Haste is the Devil’s Work

21 March 2023

Bank Woes Shift Sentiment

31 March 2023RISK INSIGHT • 28 MARCH 2023

Sailing Between Two Different Monsters

Ryan Brandham, Head of Global Capital Markets, North America

In Greek mythology, sailors feared passing through a narrow strait of water, now accepted to be the Strait of Messina separating Sicily and Italy, due to the presence of two immortal monsters. On the one side was Scylla, a six-headed monster with razor-sharp teeth, and on the other was Charybdis, who three times a day would drink down and then belch forth enough sea water to sink large ships. The two were separated by a distance less than the flight of an arrow, and giving one of them too wide of a berth left you dangerously close to the other.

After more than a decade of ultra low interest rates following the Global Financial Crisis, the incorrect classification of 2021-2022 inflation as transitory and a hesitation to raise rates, Jerome Powell and the US FOMC must feel like they are trying to navigate the US economy between the Scylla of inflation and the Charybdis of a banking crisis. The speed and magnitude of the rate hike cycle of 2022-2023 has been almost unprecedented and is starting to cause cracks in the financial system, including the failure of both Silicon Valley Bank and Signature Bank.

The setup

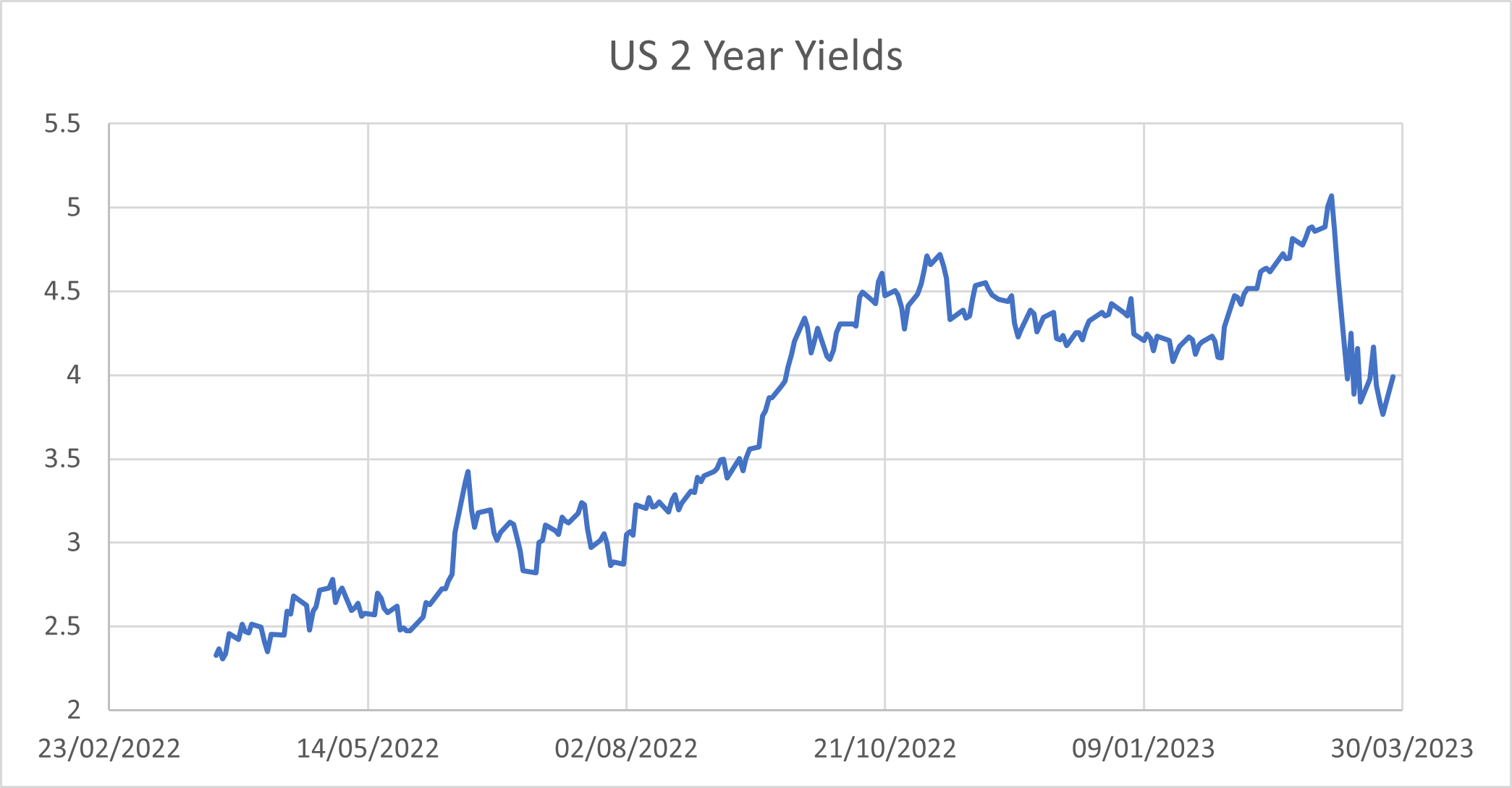

In the days leading up to the March 22 interest rate announcement, front end US rates demonstrated extreme volatility, with the market oscillating between a high probability of a hike and no hike. Additionally, as seen in Chart 1, daily movements in 2-year yields were of historic proportions.

Chart 1: Extreme single day volatility in US Front End Rates

Source: Bloomberg

Against this backdrop of instability and volatility, Powell faced a difficult task in reassuring markets that the Fed would be able to traverse these dangerous waters and have the economy emerge unscathed on the other side.

The FOMC announcement

Given the constraints, Powell delivered a 25 bps "dovish hike" and highlighted that markets should not interpret the increased use of the Fed's balance sheet to support bridge bank entities as a change in policy or a new form of quantitative easing, which could have caused panic and dented confidence in the US dollar. While he was successful in his communication on this front, markets did not accept the entire message about interest rates to the level Powell likely anticipated.

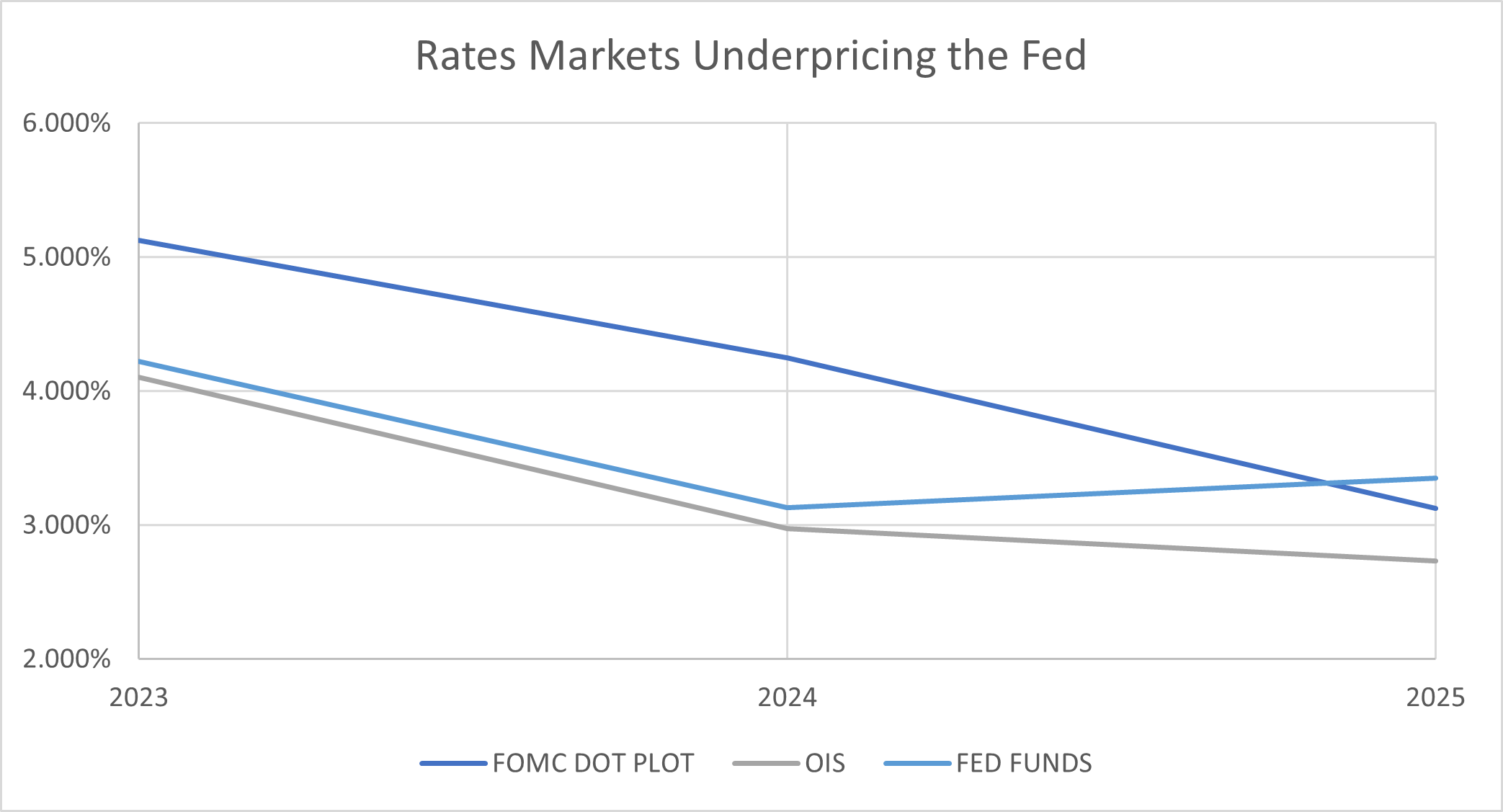

The FOMC Dot Plot remained effectively unchanged from its previous update in December 2022, with a median projected rate of 5.125% for the end of 2023, 4.25% for the end of 2024 and 3.125% for the end of 2025. This suggests one more hike in US interest rates for the rest of the calendar year.

The market reaction

Following the announcement, rates traded even lower than post-SVB levels and markets are now pricing in 100 bps of cuts by the end of this year – a large deviation from the Fed’s projected path. This reaction highlights the FOMC’s broader credibility problems. While the Fed is data dependent and has the flexibility to respond to changing circumstances, the market does not buy its projection of no rate cuts until 2024. One must therefore ask: if, as the market predicts, the Fed accelerates rate cuts to 2023 to ease pressures on the banking system, what impact would this have on inflation? Would avoiding Charybdis drive the US economy straight to Scylla’s mouth? Uncertainty is high, to say the very least.

Chart 2: US rates markets are back to underpricing the Fed.

Source: Bloomberg

In January of this year, an overvalued USD was steadily moving in the direction of fair value, that is until the rates market started materially underpricing the FOMC Dot Plot. This deviation had to be resolved… And resolved it was.

Stronger than expected US economic data, the emergence of a “sticky US inflation” market theme, a rally in US rates and a corresponding rally in the USD through February and early March gave strength to the Fed’s credibility. Its projections won the day and markets had to reprice to match expectations.

How will things resolve this time around?

Although we are sticking with the longer-term view of an overvalued USD that will correct lower over time, the market is already underpricing the Fed meaning that it will become increasingly harder to find new reasons for US rates and the USD to go lower. Unless the Fed changes course and caves to the market’s predicted path, risks feel skewed toward a stronger USD in the short term.

Prudent risk managers must be prepared for either outcome as the Fed tries to navigate these dangerous waters. On the one hand, risk managers will want to take steps now to re-evaluate their counterparty panel and proactively manage any potential credit exposures in case an overly hawkish Fed causes these early wobbles to extend into a full-blown banking crisis. On the other hand, if the Fed is wrong and must cut to market expectations, damaging inflation could pick up, in turn threatening global confidence in the USD and leading to a weaker US dollar across the board. Against this outcome, risk managers will want to take immediate steps to ensure their hedge programs are optimized for potentially adverse liquidity implications.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.