The Risks of the Geopolitical Cycle

11 October 2023

Validus appoints senior pension and asset management specialist

20 October 2023RISK INSIGHT • 18 OCTOBER 2023

It’s all going wrong for the Central Banks (again)

Marc Cogliatti, Head of Capital Markets EMEA

We’ve been banging the drum about inflation and the risk of ‘higher rates for longer’ for some time now, but it seems that pressure on the world’s Central Banks has intensified over the past week.

Rising oil prices have been a key theme over recent months, but no sooner had prices started to reverse (Brent fell from $95 to $85 at the beginning of this month) than the conflict in the Middle East spooked markets and prices jumped higher again last week. This comes just as the weather (certainly for us in the UK) has turned colder and we all contemplate putting the heating on.

That said, inflationary pressures aren’t confined to the UK, or even Europe, and there are signs globally that inflation stems from more than just rising energy prices. Last week’s US CPI print showed prices rising for the second consecutive month fuelled by an increase in housing costs, car insurance and recreational services. Although Core CPI at 4.1% is notably lower compared to its peak of 6.6% a year ago, it confirms that inflation runs deeper than the notoriously volatile food and energy components and is thus not conducive to a series of rate cuts from the Federal Reserve (Fed).

Unsurprisingly, the market has shifted to price out about 13bps of cuts for next year, meaning two 25bps cuts by September 2024 are no longer anticipated. Despite the flatter curve, the focus is still on the number of rate cuts for 2024, with very little talk of possible rate hikes. In our view, this still grossly underestimates the risk that the Fed (and others) will have to raise rates further to curtail rising prices.

Guidance from the Fed has been relatively balanced in recent weeks with various speakers weighing downside risks to the economy (small businesses and housing in particular) with the need to prevent prices from accelerating higher again. Looking at the list of voting members for 2023 (see table below), 7 of the 11 are deemed hawks (i.e. favouring higher rates), two are neutral and two are doves (i.e. favouring rates lower). This is broadly similar for 2024 although two of the most hawkish voices, Kashkari and Logan, won’t vote in 2024 or 2025.

Chart 1: FOMC - Hawk/ Dove Analysis

Source: In Touch Capital Markets

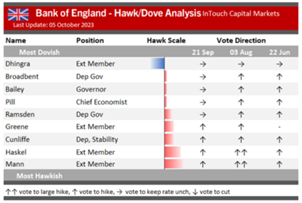

A hawkish bias is also evident within the Bank of England (BoE), although the monetary policy committee (MPC) voted 5-4 in September in favour of keeping rates unchanged at 5.25%.

Chart 2: Bank of England - Hawk/ Dove Analysis

Source: In Touch Capital Markets

The difference between the BoE and the Fed, however, is that the market still favours another hike from the MPC over a cut (albeit marginally).

From a currency perspective, we continue to see risk that the dollar will stand firm and potentially continue its advance, especially if the market continues to price out rate cuts from the Fed for 2024, and even starts to factor in additional tightening. As the currency with the most aggressive rate cuts priced in, it stands to gain the most if it becomes apparent that further tightening is likely. Meanwhile, if the crisis in the Middle East escalates further in the coming days and weeks, recent experience suggests that the dollar will benefit from safe haven demand.

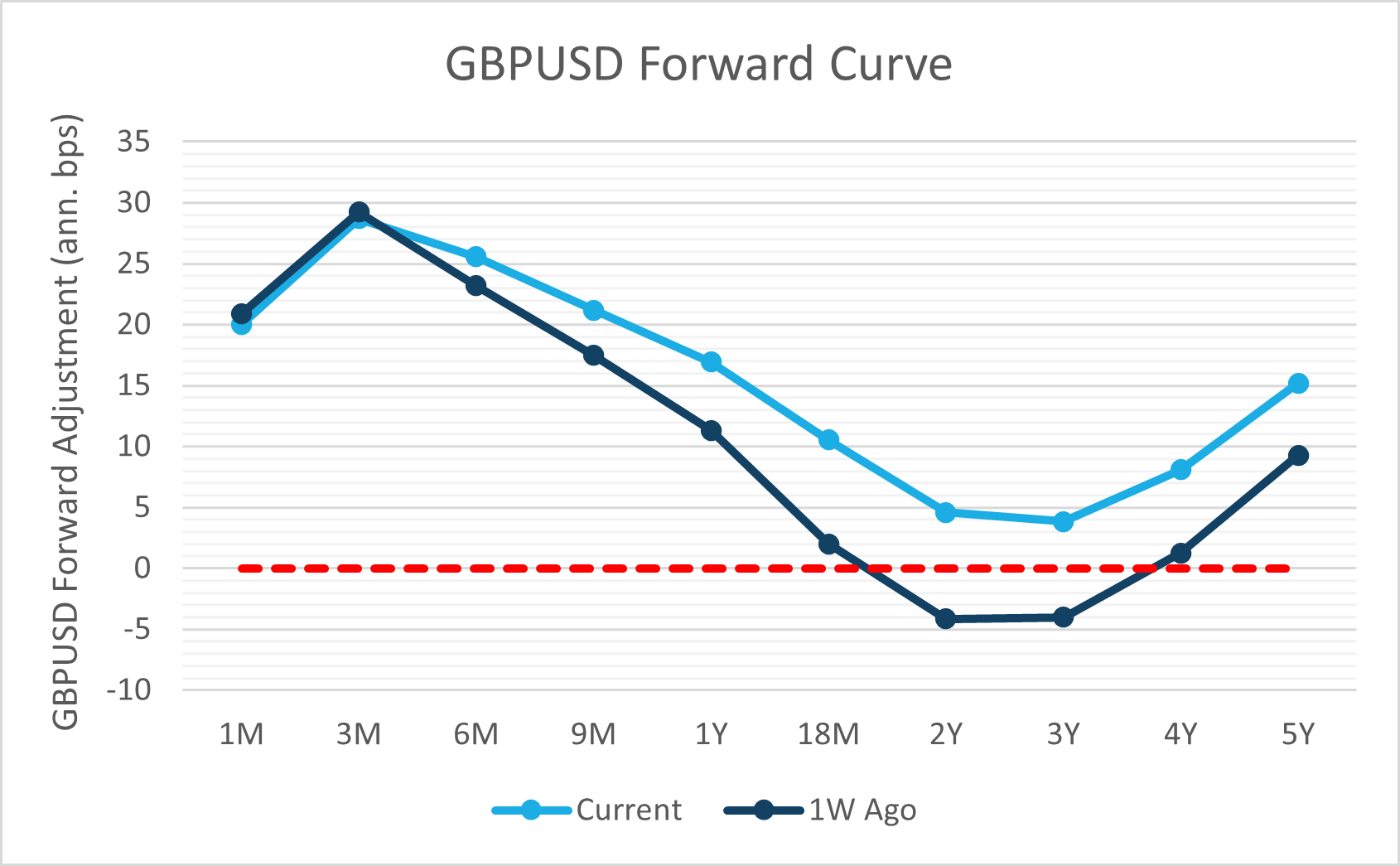

A second point worth noting for hedgers is the recent shift in the GBPUSD forward curve. The chart below compares the forward adjustment today (light blue) vs. that of a week ago (dark blue). Although the shape is similar, there is a notable difference at the two and three-year mark where points were negative a week ago compared to being positive today. This is the result of higher US rates following last week’s CPI print and is good news for a dollar-denominated vehicle hedging sterling assets.

Chart 3: GBPUSD Forward Curve

Source: In Touch Capital Markets

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.