Managing Risk in a Volatile Environment – Walter GAM Mountainside Chats

24 May 2023

Reviving Concerns: Central Banks and Inflation Regain the Spotlight

2 June 2023RISK INSIGHT • 31 MAY 2023

The market meets (the Fed’s) expectations

Kambiz Kazemi, Chief Investment Officer

Following the regional bank saga of mid-March with the takeover of Silicon Valley Bank (SVB) and subsequent tremors which had far reaching effects and led to a takeover of Credit Suisse by rival UBS, investors aggressively priced imminent rate cuts by the Fed.

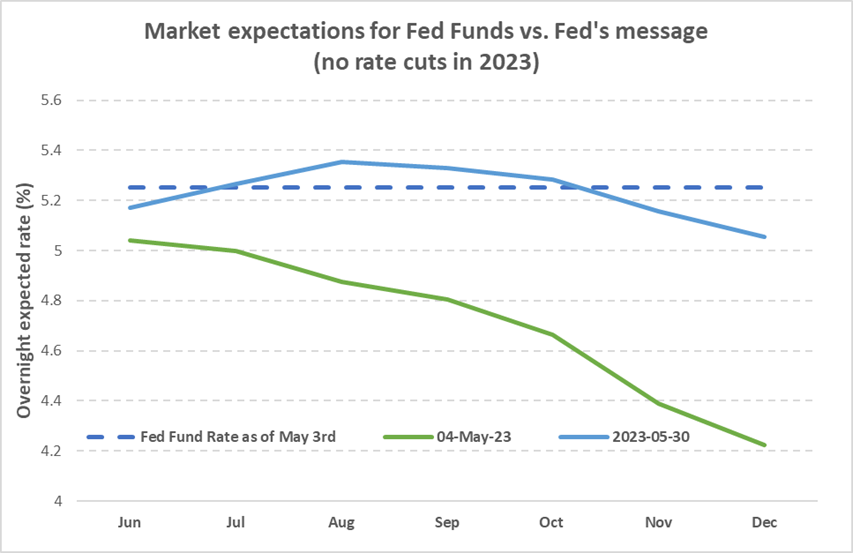

Indeed, despite the Fed’s decision to hike rates one more time on May 3rd, emphasised that it does not see inflation fading in the near term, nearly 1% of cuts were being priced in between June and December 2023. And, as Chair Powell and FOMC members repeatedly indicated that they did not foresee any rate cuts in the near future, markets persisted in projecting important rate cuts as early as September 2023.

We highlighted this divergence between expectations and the Fed’s messaging on various occasions in previous notes and comments – most recently in our April 18th note, “Disconnect between markets and the Fed continues”. Expectations eventually had to meet reality as the summer – during which the market was pricing these cuts – quickly approached. They would either materialize – with the Fed’s approach changing – or the market would have to realign its expectations.

The alignment did occur and did so in a staggering manner. The market met the Fed’s expectations by pricing out nearly four rate cuts (1%) over the course of approximately three weeks.

During the same three-week period, the US 2-year rate rose by 64bps, which has had a 1 in 100 chance of occurring since 1988. This type of shift in short-term rates is extreme.

Chart 1: Market expectations for Fed funds vs Fed's message

Source: Bloomberg

Such a sudden shift in short-term rates, combined with the uncertainty around the debt ceiling that prevailed in the last two weeks, could have been disruptive. However, thankfully, this latest bout of volatility has been orderly and has not caused any noticeable market dysfunction – albeit liquidity has not fully recovered to pre-SVB levels.

A fundamental shift

Following the Global Financial Crisis of 2008, whenever there was a divergence between the Fed’s projections and market participants’ expectations, more often than not it was the Fed that ended up meeting market expectations. In other words, markets were conditioned to being able to “force” the Fed – or at least believing they could do so. When the Fed tried to be less dovish, markets pushed for more cuts or more quantitative easing and the Fed duly obliged. Similarly, when the Fed tried to signal the end of the easy money cycle, the market threw a “tantrum” which led to the Fed adjusting its interest rate trajectory.

As such, the fact that markets have converged towards the Fed’s expectations is very salient and could have some interesting consequences.

- The Fed credibility is (slowly) being restored

- Inflation control prospects have solidified

The Fed previously lost some of its credibility due to its insistence on depicting inflation as transitory, and its belated action in reining it in, which could lead to potentially higher costs to the economy (some of which are yet to be witnessed).

The combination of the Fed proceeding with a rate hike in March despite the turmoil caused by the flight of deposits from some regional banks, and their steadfastness in keeping with the higher for longer message, seems to have finally impacted the market’s appreciation of the Fed and re-established its credibility in part.

This is a very positive development for the Fed and markets, because trust in the Fed’s ability to deliver what it promises is a key tenant of a sound market and brings the level of uncertainty (i.e. potential volatility) generally lower. Going forward, even in tense settings, we can expect the market to face volatility with more serenity and calm.

As it stands, the market has resigned itself to seeing higher (rates) for longer, with no rate cuts on the horizon until closer to the end of 2023. Once again, this is a positive development to the extent that it will likely help anchor long-term inflation expectations while providing the Fed with time to assess whether inflation stickiness dissipates in the near-term.

However, this higher for longer strategy comes at a cost, that of a potential recession and economic slowdown. The health of households’ balance sheets at the start of this hiking cycle and the strength of the labor market so far have helped sustain economic growth. Yet, weaknesses have started appearing in different corners of the economy and investment landscape. For instance, the higher cost of capital has adversely affected the growth of investments in private assets and borrowing for mid-tier corporations. Real estate valuations also remain an area of focus and should be monitored.

Another corollary effect of the recent run up in short-term US yields has been a slight appreciation of the US dollar and a drop in commodity prices. At this juncture, we see the fast-paced repricing of the front of the curve nearly complete and, as a result, rate markets and the US dollar will likely be more stable through the summer as we await more data on the inflation front.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.