Validus appoints senior pension and asset management specialist

20 October 2023

Central Bankers and Cooling Data Set the Tone

8 November 2023INSIGHTS • 25 OCTOBER 2023

Decision Time for the BoE

Shane O'Neill, Head of Interest Rate Trading

In their most recent meeting, the Bank of England’s (BoE) Monetary Policy Committee (MPC) paused their rate hiking cycle – it was the first pause since the cycle began at the end of 2021. The decision passed on a knife-edge vote of 5-4, with the minority preferring another 0.25% hike. The decision was met with mixed emotions – some were relieved that the peak in rates had potentially finally come, whilst others thought it was a little premature and that the battle against prices required further action. In the weeks since that meeting, data out of the UK has done little to settle the argument.

Those looking for the cycle to stop here, or even begin to reverse, will point toward a weakening UK economy, and they’ve been given supporting data in recent weeks. This month, the industrial production and manufacturing sectors posted their second consecutive month of contraction, both coming in more than 0.5% worse than economists had feared. The construction industry is also faltering, again posting consecutive monthly declines. Although it is less structurally important than manufacturing, it is a warning sign for a larger concern – property. Nationwide reported a yearly drop in house prices of more than 5% and mortgage approvals fell back toward their lowest levels since the start of the pandemic, as increasing rates give buyers pause for thought before committing to purchases.

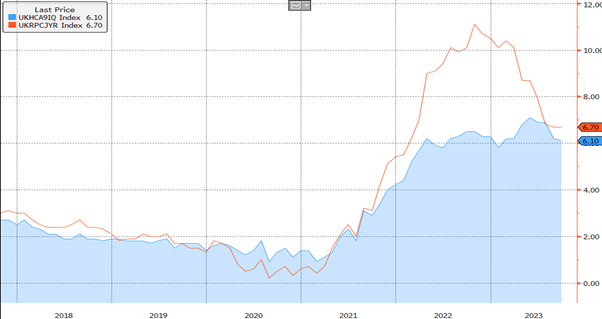

BoE Governor Bailey is also adding fuel to the dovish fire. In an interview last week, he spoke about how he expected a large fall in inflation imminently. With energy price effects falling out in the next print, he expects a reading of 4.9%, down from this month’s worrying figure of 6.7%. And it is this month’s figure where the argument for pausing, or cutting, begins to lose steam. Following a quarter of consecutive headline inflation declines, the most recent figure surprised economists and stayed flat, with markets expecting a 0.1% fall. Core inflation, perhaps the most worrying reading, also remains surprisingly sticky – coming in at 6.1% versus expectations for a fall to 6.0%.

Chart 1: Recent inflation data came in higher than expected, buoyed by an uptick in services inflation

Source: Bloomberg

Where Bailey may be correct in predicting an upcoming fall in headline inflation, core figures won’t be affected as directly by energy cost effects dropping out. Services inflation, a measure watched closely by the MPC, unexpectedly accelerated to 6.9% from 6.8% – a critical number for an economy so dependent on services. And when we see services inflation, we see wage pressure – and although Bailey was optimistic about headline numbers, he did point out worries around wage pressures. Most recent data showed wages growing at 8.1% in the quarter up to August – Bailey pointed out that this was “well above anything that’s consistent” with their 2% inflation target.

Pressure is also mounting from across the pond – in a recent speech at the Economic Club of New York, Fed Chair Powell had a few interesting and hawkish quips. Firstly, when talking about the next phase of the cycle he said: “Given the fast pace of the tightening, there may still be meaningful tightening in the pipeline.” He followed this up with: “I think the evidence is not that policy is too tight right now.” Using current and forecasted inflation, Bloomberg has calculated that policy rates are some 300bps more restrictive in the US than in the UK. And, though each economy has its own nuances, recent economic data (pertinently employment) has been very comparable in both countries. Increasing the risk that the next phase in the UK will indeed be further hikes and not continued pausing, or cutting, if the BoE is to be seen as addressing the inflation problem with the same commitment as their US counterparts.

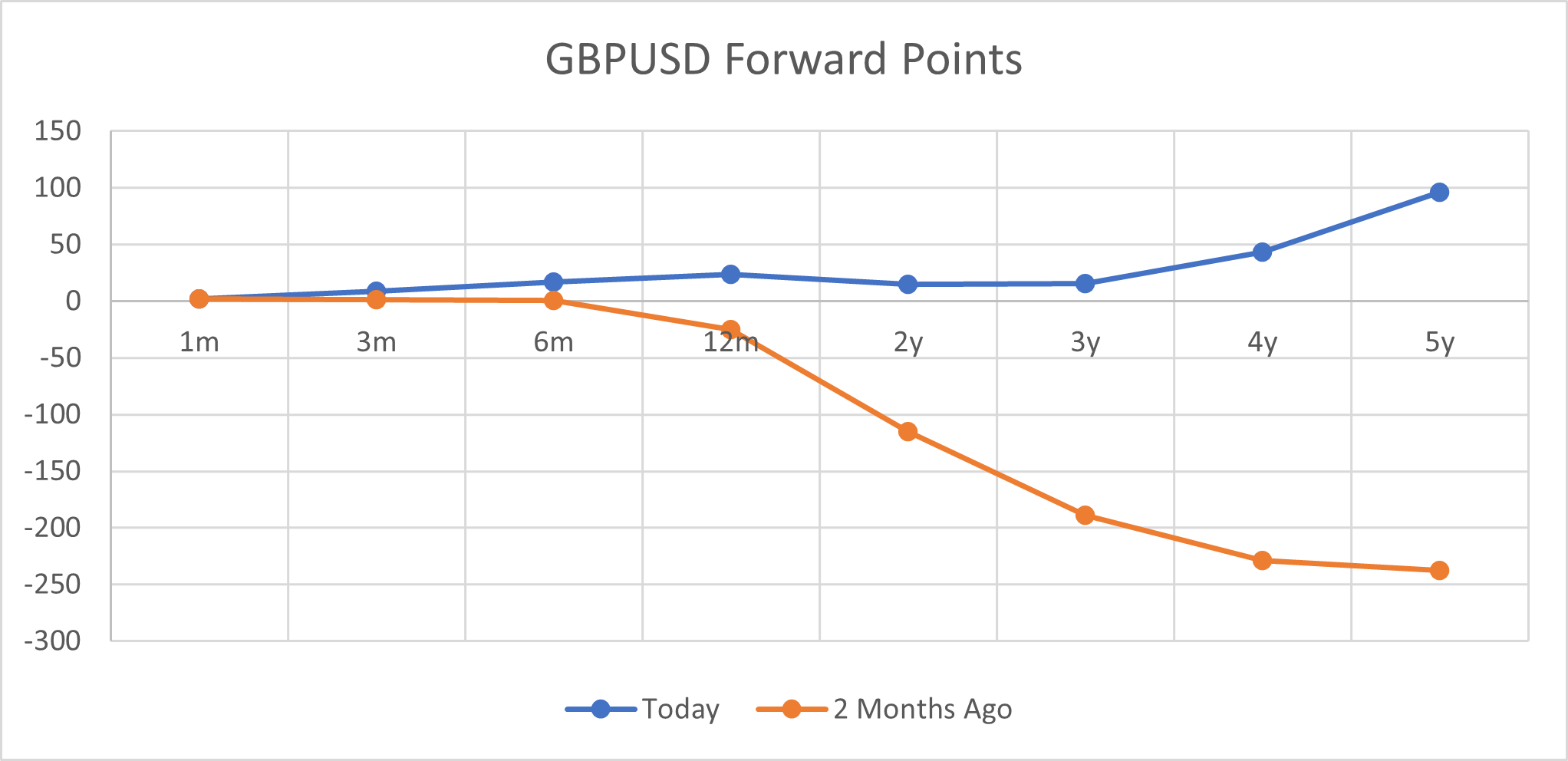

The next move from the BoE is clearly going to be a pivotal one and will inform us of their outlook going forward. The fallout from their next meeting (2nd November) will be of serious significance to risk managers looking at interest rates and FX alike. We continue to believe that the more significant risk is a move higher in yields driven by both an over-eagerness to price in cuts and an under-appreciation of the stickiness of the UK inflation problem. This creates an opportunity for those exposed to higher interest rates to implement hedges now, but perhaps the larger move has been seen in FX forward points. Just two months ago, almost every tenor of hedge had negative forward points – or a cost associated with hedging GBP assets back to USD. Now, the curve is positive for almost every tenor, meaning USD funds see a pickup when hedging GBP exposures – if GBP rates are pushed higher, either by market forces of central bank rhetoric, this pick up will be eroded and perhaps once again become a cost.

Chart 2: Over the last two months forward points have moved from significantly negative to positive in GBPUSD

Source: Bloomberg

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.