The US Debt Ceiling: Is the market worried? Should risk managers be?

16 May 2023

Managing Risk in a Volatile Environment – Walter GAM Mountainside Chats

24 May 2023RISK INSIGHT • 24 MAY 2023

Will the labour market be the answer to the MPC’s prayers?

Marc Cogliatti, Head of Capital Markets, EMEA

After 18 months of interest rates hikes, the market’s focus of late has been on when the Central Bank will start loosening policy again. The question is even more prevalent in the US where the market is now pricing in almost three 25bps rate cuts (one for each of November, December and January’s meetings). However, scope for the Bank of England to even pause, let alone start easing, is considerably more limited given that headline inflation remains close to 9%.

We’ve long talked about the dangers of inflation expectations becoming embedded, thus further fuelling higher prices and this continues to remain a concern. However, there may be a light at the end of the tunnel, coming from the labour market. For the past year, the jobs market has been close to boiling over. Unemployment has been at record lows (not a bad thing obviously) while the number of vacancies has been high (again, usually another positive as it implies companies are looking to expand which in turn should help fuel economic growth). However, the issue is that companies have been forced to respond with considerably higher wages to attract and retain the best talent and a viscous circle has formed where companies are forced to put up prices to pay higher wages and so forth. Obviously, there are other factors at play in the inflation storm, like problems with the supply chain leading to a rising cost of raw materials and falling productivity, but we can focus on those another time.

Last week’s UK labour market data showed a slight uptick in the unemployment rate (3.9% in March vs 3.8% in February) while average earnings (5.8%) was slightly lower than February’s reading (5.9%). By themselves, the numbers aren’t enough to take the heat of the Bank of England, but at least there is a sign that things might be starting to move in the right direction. A deeper dive into the data shows that the uptick in unemployment was almost exclusively down to and increase in the participation rate which again is encouraging (another reason for the tight labour market and higher wages has been the lack of people looking for work). Again, we are a long way off the point where rising unemployment will dampen demand enough to bring inflation significantly lower, but at the very least, if the labour market is returning to something resembling normality, it should help ease price pressures.

One note of caution is that the redundancy rate is still historically low and pay growth, particularly in the private sector remains strong. Likewise, workers are expecting higher wages as the ‘cost of living crisis’ remains hot topic in the media. Moreover, April will see a jump (including positive revisions to prior months) as the National Living Wage takes effect and public sector pay deals start to filter through. A second point to note, is that April’s CPI numbers showed headline CPI falling to 8.7% y/y from 10.2% in March (primarily as the impact of last year’s energy price spikes fall out the equation). While that may be good news, the core reading (excluding food and energy prices) jumped from 6.2% to 6.8%, highlighting that inflation is wider spread than just food and energy. Ultimately, it suggests that there is limited scope for the MPC to take their foot off the gas just yet.

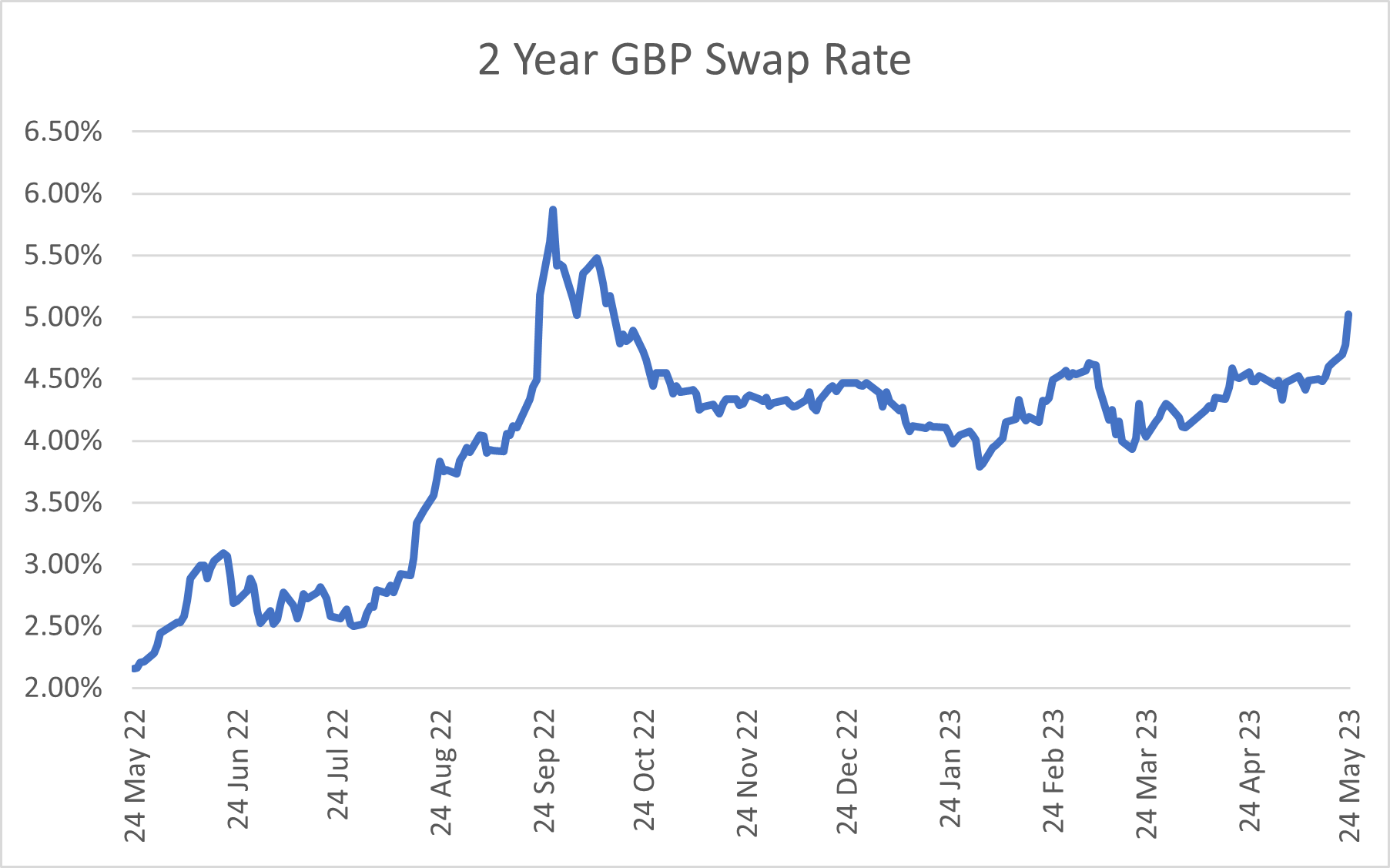

As a result, the market is now pricing in at least three more 25 bps hikes from the MPC (one in each of June, August and September). As such, the two-year swap rate continues to edge higher (see chart below) and sterling remains firm, particularly against the euro and to a slightly lesser extent against the resurgent dollar).

Chart 1: Two-year GBP swap rate

Source: Bloomberg

Data aside, the focus this week remains on the US debt ceiling as talks between President Biden and Speaker McCarthy continue. Monday’s meeting between the pair seemed to be positive with McCarthy saying, “The tone tonight was better than any other time we’ve had discussions.” Biden followed up saying that default is off the table and the only way to move forward is a good faith bipartisan agreement. However, reports this morning suggest there is still a long way to go before an agreement is reached. Treasury Secretary Janet Yellen cautioned that a deal needs to get done in the next few days to avoid the debt ceiling being hit and the government potentially running out of cash in early June.

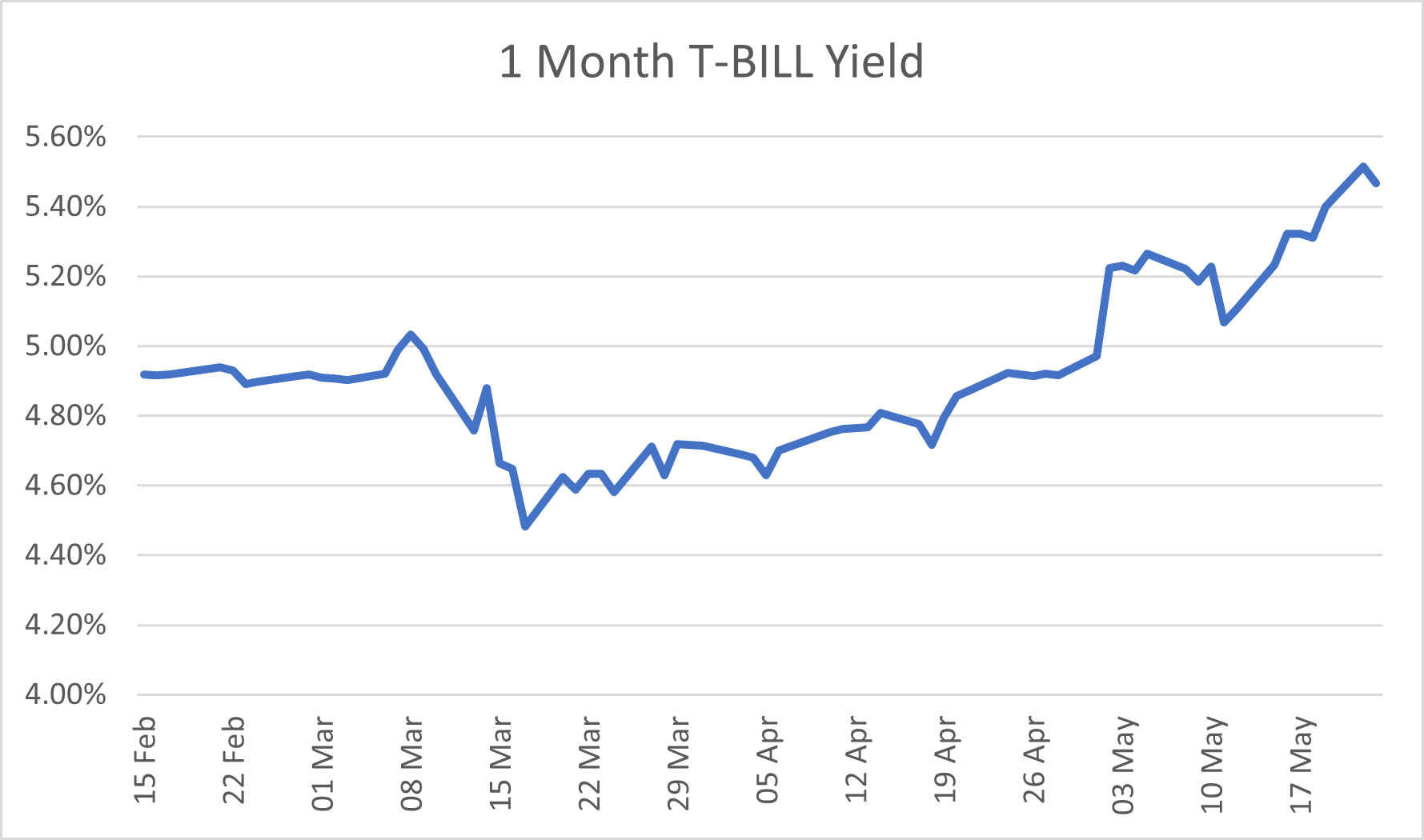

The market initially took some comfort from the positive tone. Having risen 13.2bps on Monday, the yield on the 1 month T-Bill reversed the move entirely yesterday morning after the Biden / McCarthy headlines. That said, looking at the chart below, the market is still demanding a significant premium for 1 month money vs where we were at the beginning of the month after the last Fed hike and thus isn’t entirely convinced that a disaster scenario will be avoided.

Chart 2: One-month T-BILL yield

Source: Bloomberg

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.