The Dance Continues: Fed Projections Stay Just Out of Reach of Market Pricing

20 June 2023

Central Banks Shakeup: Inflation Concerns Trigger Surprising Moves

3 July 2023RISK INSIGHT • 27 JUNE 2023

The Bank of England surprises

Marc Cogliatti, Head of Capital Markets, EMEA

The fact that the Bank of England (BoE) raised interest rates last week was hardly surprising – inflation continues to run well above target and having avoided a recession so far this year (albeit by the narrowest of margins), preventing prices spiralling further out of control remains the Monetary Policy Committee’s (MPC) number one priority. That said, the fact that the committee voted to hike rates by 50bps – as opposed to the 25bps expected by many and in line with the two previous increases – caught the market by surprise.

With the benefit of hindsight, it probably should not have come as too much of a shock. Last week’s inflation numbers showed the UK Consumer Price Index (CPI) rising 8.7% y/y, which is concerning by itself, but not as alarming as the core reading which rose to 7.1% (versus expectations of +6.8%). This confirms our fears that inflation runs far deeper than just food and energy and is entrenched in almost every aspect of consumer spending. Most alarmingly, it appears to be increasingly embedded in consumers’ expectations (i.e. consumers are becoming increasingly accepting of higher prices, which in turn encourages retailers to put prices up further). As such, it is understandable that the MPC should want to take a firm stance and utilise the main tool in their armoury to combat the problem.

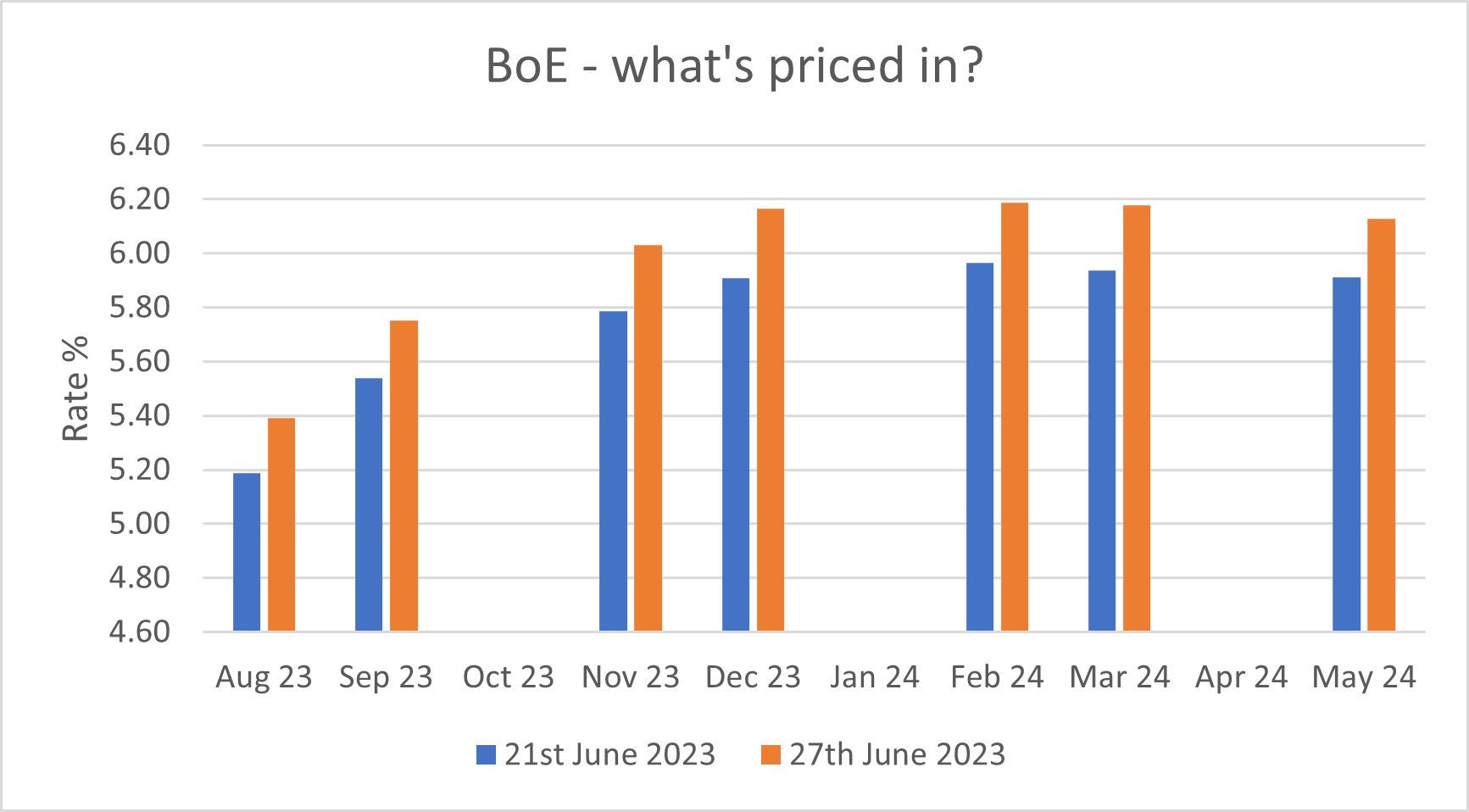

The larger than expected hike has resulted in markets pricing in further increases in the months ahead. Prior to last week’s meeting, the Overnight Index Swap (OIS) curve had rates peaking at 5.96% in February 2024 (see the orange line in the chart below). Following the latest hike, the curve for the same date is now peaking at 6.14% (see the blue line in the below chart).

Chart 1: BoE: What's priced in?

Source: Bloomberg

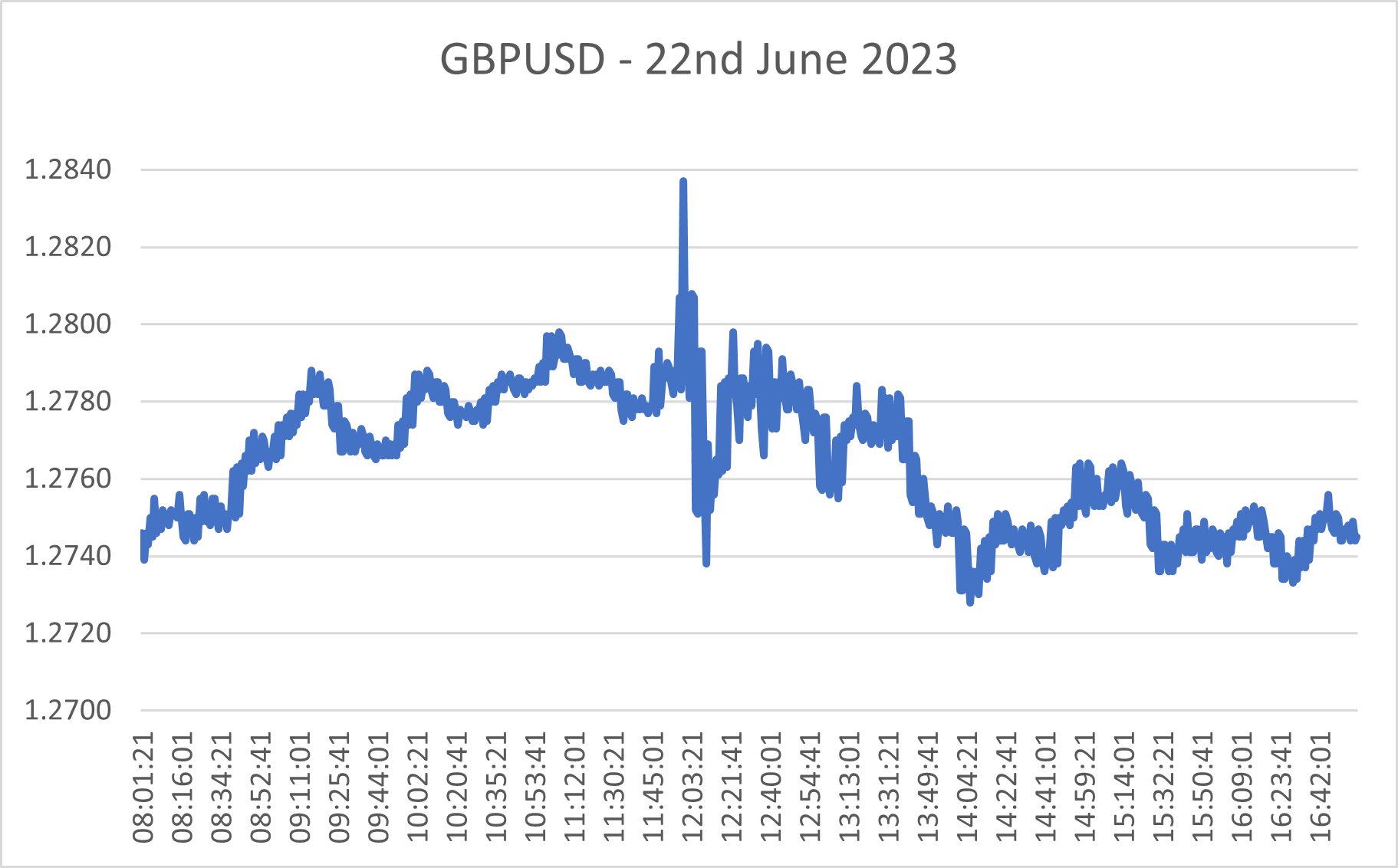

The market reaction was particularly interesting, especially in FX (see the chart below). Unsurprisingly, the larger than expected hike resulted in sterling spiking higher against the dollar (rallying from ~$1.2780 up to ~1.2840) – higher rates seemingly make GBP more attractive. However, the rally was short-lived and immediately reversed with the pair dropping back to $1.2740 where they ended the day.

Chart 2: GBPUSD - 22nd June 2023

Source: Bloomberg

While this may seem odd at first glance, the key probably lies further down the curve where rates actually moved lower (10-year yields ended down 3.8 bps on the day). The thinking seems to be that by hiking aggressively now, it will result in lower inflation in the years ahead, which in turn should give the BoE scope to cut rates again (the 6.1bps decline in inflation breakevens outweighed the 2.3bps rise in real rates).

Another point to note is that the moves in both rates and FX were only moderate and it is therefore not wise to try and draw any firm conclusions. Nevertheless, it does highlight the difficultly in trying to second guess what might happen next, particularly in FX. Are higher rates good or bad for sterling? The answer almost certainly lies in both the time frame being examined and the rationale for higher borrowing costs, but the answer is far from clear.

Looking ahead, it is hard to imagine interest rates above 6% for long. However, market participants were saying the same when rates first started to rise at the end of 2021 and the consensus was that they wouldn’t rise much above 2.5%. Expectations then changed very quickly and 4.50/5.00% seemed inevitable. With rates at 5% today and core inflation still rising, it therefore seems a little naive to think that the BoE does not have further to go.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.