. US yields headed south as the market rushed to price in 2024 rate cuts while inflation was moving back towards the Fed’s 2% target. By the end of the calendar year, the market was pricing in six interest rate cuts in the US for 2024. This was in contrast to the Fed Dot Plot, where the median forecast was for three cuts in 2024. We highlighted this in previous notes such as this one

.A different story in 2024

The strong economic data got even stronger at we entered the new year, with Non-Farm Payroll releases coming in well above expectations, Jobless Claims continuing a run of strong results and the first retail sales print on Jan 17th blowing away expectations to the upside. Perhaps most importantly, inflation releases came in above expectations and showed that both headline and core inflation may not be as cooperative on the final mile of the fight against inflation as they have been up until this point. This data, laid against the backdrop of a hawkish Fed Chair, Jerome Powell, pushing back on market pricing, caused US yields to perk up and the USD to rally as the market rushed to push back and price out rate cuts, at least through the March meeting and reducing the odds (from 100%!) for May and June.

The case for higher US yields

The heavily scrutinised US 10-year yield made a bottom in the final few days of 2023 around 3.78%, began 2024 at 3.92%, tested as low as 3.81%, and currently trades near 4.28% after a strong rise in the month of February driven by the factors mentioned above.

Notwithstanding the rally that has taken place, there are strong arguments for further appreciation. The US economy is still really strong, standing out from major global peers in terms of GDP growth, labour market strength, consumer spending resilience (until the most recent release), and strong wage growth. Plus, let’s face it, inflation is still above target. Yet everyone is salivating for rate cuts…Why is that? Calling for cuts simply to alleviate household budget stresses from accumulated inflation to date, which would feel like relief, introduces a dangerous risk of inflation perking up again before it even reaches the Fed’s target. Such a scenario would risk a feedback loop that could present a much more difficult inflation problem down the road.

So, what about the yield curve? There are several compelling reasons for US yields to go higher from here. For one, isn’t increased interest rate volatility (which we have certainly seen in the last two years, and doesn’t seem to be going anywhere) enough of a reason to justify a higher term premium in the US curve? Not to mention global geopolitical inflationary risks (Ukraine, the Middle East, the Red Sea, etc.), the risk of civil unrest as we approach the 2024 election, and the rapidly deteriorating US fiscal situation (which surely won’t get any better in an election year).

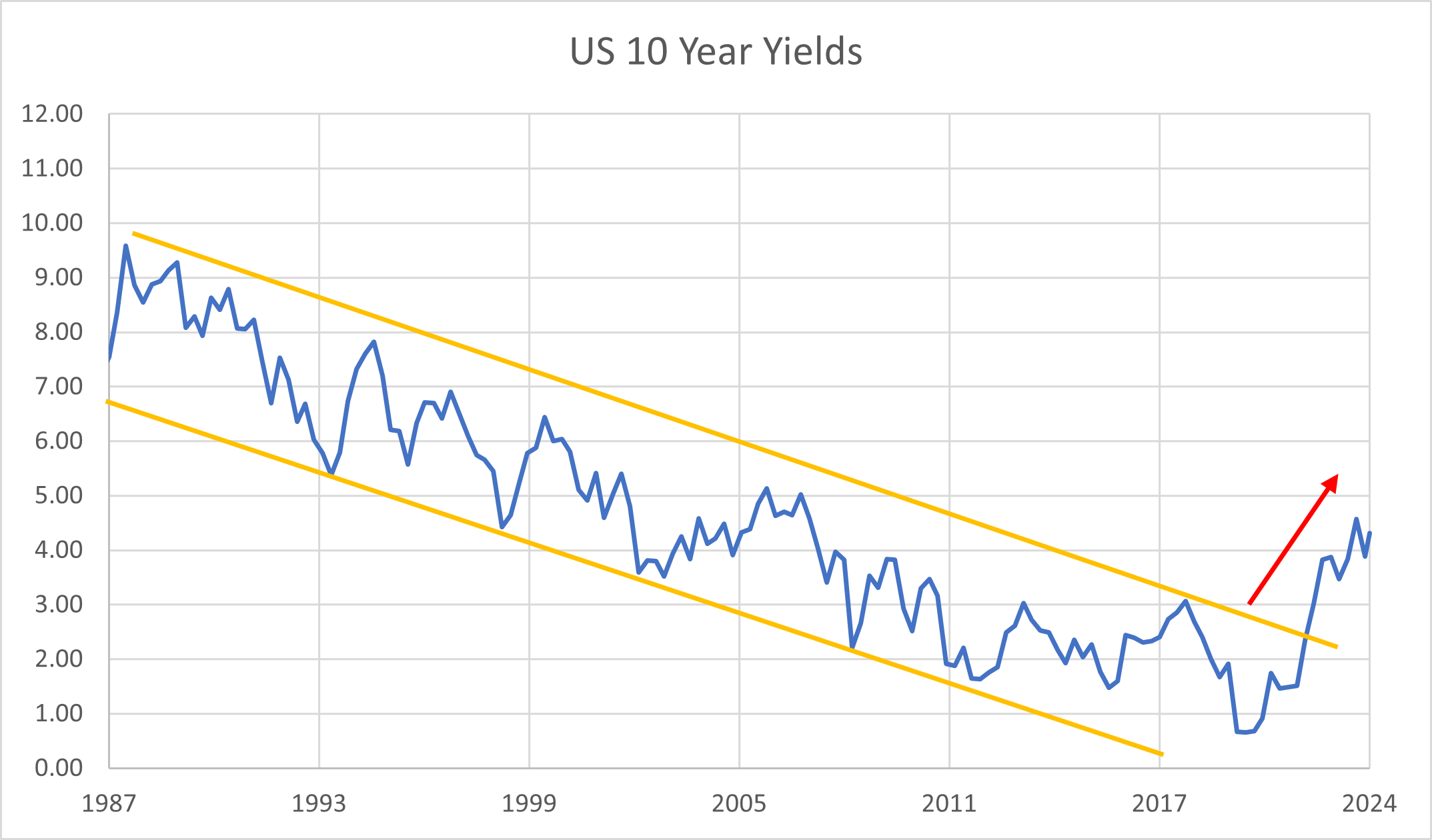

Overall, a strong case could be made that after a generation (30+ years) of falling US yields, and easier borrowing costs, market participants are emotionally not ready to process the risk of a steady grind higher in US yields, even though a generational shift may have already taken place in 2022, as pictured below.

Chart 1: US 10 Year Yields

Source: Bloomberg

Risks to this view

As with any view on the market, there are several counterpoints to consider. In this case, US retail sales figures released on February 15th were awful. Is this a one-off weak print or a turning point for the US consumer? US real rates are higher now than they have been for some time as inflation has receded from the highs and rates have not yet been cut. However, there is a lack of consensus on where exactly r* is. What if the true r* is higher than people think? Other disinflationary forces could pick up – examples include the commercial real estate sector, further economic weakness in China, or the recession that many have been calling for since the US yield curve inverted in late 2022 – as unlikely as that currently feels with US GDP tracking above 3% on an annualized basis.

At least in the short term, we have to recognise that the rise in US yields over the past few weeks is running up against the 100-day moving average resistance on many points on the curve, which could lead to a pullback in the short term, even if the overall longer-term path on US yields is heading up. Whatever the outcome, elevated interest rate volatility appears to be here for a while. While you may not be picking the bottom of the market from the beginning of 2024, risk managers with floating rate exposures would be well advised to consider interest rate cap and collar strategies that have been underpriced by the market over the past year.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.