The fight against inflation complicated by geopolitical tensions

12 February 2024

The Case for Higher US yields

21 February 2024RISK INSIGHT • 13 FEBRUARY 2024

The Canada/US (rate) Divergence

Kambiz Kazemi, Chief Investment Officer

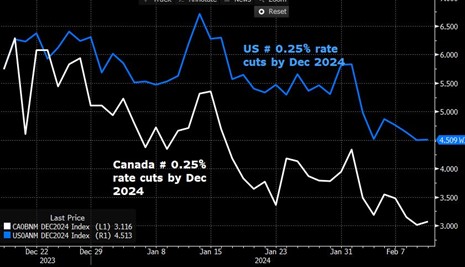

As we entered 2024, markets expected 6 rate cuts for 2024 in both Canada and the US, and nearly 7 cuts for UK and the Eurozone.

However, the month of January marked an important shift for rate cut expectations across major economies. After a strong rally in fixed income markets across the curve in the fourth quarter of 2023 which also resulted in a risk-on mode for equities, markets started to scale back their expectation of rates cuts in part due to better than expected economic numbers which dissipated worries about a major economic slowdown.

Chair Powell went once again off script during the FOMC meeting of January 31st – a now near consistent behavior during these press conferences. On the one hand, he explicitly put to sleep the expectation of a rate cut in March 2024. On the other hand, he pushed back against market expectations for nearly 6 hikes by year end, emphasizing the median expectation expressed by Fed members of 3 rate cuts.

It is important to emphasize that Chair Powell’s communication style (or lack thereof) often generates market volatility during press conferences, as he tends to provide informal and somewhat improvised input and answers in stark contrast with his predecessors and other major central bank governors.

Interestingly, the Canadian market has been even more sanguine in pricing out rate cuts. While market participants expect 4.5 cuts by year end in the US (down from 6 at the start of 2024), they only see three cuts by the Bank of Canada by December 2024 (again down from 6 at the start of the year).

Chart 1: Market expectation of number of rate cuts buy December 2024 by the Fed and Bank of Canada

Source: Bloomberg

We see a few plausible explanations for this widening divergence in expectations. One explanation could be the fact that the “starting point” of the easing cycle is not the same. The US overnight rate is currently 5.25-5.50% while Canada’s is at 5%. If one were to assume the same “final” target rate, the Fed would need two more cuts to reach it.

Another very important factor is the tone adopted by the Governor Macklem. Since January’s press conference and as recently as his February 6th speech and question period in Montreal, he has consistently pushed back against the effects of interest rates on housing projects and supply, and has taken the view that while mortgage refinancing has strained Canadian households, they are still able to meet their obligations. In essence, he sees the present “difficult” period as an adjustment period that will be over by the second half of 2024.

However, the Governor has acknowledged that the main risk to this trajectory is a potential degradation of the employment picture and rise in unemployment.

In divergence lies opportunity

In our view, the fundamentals of the Canadian economy remain less sound and more fragile than that of the US. As highlighted in a number of previous notes, the high degree of leverage of households and the fact that this exposure is floating in nature creates the distinctive vulnerability of the Canadian economy compared to the US economy, in case of a slowdown and/or increase in unemployment.

As such, this divergence in expected overnight rates is likely capped at the levels we see today. For it to further widen it would require either of:

- The market expecting stickier and higher inflation in Canada than the US in the coming quarters.

- The effects of a potential economic slowdown to be much more severe in the US than Canada.

Both these elements, while possible, have a low probability of materializing in our view.

As a result, one might consider a relative value opportunity which consists in positioning – whether from an investment perspective or a risk management one - for a closing of this Canada/US gap in expectations.

This type of positioning can be expressed and structured in many ways depending on the specific risk appetite and constraints of investors, but generically speaking, it would require taking a long position (in price terms) in Canada in the 1-year horizon versus a short position (in price terms) in US 1-year horizon. An indirect alternative would be to look for an increase in USDCAD over the quarters to come.

For a more in-depth discussion on how to incorporate such a scenario in your portfolios and hedges please do not hesitate to reach out to us.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.