Hawkish Confidence gives way to Data Dependency

14 August 2023

September’s Clues: Unveiling the data on the Fed’s next moves

23 August 2023RISK INSIGHT • 16 AUGUST 2023

UK GDP – good news or bad? It depends on who’s asking.

Marc Cogliatti, Head of Global Capital Markets EMEA

At first glance, last week’s UK GDP figures offer some light relief to those who have been fearing that the UK economy is sliding into recession. Headline GDP showed the UK economy expanding 0.5% in June, beating the consensus forecast for 0.2% growth. It means that the economy grew 0.2% in the second quarter of 2023, exceeding expectations for a flat reading. Encouragingly, the growth was broad based with the industrial, construction and service sectors all contributing positively. Household spending rose 0.7% in real terms, a surprisingly strong reading relative to its long run average. Given the current inflationary backdrop, this number could conceivably have been considerably lower.

However, there are a couple of factors that suggest we shouldn’t get too optimistic about the health of UK PLC:

- Whilst any growth is welcome, especially given the headwinds experienced in recent years, expansion of 0.2% quarter on quarter or 0.4% versus the same period as last year is well below the long-term average or what anyone would deem ‘healthy’.

- The readings for May and June were skewed by an additional Bank Holiday to celebrate the King’s Coronation – negatively impacting May’s numbers and boosting those in June. Better weather in June also helped boost food and beverage sales.

- In the current inflationary environment, it doesn’t help the Bank of England in its quest to quell rising prices. If businesses continue to invest and consumers continue to spend, it only encourages (or even forces) retailers to raise prices further.

Judging by the market’s reaction, this last point seems to be the main takeaway from the news. Concerns about inflation were compounded on Tuesday by another jump in UK average earnings. Wage growth, excluding bonuses, jumped 7.8% in the three months through to June compared with the same period 12 months ago (the market had been expected a reading of +7.4%).

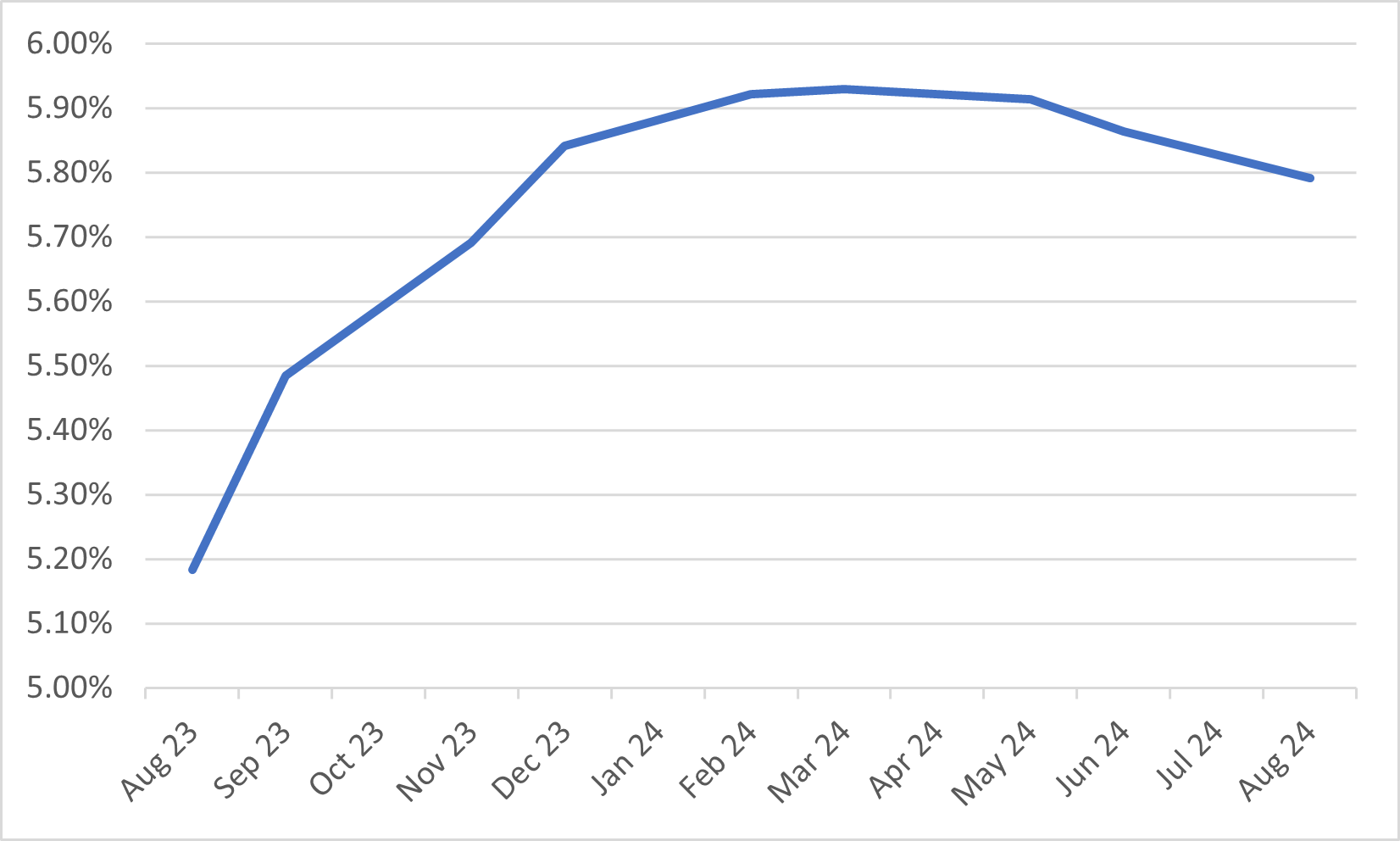

On Thursday last week, the market had fully priced in a 25bps hike by the Bank of England’s November meeting, and an 80% chance of a further 25bps by March 2024. Following the publication of these latest employment figures, the Overnight Index Swaps curve has 25bps hikes fully priced in for September and November and a another 25bps by March 2024 (see chart below). In FX, sterling has been well supported against both the dollar and the euro, although gains have been short lived, particularly against the dollar.

Chart 1: Implied Policy Rate/ OIS Curve (%)

Source: Bloomberg

Looking ahead, our thinking remains unchanged from where we were a couple of weeks ago when we posed the question ‘Have we seen the peak in UK rates?’. The recent news adds confidence to our view that the risk to UK interest rates remains skewed to the upside. If the economy is growing, it will not only aid further upside risk to inflation, but also give the Bank of England confidence that their recent actions aren’t proving too damaging to the broader economy (and thus they can tighten further).

However, as highlighted last week, we remain cautious about getting too bullish on sterling, particularly against the dollar. As well as the points made previously about market positioning, risk reversals and the consensus forecast, it was evident last week that a dip in US yields was not accompanied by a fall in the dollar. If anything, the dollar was stronger against both the pound and the euro – suggesting the ‘risk off’ theme that we previously became so accustomed to might warrant increased consideration going forward.

CPI numbers for July will be closely monitored and will shape the outlook for rates in the weeks and months ahead. Both headline (+6.3% y/y) and core (+6.7% y/y) readings are expected to have fallen sharply in July, but if this proves not to be the case, the market will likely move to price in even more aggressive tightening.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.